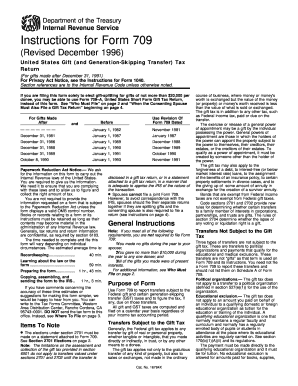

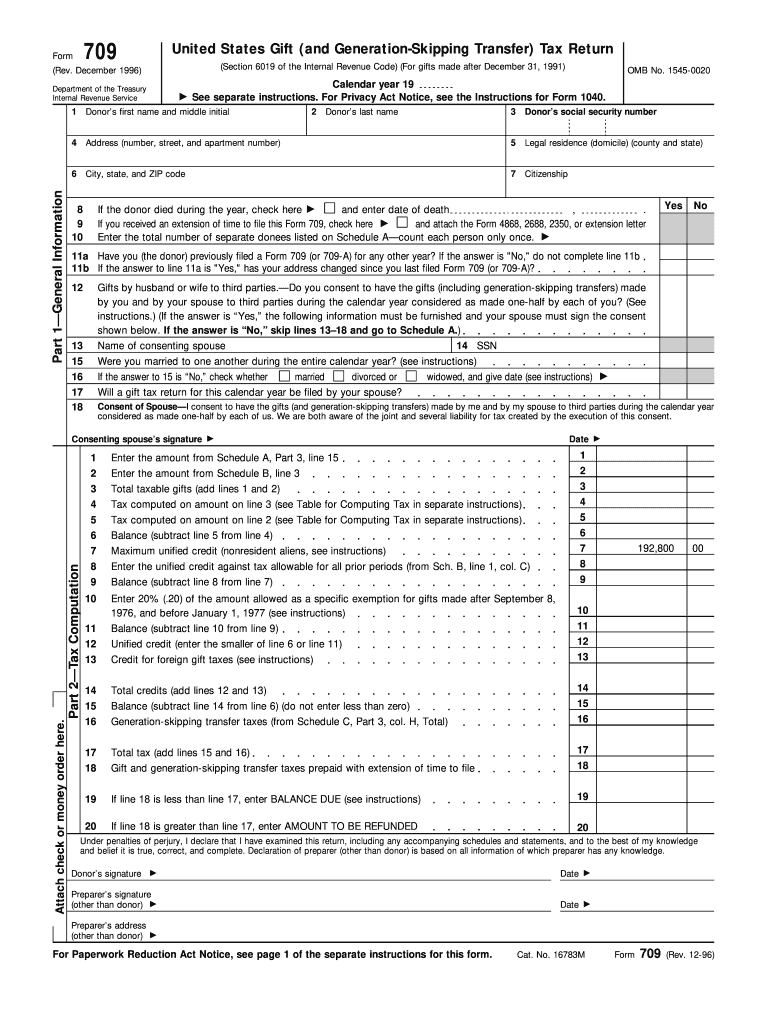

IRS 709 1996 free printable template

Instructions and Help about IRS 709

How to edit IRS 709

How to fill out IRS 709

About IRS previous version

What is IRS 709?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 709

What should I do if I realize I've made a mistake on my filed IRS 709?

If you've made a mistake on your filed IRS 709, you will need to file an amended form. This involves submitting a corrected version with the appropriate changes marked clearly to ensure the IRS can process your corrections efficiently. It's advisable to keep copies of both the original and amended forms for your records.

How can I verify the status of my filed IRS 709?

To verify the status of your filed IRS 709, you can utilize the IRS's online tools which will allow you to check the processing status. Additionally, maintaining a copy of your submission can help you reference details if you encounter any issues or need to resolve rejection codes.

Are there special considerations for filing IRS 709 when dealing with nonresident aliens?

Yes, filing IRS 709 for nonresident aliens can involve different rules and requirements compared to residents. It's crucial to understand how residency status impacts gift tax obligations and reporting requirements. Consulting with a tax professional who is familiar with international tax law is highly recommended to navigate these nuances.

What common errors should I watch for to avoid complications with my IRS 709 submission?

Common errors include incorrect taxpayer identification numbers, misreporting gift values, and failing to include all required information. Double-checking your entries and ensuring you have all necessary documentation can help prevent these mistakes before submission.

See what our users say