Get the free Village of Loudonville Income Tax Return - tax ohio

Show details

This document serves as an income tax return for residents of Loudonville, including instructions for filing, penalties for late submissions, and exemptions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign village of loudonville income

Edit your village of loudonville income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your village of loudonville income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing village of loudonville income online

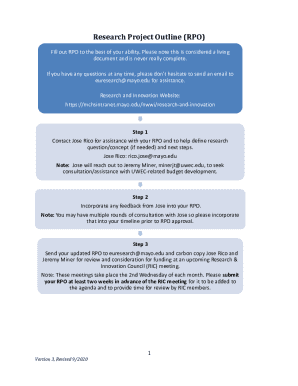

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit village of loudonville income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out village of loudonville income

How to fill out Village of Loudonville Income Tax Return

01

Obtain the Village of Loudonville Income Tax Return form from the official village website or tax office.

02

Fill in your name, address, and Social Security number in the designated sections of the form.

03

Report your total income for the tax year, including wages, salaries, and any other earnings.

04

Deduct any allowable expenses or exemptions as specified in the instructions accompanying the form.

05

Calculate your taxable income by subtracting deductions from your total income.

06

Apply the appropriate tax rate to your taxable income to determine your tax liability.

07

Complete any additional sections that pertain to credits or prepayments that may reduce your total tax owed.

08

Sign and date the form, certifying that the information provided is accurate.

09

Submit the completed form to the Village of Loudonville tax office by the designated deadline.

Who needs Village of Loudonville Income Tax Return?

01

Residents of the Village of Loudonville who earn income.

02

Individuals who receive income from a business operating within the village.

03

Anyone who is subject to the village's income tax ordinance.

Fill

form

: Try Risk Free

People Also Ask about

How much is Ohio state income tax on $100,000?

Ohio Taxable IncomeTax Calculation $40,000 – $80,000 $1,112.50 + 4.327% of excess over $40,000 $80,000 – $100,000 $2,843.30 + 4.945% of excess over $80,000 $100,000 – $200,000 $3,832.30 + 5.741% of excess over $100,000 more than $200,000 $9,573.30 + 6.24% of excess over $200,0005 more rows

What Ohio cities have no income tax?

With a population of approximately 46,000 people, the City of Beavercreek is one of three cities in the state of Ohio that does not have an income tax. The other two are Bellbrook, Ohio (population of 7,300) and Cortland, Ohio (population of 7,100).

How much is $100,000 after taxes in Ohio?

If you make $100,000 a year living in the region of Ohio, United States of America, you will be taxed $25,521. That means that your net pay will be $74,479 per year, or $6,207 per month. Your average tax rate is 25.5% and your marginal tax rate is 36.3%.

Where is the best place to live to avoid income tax?

Low-tax countries compared: Key rates you should know CountryIncome taxCorporate tax United Arab Emirates 0% 9% Vanuatu 0% 0% Bahamas 0% 0% Anguilla 0% 0%6 more rows • May 14, 2025

Where is the income tax return?

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can contact the IRS to check on the status of your refund.

Is Ohio an income tax free state?

Ohio has a graduated state individual income tax, with rates ranging from 2.750 percent to 3.500 percent. There are also jurisdictions that collect local income taxes. Ohio does not have a corporate income tax but does levy a state gross receipts tax.

Where to mail a CO state tax return?

Income Tax FormAddress DR 104BEP DR 0108 DR 0158-C,DR 0158-F,DR 0158-I,DR 0158-N DR 0900, DR0900C, DR0900P Colorado Department of Revenue Denver, CO 80261-0008 All other income tax related forms Colorado Department of Revenue Denver, CO 80261-00082 more rows

What city in Ohio has the lowest taxes?

Once again, and like most years, the lowest tax rate is on Middle Bass Island, part of the multi-island Put-in-Bay Township, northwest of Sandusky. The taxes there amount to $713 per year for every $100,000 of home value, a $153 decrease from the previous year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Village of Loudonville Income Tax Return?

The Village of Loudonville Income Tax Return is a legal document filed by residents and non-residents who earn income within the village to report their earnings and calculate taxes owed to the village.

Who is required to file Village of Loudonville Income Tax Return?

Residents of the Village of Loudonville, as well as non-residents who earn income from work performed within the village, are required to file the Village of Loudonville Income Tax Return.

How to fill out Village of Loudonville Income Tax Return?

To fill out the Village of Loudonville Income Tax Return, obtain the form from the village's finance department or website, provide your personal and income information, calculate tax owed based on the village's tax rate, and submit the form by the required deadline.

What is the purpose of Village of Loudonville Income Tax Return?

The purpose of the Village of Loudonville Income Tax Return is to ensure that individuals and businesses pay their fair share of taxes to fund local services and infrastructure, such as roads, schools, and public safety.

What information must be reported on Village of Loudonville Income Tax Return?

The information that must be reported on the Village of Loudonville Income Tax Return includes personal identification details, total income earned, deductions and credits applicable, and the calculation of tax liability.

Fill out your village of loudonville income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Village Of Loudonville Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.