Get the free Form 902 - tax ohio

Show details

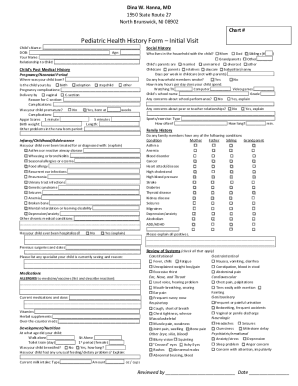

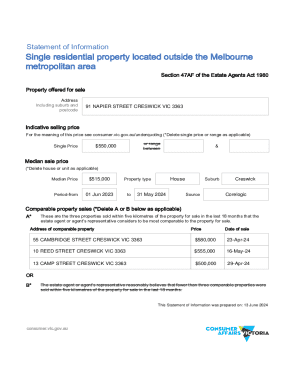

This form is used by taxpayers to claim a deduction from the book value of taxable personal property based on its true value rather than the book value after depreciation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 902 - tax

Edit your form 902 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 902 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

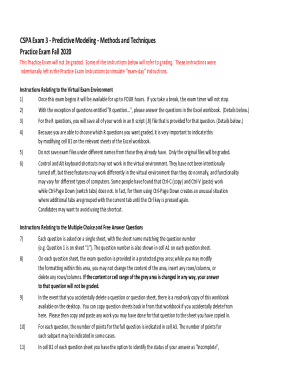

Editing form 902 - tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 902 - tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 902 - tax

How to fill out Form 902

01

Gather necessary information: Collect all relevant documents and information needed to fill out Form 902.

02

Open the form: Access Form 902 either from the official website or download it.

03

Complete the applicant information: Fill in your personal details such as name, address, and contact information.

04

Provide additional details: Enter any supporting details requested by the form, such as your Social Security Number.

05

Review the instructions: Carefully read through the instructions provided on the form to ensure accuracy.

06

Sign and date the form: After completing all sections, sign and date the form at the designated areas.

07

Submit the form: Send the completed Form 902 to the appropriate agency or department as indicated in the instructions.

Who needs Form 902?

01

Individuals who are applying for certain benefits or services that require the completion of Form 902.

02

People who need to provide personal information for identity verification processes.

03

Applicants seeking to comply with regulatory requirements necessitating Form 902.

Fill

form

: Try Risk Free

People Also Ask about

What is a CCC 901 form?

Producers are required to complete this form to report information about their farming operation. This information is used by FSA to determine the ownership interest of entities for payment limitation purposes. Submit the original of the completed form in hard copy or facsimile to the appropriate FSA servicing office.

What is form CCC 941 used for?

IRS requires written consent from the individual or legal entity to provide USDA verification of compliance with AGI limitation provisions. The annual certification is made possible by completing the CCC-941 form, Average Adjusted Gross Income Certification and Consent to Disclosure of Tax Information.

What is a 902 form?

Form 902, Third Party Entity Registration Form. 5/2/2025. Forms. Download PDF. To protect the integrity of the data reporting and submissions process, the WCIRB requires that an insurer formally designate its TPE(s) through an indemnification agreement with the WCIRB by filling out this registration form.

What is form ad 2047?

FSA form AD-2047 to collect personal information including address, Social Security Number, phone number(s), fax number(s), email address, etc., for each member of the farming operation, in addition to a copy of Social Security Card.

What is the ad 1026 form?

To comply with the HELC and WC provisions, producers must fill out and sign form AD-1026 certifying they will not: Plant or produce an agricultural commodity on highly erodible land without following an NRCS approved conservation plan or system; Plant or produce an agricultural commodity on a converted wetland; or

What is form ad 2047 for?

FSA form AD-2047 to collect personal information including address, Social Security Number, phone number(s), fax number(s), email address, etc., for each member of the farming operation, in addition to a copy of Social Security Card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 902?

Form 902 is a tax form used by certain entities to report various financial information to the IRS.

Who is required to file Form 902?

Entities that meet specific criteria set by the IRS, usually related to tax-exempt status or certain financial transactions, are required to file Form 902.

How to fill out Form 902?

To fill out Form 902, gather the necessary financial data, follow the instructions provided by the IRS, and ensure all required fields are completed before submission.

What is the purpose of Form 902?

The purpose of Form 902 is to provide the IRS with important financial information that may affect an entity's tax status or reporting requirements.

What information must be reported on Form 902?

Information that must be reported on Form 902 includes details about income, expenses, and other relevant financial activities of the entity.

Fill out your form 902 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 902 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.