Get the free Form 4684

Show details

Este formulario se utiliza para informar pérdidas de propiedad debido a accidentes o robos que no se utilizan en un negocio o para fines de generación de ingresos. Se deben usar formularios separados

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 4684

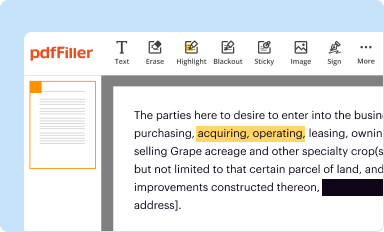

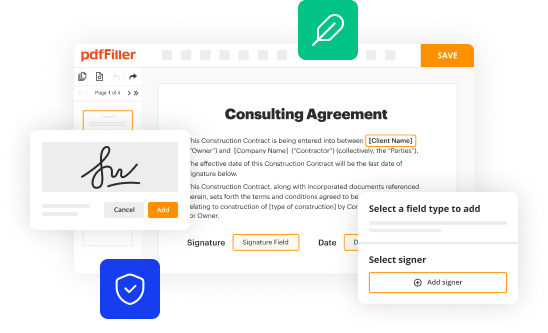

Edit your form 4684 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

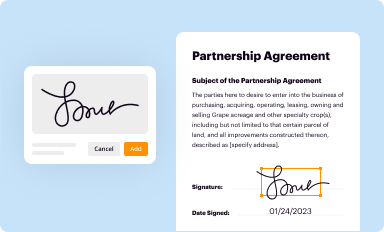

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4684 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4684 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 4684. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 4684

How to fill out Form 4684

01

Download Form 4684 from the IRS website.

02

Begin by entering your name and social security number at the top of the form.

03

Indicate the type of loss you are reporting: casualty or theft.

04

Describe the property lost or damaged, including its location.

05

Provide the date of the event causing the loss.

06

Calculate the amount of loss using the IRS guidelines for property valuation.

07

Provide any additional information or documentation required.

08

Sign and date the form before submitting it with your tax return.

Who needs Form 4684?

01

Individuals who have suffered a loss due to theft or casualty events such as floods, hurricanes, or fires.

02

Taxpayers seeking to claim a deduction for personal property losses on their federal tax returns.

03

Individuals who have experienced losses that are not covered by insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form 4684 used for?

Form 4684 is an Internal Revenue Service (IRS) form for reporting gains or losses from casualties and thefts which may be deductible for taxpayers who itemize deductions. Casualty losses can be the result of fires, floods, and other disasters.

What qualifies for for casualty loss deduction under IRS Code section 165?

except as provided in subsection (h), losses of property not connected with a trade or business or a transaction entered into for profit, if such losses arise from fire, storm, shipwreck, or other casualty, or from theft.

What qualifies as a casualty loss deduction?

Understanding Casualty Losses and Their Application The IRS allows taxpayers to deduct losses resulting from sudden, unexpected, or unusual events. These events include natural disasters, thefts, and accidents that damage or destroy property. For a loss to qualify, it must be: Physical.

What qualifies as a qualified disaster loss?

A disaster loss is a loss that is attributable to a federally declared disaster and that occurs in an area eligible for assistance pursuant to the Presidential declaration. The disaster loss must occur in a county eligible for public or individual assistance (or both).

What qualifies as a loss for tax purposes?

You have a capital gain if you sell the asset for more than your adjusted basis. You have a capital loss if you sell the asset for less than your adjusted basis. Losses from the sale of personal-use property, such as your home or car, aren't tax deductible.

What qualifies for a casualty loss deduction?

Understanding Casualty Losses and Their Application The IRS allows taxpayers to deduct losses resulting from sudden, unexpected, or unusual events. These events include natural disasters, thefts, and accidents that damage or destroy property. For a loss to qualify, it must be: Physical.

What is an example of a casualty gain?

Example. A single taxpayer's home is destroyed by a hurricane and the taxpayer is paid $400,000 by his insurance company. The taxpayer's basis in the home was $100,000 so the casualty gain is $300,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 4684?

Form 4684 is a tax form used to report casualties and theft losses for individuals, corporations, and partnerships on their federal income tax returns.

Who is required to file Form 4684?

Taxpayers who have experienced a casualty or theft loss that they wish to claim as a deduction must file Form 4684.

How to fill out Form 4684?

To fill out Form 4684, taxpayers must provide personal information, detail each casualty or theft event, calculate the loss amount, and provide supporting documentation if required.

What is the purpose of Form 4684?

The purpose of Form 4684 is to allow taxpayers to report and claim deductions for financial losses resulting from casualties, thefts, or disasters.

What information must be reported on Form 4684?

Taxpayers must report details such as the date of loss, type of property affected, description of the loss, estimated loss amount, and any insurance reimbursements received.

Fill out your form 4684 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4684 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.