Get the free Mortgage Loan Originator Application

Show details

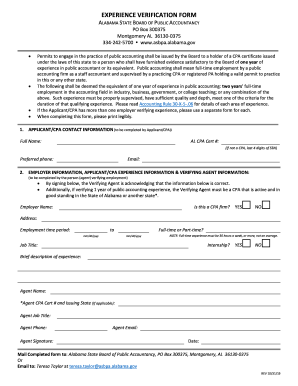

This document is an application form required by the Oklahoma Department of Consumer Credit for individuals seeking to become licensed Mortgage Loan Originators in Oklahoma. It includes sections for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan originator application

Edit your mortgage loan originator application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan originator application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage loan originator application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage loan originator application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan originator application

How to fill out Mortgage Loan Originator Application

01

Obtain the Mortgage Loan Originator Application form from your local regulatory agency or website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your employment history, detailing your previous roles in the mortgage industry.

04

Disclose any criminal history or disciplinary actions, if applicable.

05

List your educational qualifications, including any relevant certifications or degrees.

06

Complete any required fingerprinting or background check as mandated by the state.

07

Review your application for accuracy and completeness before submission.

08

Submit your application to the relevant regulatory agency, along with any required fees.

Who needs Mortgage Loan Originator Application?

01

Individuals seeking to become licensed mortgage loan originators.

02

Real estate professionals looking to expand their services.

03

Anyone aiming to work in the mortgage lending industry.

Fill

form

: Try Risk Free

People Also Ask about

How hard is the MLO safe exam?

The SAFE MLO Test is Difficult, But Why? As an aspiring Mortgage Loan Officer (MLO), there are certain steps you need to take to obtain your license, including taking and passing the SAFE MLO Test. Failing this test is a shared experience for new MLOs, with only 57% of test takers passing on their first attempt.

What percentage of people pass the MLO test?

Passing score: 75%+ National pass rate: 56% Pass rate with MLO Test Ready: 85%

What is the pass rate for the mortgage loan originator license?

The average first-time pass rate on the NMLS exam is only 57% Avoid being part of the 43% who fail and need to retake the exam. This training program features an average pass rate of 85% and is specifically designed to increase your chances of success.

How hard is the mortgage loan originator test?

Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult. Did you know that only 56% of NMLS test takers pass the exam on their first attempt?

How do you describe a mortgage loan originator on a resume?

Yes. You can become a loan originator even if you have bad credit, though there may be challenges to overcome. Licensing requirements for loan originators (including completing the NMLS exam and background checks) don't explicitly disqualify candidates based on credit scores.

Is the mortgage loan originator test hard?

Working in the mortgage industry comes with a lot of responsibility. Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult.

How to market yourself as a mortgage loan originator?

For example: “Accomplished loan officer, well-versed with loan standards and laws. Possesses excellent customer service skills.” Another example: “Accomplished mortgage loan officer with expert knowledge of loan programs and NMLS compliance guidelines. Adept at delivering outstanding customer service.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Loan Originator Application?

The Mortgage Loan Originator Application is a formal document that individuals must complete to obtain a license to operate as a mortgage loan originator, which allows them to facilitate home loans and act as intermediaries between borrowers and lenders.

Who is required to file Mortgage Loan Originator Application?

Anyone who intends to work as a mortgage loan originator and engage in the business of taking mortgage loan applications or negotiating terms must file a Mortgage Loan Originator Application.

How to fill out Mortgage Loan Originator Application?

To fill out the Mortgage Loan Originator Application, individuals must provide personal information, employment history, financial details, and disclosures regarding any criminal history or regulatory actions, all in accordance with the guidelines set by the Nationwide Mortgage Licensing System (NMLS).

What is the purpose of Mortgage Loan Originator Application?

The purpose of the Mortgage Loan Originator Application is to ensure that individuals seeking to originate loans meet certain qualification standards and to protect consumers by providing a mechanism for oversight and accountability in the mortgage lending process.

What information must be reported on Mortgage Loan Originator Application?

Information that must be reported on the Mortgage Loan Originator Application includes personal identification details, employment history, financial records, any criminal convictions, disciplinary actions by regulatory agencies, and other pertinent background information necessary for the licensing process.

Fill out your mortgage loan originator application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Originator Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.