Get the free Form 706

Show details

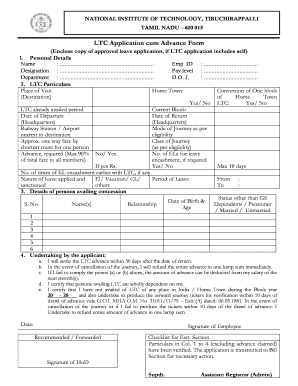

This form is used to report the estate and generation-skipping transfer taxes owed on the estate of a decedent. It requires information about the decedent, the executor, the estate's gross value,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 706

Edit your form 706 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 706 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 706 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 706. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 706

How to fill out Form 706

01

Begin by obtaining the Form 706 from the IRS website or your tax professional.

02

Gather all necessary information regarding the deceased's assets, including real estate, bank accounts, investments, and personal property.

03

Calculate the gross estate value by summing the total value of all assets owned by the deceased at the time of death.

04

Deduct any allowable expenses, debts, and specific exemptions to arrive at the taxable estate value.

05

Complete the personal information section, including the decedent's name, social security number, date of death, and executor's details.

06

Fill out the asset sections of the form, detailing each asset, its fair market value, and any applicable deductions.

07

Report any gifts made by the decedent within three years of death in the appropriate section.

08

Calculate the estate tax owed using the tax tables provided in the form instructions.

09

Review the completed form for accuracy and seek assistance from a tax professional if needed.

10

Submit the form to the IRS along with payment of any estate tax due within nine months of the decedent's death.

Who needs Form 706?

01

Form 706 is required to be filed by the executor of an estate if the deceased person's gross estate exceeds the filing threshold set by the IRS, which is $12.06 million for 2022.

Fill

form

: Try Risk Free

People Also Ask about

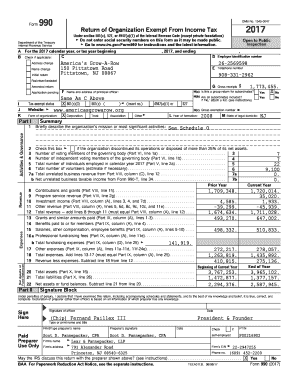

How much does it cost to file Form 706?

The Cost of Tax Preparation Tax FormCost per FormAverage Hourly Fees Form 990 (Exempt Organization) $735 $171.48 Form 1120-S (S Corporation) $903 $179.81 Form 1120 (Corporation) $913 $181.57 Form 706 (Estate) $1289 $188.6310 more rows

Who prepares form 706?

Who should prepare Form 706? Your executor or personal representative is responsible for filing Form 706. Generally, this task is handled by your accountant or family attorney, depending on their capabilities and the specific estate needs.

How much does it cost to file a 706?

The Cost of Tax Preparation Tax FormCost per FormAverage Hourly Fees Form 990 (Exempt Organization) $735 $171.48 Form 1120-S (S Corporation) $903 $179.81 Form 1120 (Corporation) $913 $181.57 Form 706 (Estate) $1289 $188.6310 more rows

Who prepares estate tax returns?

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. The types of taxes a deceased taxpayer's estate can owe are: Income tax on income generated by assets of the estate of the deceased.

Who signs 706 if there is no executor?

IRC Section 2203 states: “(t)he term 'executor' … means the executor or administrator of the decedent, or, if there is no executor or administrator appointed, qualified and acting within the United States, then any person in actual or constructive possession of any property of the decedent.”

What is a 706 form used for?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

Do I have to report the sale of inherited property to the IRS?

Report the sale on Schedule D (Form 1040), Capital Gains and Losses and on Form 8949, Sales and Other Dispositions of Capital Assets: If you sell the property for more than your basis, you have a taxable gain.

Who is responsible for filing form 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 706?

Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return, used to report the estate tax liability of a deceased person's estate.

Who is required to file Form 706?

Form 706 must be filed by the executor or administrator of an estate if the gross estate exceeds the federal estate tax exemption amount, which is subject to change based on tax law.

How to fill out Form 706?

To fill out Form 706, you should gather all necessary information about the deceased's assets, debts, and liabilities, calculate the value of the estate, and report these details on the form, following the instructions provided by the IRS.

What is the purpose of Form 706?

The purpose of Form 706 is to calculate and report the estate tax due on the estate of a deceased person, ensuring compliance with federal tax laws.

What information must be reported on Form 706?

Form 706 requires reporting of the gross estate value, deductions for debts, expenses, and certain bequests, the taxable estate value, and information about any previously paid generation-skipping transfer taxes.

Fill out your form 706 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 706 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.