Get the free Application for Authorization as an Independent Certified Public Accountant for Capt...

Show details

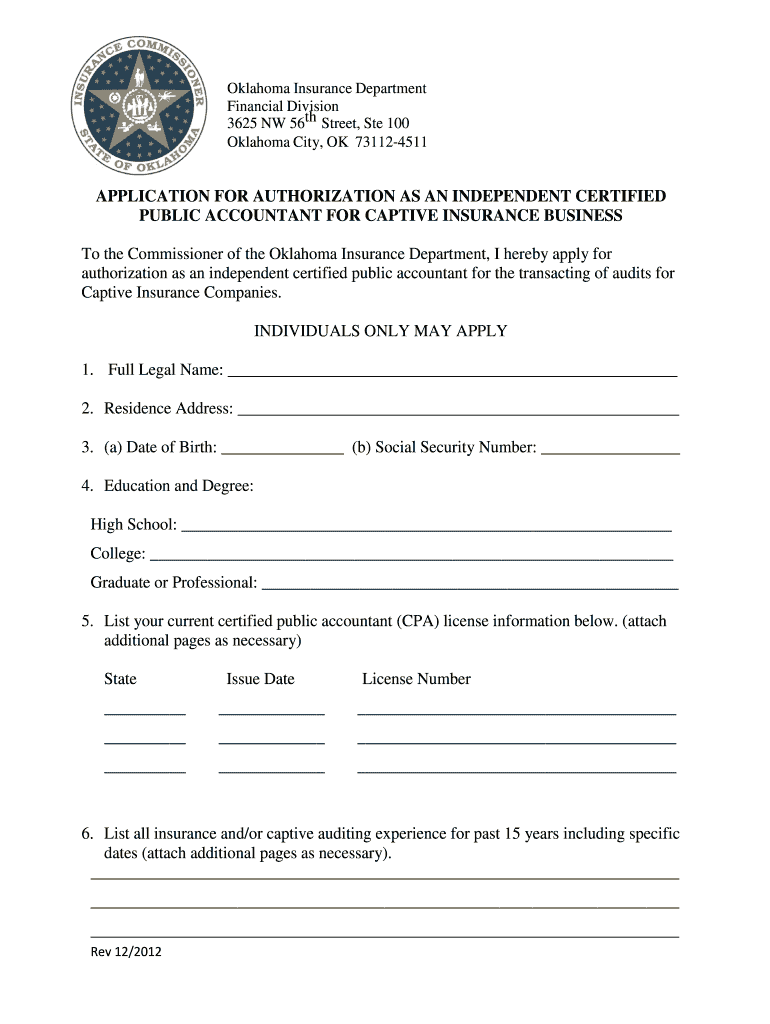

This document is an application form for individuals seeking authorization as independent certified public accountants to conduct audits for Captive Insurance Companies in Oklahoma.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for authorization as

Edit your application for authorization as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for authorization as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for authorization as online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for authorization as. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for authorization as

How to fill out Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business

01

Obtain the Application for Authorization form from the relevant regulatory body or agency.

02

Read the instructions carefully to ensure all requirements are understood.

03

Complete all personal and professional information including your CPA license details.

04

Provide information about your experience and qualifications relevant to captive insurance.

05

Disclose any prior disciplinary actions or complaints, if applicable.

06

Include any relevant certifications or supporting documents as required.

07

Review the application for completeness and accuracy.

08

Sign and date the application form.

09

Submit the application along with any required fees to the appropriate authority.

Who needs Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

01

Independent Certified Public Accountants who wish to offer accounting services specifically for captive insurance businesses.

02

Firms planning to engage with captive insurance companies in need of audit and financial reporting expertise.

Fill

form

: Try Risk Free

People Also Ask about

Who is the owner of captive insurance?

In a captive insurance company, the policyholder is also the owner but can write insurance contracts to a related third party.

What is an independent certified public accountant?

Independent public accountants are certified professionals or accounting firms that provide auditing, accounting, and consulting services to businesses, organizations, and government entities, but are not involved in the day-to-day operations of those entities.

How do you account for captive insurance?

Accounting for captive insurance involves determining appropriate reserve levels to cover potential future claims. The accounting treatment of these reserves requires a nuanced approach, considering factors such as actuarial assessments and changes in the risk profile of the captive.

How do you account for insurance in accounting?

The payment made by the company is listed as an expense for the accounting period. If the insurance is used to cover production and operation, then the insurance expense can be listed in an overhead cost pool and divided into each unit produced during the period.

How is captive insurance taxed?

Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes. Captive owners may also deduct losses on unpaid losses as they are incurred, providing an accelerated deduction timeframe from typical insurance arrangements or traditional self-insurers.

How do captives work in insurance?

The captive provides the owner or its affiliates with insurance coverage for risks that the owner wishes to retain, and the insured entities pay premium to the captive. Any profits made by a captive are retained within the parent company's group rather than being 'lost' to the insurance market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

It is a formal request submitted by certified public accountants seeking approval to provide auditing and accounting services specifically for captive insurance companies.

Who is required to file Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

Independent Certified Public Accountants who wish to serve as auditors for captive insurance entities are required to file this application.

How to fill out Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

The application must be completed with accurate personal and professional information, including credentials, experience in insurance, and compliance with regulatory standards.

What is the purpose of Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

The purpose is to ensure that independent accountants meet the necessary qualifications and standards to effectively audit and report on the financial statements of captive insurance companies.

What information must be reported on Application for Authorization as an Independent Certified Public Accountant for Captive Insurance Business?

The application must include details such as the accountant's licensing information, professional experience, educational background, and evidence of any relevant training or certifications in captive insurance.

Fill out your application for authorization as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Authorization As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.