Get the free OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS

Show details

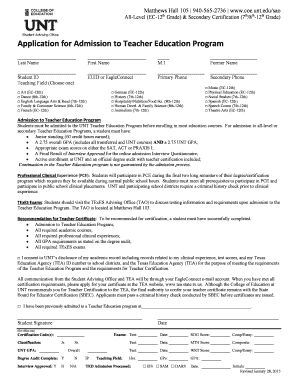

This document provides a list of individuals and firms registered with the Oklahoma Accountancy Board that meet the Government Auditing Standards for continuing education and external quality review.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma accountancy board registrants

Edit your oklahoma accountancy board registrants form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma accountancy board registrants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma accountancy board registrants online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oklahoma accountancy board registrants. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma accountancy board registrants

How to fill out OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS

01

Visit the Oklahoma Accountancy Board website.

02

Download the application form for Registrants Performing Governmental Audits.

03

Carefully read the instructions provided in the application form.

04

Fill out the personal information section including name, address, and contact details.

05

Provide your professional credentials, including CPA license number and any relevant experience.

06

Indicate the types of governmental audits you will be performing.

07

Attach any required documentation, such as proof of continuing education.

08

Review your application for completeness and accuracy.

09

Sign and date the application form.

10

Submit the application along with any required fees to the Oklahoma Accountancy Board.

Who needs OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

01

CPAs and accountants who plan to conduct audits for government entities in Oklahoma.

02

Government agencies that require oversight and transparency in their financial auditing processes.

03

Taxpayers and stakeholders interested in the accountability of government spending.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of an audit performed by a certified public accountant?

The primary purpose of a CPA audit is to provide reasonable assurance that the financial statements are free from material misstatement and fairly represent the company's financial position. This assurance is crucial for stakeholders who rely on these financial statements to make informed decisions.

Who audits public accounting firms?

The PCAOB is a nonprofit corporation established by Congress to oversee the audits of public companies in order to protect investors and further the public interest in the preparation of informative, accurate, and independent audit reports.

What is the Sarbanes-Oxley Act and the Public Company Accounting Oversight Board?

The United States Public Company Accounting Oversight Board (PCAOB) is a private-sector, non-profit corporation, created by the Sarbanes-Oxley Act of 2002, to oversee the auditors of public companies in order to protect the interests of investors and further the public interest in the preparation of informative, fair,

What is the Sarbanes-Oxley Act in simple terms?

The Act requires year-end financial disclosure reports and that all financial reports come with an internal controls report. Financial disclosures must contain reporting of material changes in financial condition.

What legislation created the Public Company Accounting Oversight Board which helps keep track of auditing activities?

The Public Company Accounting Oversight Board (also known as the PCAOB) is a private-sector, nonprofit corporation created by the Sarbanes-Oxley Act of 2002 to oversee accounting professionals who provide independent audit reports for publicly traded companies.

What is the Sarbanes-Oxley Act Public Company Accounting Oversight Board?

The United States Public Company Accounting Oversight Board (PCAOB) is a private-sector, non-profit corporation, created by the Sarbanes-Oxley Act of 2002, to oversee the auditors of public companies in order to protect the interests of investors and further the public interest in the preparation of informative, fair,

What does the public company accounting oversight board do?

Auditors of public companies are prohibited by the Sarbanes-Oxley Act to provide non-audit services, such as consulting, to their audit clients. Congress made certain exceptions for tax services, which are therefore overseen by the PCAOB.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

The Oklahoma Accountancy Board Registrants Performing Governmental Audits refers to the list of certified public accountants (CPAs) and accounting firms who are registered with the Oklahoma Accountancy Board to conduct governmental audits in compliance with state regulations.

Who is required to file OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

Registered CPAs and accounting firms that perform audits for governmental entities in Oklahoma are required to file the Oklahoma Accountancy Board Registrants Performing Governmental Audits.

How to fill out OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

To fill out the form, registrants should provide their names, CPA license numbers, firm details, and specific information about the governmental audits they have conducted. Detailed instructions are typically provided by the Oklahoma Accountancy Board.

What is the purpose of OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

The purpose is to ensure transparency and accountability in government financial reporting by tracking and regulating the CPAs who perform audits on governmental entities.

What information must be reported on OKLAHOMA ACCOUNTANCY BOARD REGISTRANTS PERFORMING GOVERMENTAL AUDITS?

The report must include the registrant's personal information, CPA license number, firm's name, the types of governmental entities audited, and the dates of those audits.

Fill out your oklahoma accountancy board registrants online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Accountancy Board Registrants is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.