Get the free WCC Form # 32 - wcc sc

Show details

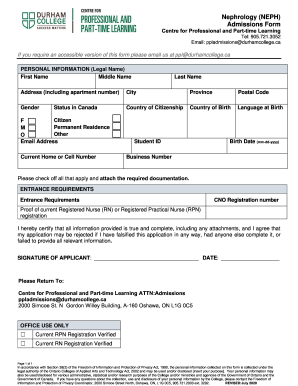

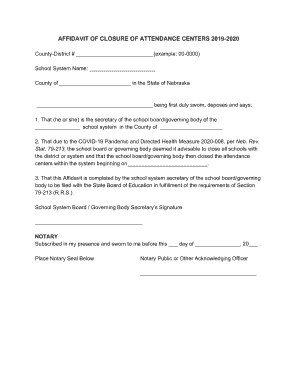

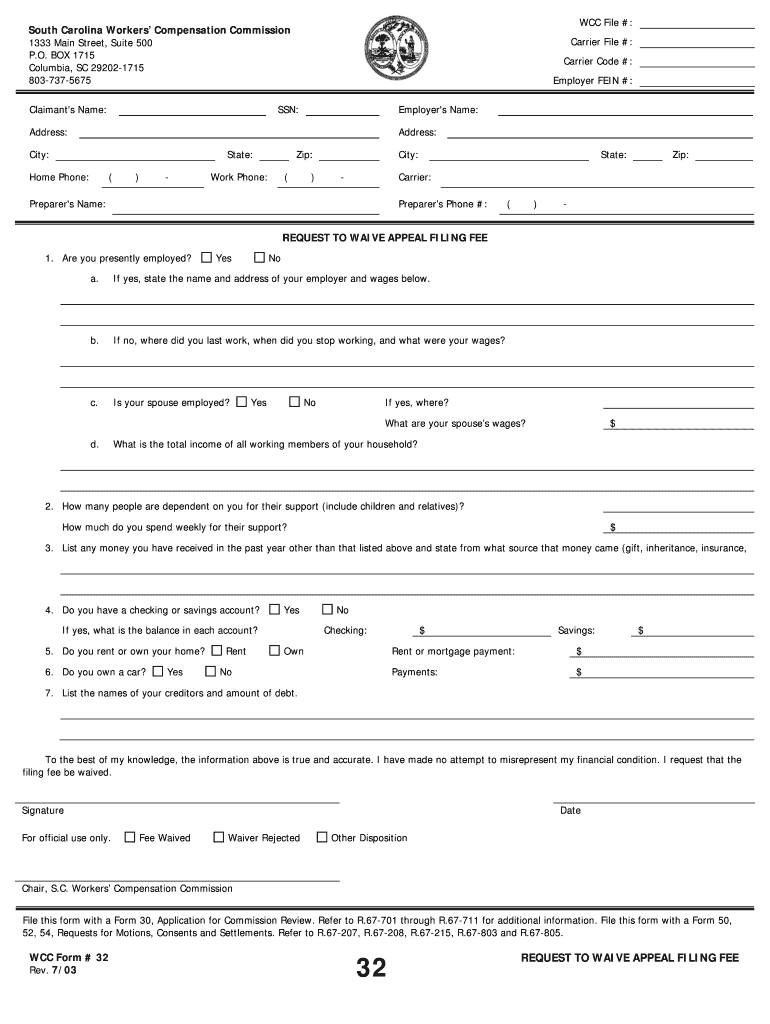

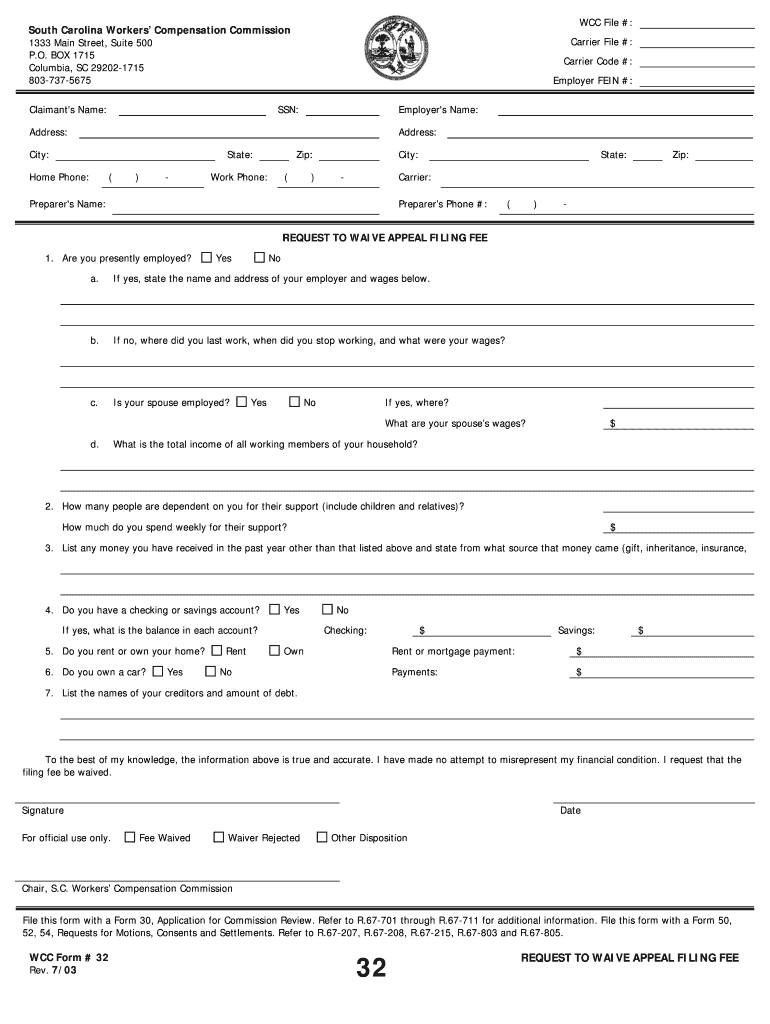

This form is for individuals seeking to have the filing fee for an appeal waived due to financial hardship. It collects personal information, employment status, household income, expenses, and debt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wcc form 32

Edit your wcc form 32 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wcc form 32 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wcc form 32 online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wcc form 32. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wcc form 32

How to fill out WCC Form # 32

01

Download the WCC Form # 32 from the official website.

02

Read the instructions carefully before starting the form.

03

Begin filling out your personal information, including your name, address, and contact details.

04

Provide details about the incident that requires the form, including date, time, and nature of the incident.

05

Include any relevant witness information, if applicable.

06

Review the specific claims or requests being made on the form.

07

Sign and date the form at the designated areas.

08

Submit the completed form to the appropriate authority as instructed.

Who needs WCC Form # 32?

01

Individuals who have experienced a workplace injury or accident.

02

Employees seeking to claim workers' compensation benefits.

03

Employers needing to report workplace incidents for compliance purposes.

04

Legal representatives handling workers' compensation cases.

Fill

form

: Try Risk Free

People Also Ask about

How to file for workers' compensation in South Carolina?

File a claim by filling out and submitting Form 50 (in case of work-related injuries) or Form 52 (in case of work-related death) to the Commission. Request a hearing by indicating this desire on the claim form (Line 13b on Form 50 or Line 12b on Form 52).

How to get workers' comp tax form?

Workers' compensation benefits are not taxable, and you won't receive a 1099 form for them. These benefits are meant to provide financial relief without the burden of taxes. However, if you also receive SSDI or a personal injury settlement, other taxable income might come into play.

How do I get workers comp for 1099 employees?

State laws don't require employers to provide workers' comp insurance for 1099 contractors. However, contractors may choose to buy this coverage themselves as it can pay for work-related medical bills that regular health insurance may not cover.

Does Workmans Comp get reported to the IRS?

Generally, workers' compensation benefits are not taxable and do not need to be reported on your federal or state tax returns.

How do I report workers' comp on my taxes at TurboTax?

Worker compensation is not taxable and does not get entered on a tax return.

Do you get a tax form from workers' comp?

Workers' compensation benefits are not taxable, and you won't receive a 1099 form for them. These benefits are meant to provide financial relief without the burden of taxes. However, if you also receive SSDI or a personal injury settlement, other taxable income might come into play.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

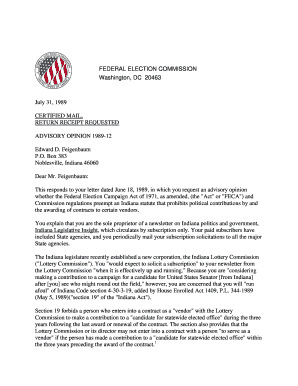

What is WCC Form # 32?

WCC Form # 32 is a specific form utilized in the workers' compensation system, typically for reporting and documenting claims related to workplace injuries or illnesses.

Who is required to file WCC Form # 32?

Employers and insurance carriers involved in a workers' compensation claim are required to file WCC Form # 32, especially when reporting details of an injured employee's claim.

How to fill out WCC Form # 32?

To fill out WCC Form # 32, the filer should provide accurate information regarding the employee's details, the nature of the injury, medical treatment received, and any payments made under the workers' compensation claim.

What is the purpose of WCC Form # 32?

The purpose of WCC Form # 32 is to ensure that all relevant details related to a workers' compensation claim are documented and reported, facilitating the claims process and ensuring compliance with regulatory requirements.

What information must be reported on WCC Form # 32?

Information required on WCC Form # 32 includes the employee's name, identification number, details of the injury, date of the incident, medical treatments provided, and any compensation payments made.

Fill out your wcc form 32 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wcc Form 32 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.