Get the free claim for refund for trust fund recovery penalty rev proc form

Show details

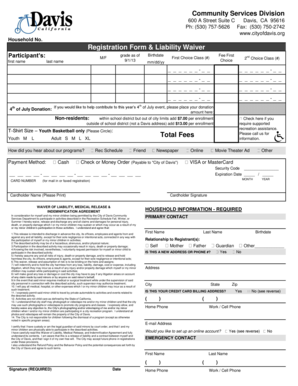

26 CFR 601. 104 Collection functions. Also Part I 6672 301. 6672. Rev. Proc. 2005 34 SECTION 1. PURPOSE This revenue procedure sets forth updated procedures for appeals of proposed trust fund recovery penalty assessments arising under section 6672 of the Internal Revenue Code. 03 Only Appeals may consider a claim for abatement if the assessment was made on the basis of a decision of Appeals. If abatement claim. SECTION 9. EFFECT ON OTHER DOCUMEN...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for refund for

Edit your claim for refund for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for refund for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for refund for online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for refund for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for refund for

How to fill out claim for refund:

01

Gather all necessary documents: This includes any receipts, invoices, or proof of purchase related to the item or service for which you are seeking a refund. It is important to have all relevant documentation to support your claim.

02

Determine the reason for the refund: Clearly identify the specific issue or problem that has led you to seek a refund. Whether it's a defective product, unsatisfactory service, or any other valid reason, make sure to provide a detailed description of the problem.

03

Contact the seller or service provider: Reach out to the person or company from whom you purchased the item or service. You can do this via phone, email, or in person. Explain your situation and intent to file a claim for a refund. They may provide you with specific instructions on how to proceed.

04

Fill out the claim form: Many sellers or service providers have a specific claim form that needs to be filled out. Take your time to complete the form accurately. Provide all the necessary information, such as your personal details, purchase details, and a clear explanation of the problem that warrants a refund.

05

Attach supporting documents: Along with the claim form, attach copies of all the relevant documents you gathered in step 1. These documents will serve as evidence to support your claim.

06

Follow up with the seller or service provider: It is important to stay in touch with the person or company handling your claim. Check in regularly to inquire about the progress and inquire about any additional information they may need from you.

Who needs a claim for refund:

01

Customers who received a defective product: If you have purchased an item that is not functioning properly or has defects, you may need to file a claim for a refund.

02

Dissatisfied customers: Those who are unhappy with a product or service may seek a refund. This could be due to poor quality, misleading advertising, or failure to meet the promised standards.

03

Customers who canceled services: In cases where you have canceled a service but have been charged regardless, a claim for a refund is necessary to rectify the situation.

Note: The specific requirements for filing a claim for a refund may vary depending on the seller, service provider, or jurisdiction. It is essential to familiarize yourself with the specific procedures and policies related to refund claims in your particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claim for refund for without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including claim for refund for, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in claim for refund for without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit claim for refund for and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit claim for refund for on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as claim for refund for. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is claim for refund for?

Claim for refund is a formal request made by an individual or entity to the IRS to return or reimburse taxes that were overpaid or wrongfully paid.

Who is required to file claim for refund for?

Any individual or entity who believes they have overpaid or wrongfully paid taxes is required to file a claim for refund.

How to fill out claim for refund for?

To fill out a claim for refund, individuals or entities need to complete Form 843, Claim for Refund and Request for Abatement, including all required information and supporting documentation.

What is the purpose of claim for refund for?

The purpose of a claim for refund is to request the return or reimbursement of taxes that were overpaid or wrongfully paid.

What information must be reported on claim for refund for?

A claim for refund must include detailed information such as the tax year, specific tax type, amount of overpayment, explanation for the refund request, and any supporting documentation.

Fill out your claim for refund for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Refund For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.