Get the free Cigarette Excise Tax Stamp Credit Application - state sd

Show details

Este documento es una solicitud de crédito de impuesto sobre el sello de cigarrillos en el estado de Dakota del Sur para distribuidores que devuelven cigarrillos dañados o no vendibles.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cigarette excise tax stamp

Edit your cigarette excise tax stamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cigarette excise tax stamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cigarette excise tax stamp online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cigarette excise tax stamp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

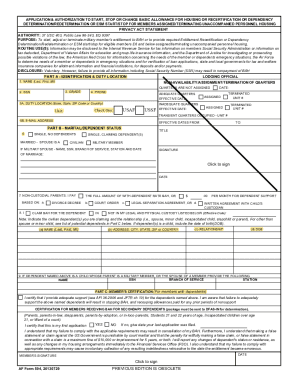

How to fill out cigarette excise tax stamp

How to fill out Cigarette Excise Tax Stamp Credit Application

01

Obtain the Cigarette Excise Tax Stamp Credit Application form from the appropriate revenue agency website or local office.

02

Fill in your business information accurately, including your name, address, and contact details.

03

Provide details about your sales of cigarettes for the reporting period, including quantities and any relevant tax information.

04

Calculate the amount of credit you are applying for based on the eligible excise taxes paid.

05

Attach any necessary documentation, such as proof of taxes paid or sales records.

06

Review the application for completeness and accuracy.

07

Sign and date the application to certify that all information provided is true.

08

Submit the completed application to the designated agency by the specified deadline.

Who needs Cigarette Excise Tax Stamp Credit Application?

01

Businesses that sell cigarettes and have paid excise taxes on those sales.

02

Retailers and wholesalers looking to claim a credit for the excise taxes on cigarette sales.

03

Any entity legally required to remit cigarette excise taxes to the government and seeking reimbursement.

Fill

form

: Try Risk Free

People Also Ask about

How much is the federal tax on a pack of cigarettes?

The current federal cigarette tax is $1.01 per pack. The American Lung Association supports increasing the federal cigarette tax and making federal tax rates on other tobacco products equal to the cigarette tax.

What states don't have tax stamps on cigarettes?

About This Map Location Sort by Location in descending orderTax Stamp Required Summary Sort by Tax Stamp Required Summary in descending order North Carolina No tax stamp required North Dakota No tax stamp required Northern Marianas No tax stamp required Ohio Tax stamp required54 more rows

Who puts the tax stamp on cigarettes?

Cigarettes are subject to the cigarette tax and the cigarette and tobacco products surtaxes. Cigarette distributors pay the tax and surtax to the State of California by purchasing cigarette tax stamps from the California Department of Tax and Fee Administration (CDTFA).

What is an ATF tax stamp?

In 2016 California voters raised taxes on tobacco products when they passed Proposition 56, which created the California Healthcare, Research and Prevention Tobacco Tax Act of 2016, which took effect in April 2017.

How to spot a cigarette tax stamp?

Hold the tax stamp in front of you and note the color, then tilt the pack and see if the color changes on the tax stamp. If the ink doesn't appear shiny and change to blue, it's not a genuine tax stamp.

Why do cigarettes have tax stamps?

When a licensed vendor (e.g., manufacturer, distributor, wholesaler) has paid the state excise tax for tobacco products, they receive a stamp from the state to affix to the tobacco products in order to sell at retail. Essentially, tax stamps are evidence of the payment of tax.

What is a tax stamp for cigarettes?

A cigarette tax stamp is a specific example of a revenue stamp. The 1978 Contraband Cigarette Act prohibits the transport, receipt, shipment, possession, distribution, or purchase of more than 60,000 cigarettes (300 cartons) not bearing the official tax stamp of the U.S. state in which the cigarettes are located.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cigarette Excise Tax Stamp Credit Application?

The Cigarette Excise Tax Stamp Credit Application is a form used by eligible distributors or manufacturers to request a credit for the excise tax paid on cigarettes that have been untaxed or unconsumed.

Who is required to file Cigarette Excise Tax Stamp Credit Application?

Distributors and manufacturers of cigarettes who have paid excise tax on products that are unsold, stolen, or lost may be required to file the Cigarette Excise Tax Stamp Credit Application.

How to fill out Cigarette Excise Tax Stamp Credit Application?

To fill out the application, provide details such as the total quantity of stamps, the reason for the credit request, and the amount of tax previously paid. Ensure all sections are completed accurately and submit the application to the designated tax authority.

What is the purpose of Cigarette Excise Tax Stamp Credit Application?

The purpose of the Cigarette Excise Tax Stamp Credit Application is to allow eligible distributors and manufacturers to recover excise tax paid on cigarettes that are not sold or consumed, ensuring fair taxation practices.

What information must be reported on Cigarette Excise Tax Stamp Credit Application?

The application must report the total quantity of cigarette stamps, the amount of excise tax paid, the reasons for the credit request, and any relevant supporting documentation as required by the tax authority.

Fill out your cigarette excise tax stamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cigarette Excise Tax Stamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.