Get the free SD EForm - 0884 V2 - state sd

Show details

This form is used by financial institutions in South Dakota to submit their quarterly estimate payment for the franchise tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sd eform - 0884

Edit your sd eform - 0884 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sd eform - 0884 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sd eform - 0884 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sd eform - 0884. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sd eform - 0884

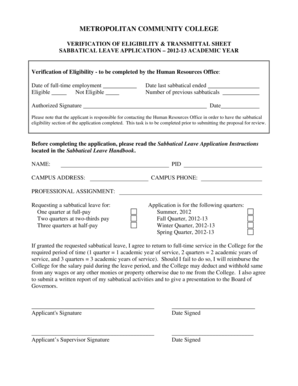

How to fill out SD EForm - 0884 V2

01

Begin by downloading the SD EForm - 0884 V2 from the official website.

02

Open the form and read the instructions carefully before filling it out.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Complete the sections related to the purpose of the form, providing any required details as specified.

05

Ensure all necessary documentation is attached, if applicable as per the instructions.

06

Review the form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate agency or department.

Who needs SD EForm - 0884 V2?

01

Individuals applying for assistance or benefits related to state services.

02

Organizations or institutions that require documentation for state funding.

03

Anyone needing to report information related to their eligibility for specific state programs.

Fill

form

: Try Risk Free

People Also Ask about

Is there a federal income tax in South Dakota?

Even though residents can reap these benefits, they're still subject to federal income tax, sales tax, and property tax. *Note that even though South Dakota has no state income tax, you are still responsible for federal taxes if you meet the IRS income filing threshold.

How to apply for a South Dakota sales tax license?

How do you register for a sales tax permit in South Dakota? You can apply online at the South Dakota Tax Application website or call 1-800-829-9188 for more information on applying in person.

How much is 100k after taxes in South Dakota?

If you make $100,000 a year living in the region of South Dakota, United States of America, you will be taxed $22,418. That means that your net pay will be $77,582 per year, or $6,465 per month. Your average tax rate is 22.4% and your marginal tax rate is 31.2%.

What is the phone number for South Dakota excise tax?

Phone - 1.800. 829.9188. Virtual Office Visit - schedule an appointment to speak with one of our business tax agents.

How much is South Dakota sales tax on vehicles?

Motor vehicles are not subject to state and local sales taxes. They are subject to a four percent motor vehicle tax on the purchase price. Most cities and towns in South Dakota have a local sales tax in addition to the state tax.

How much tax is deducted from a paycheck in South Dakota?

Overview of South Dakota Taxes Gross Paycheck$2,662 FICA and State Insurance Taxes 7.65% $204 Details Social Security 6.20% $165 Medicare 1.45% $3923 more rows

How much is South Dakota state income tax?

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.20 percent state sales tax rate and an average combined state and local sales tax rate of 6.11 percent.

How much is federal income tax in South Dakota?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax Rate Federal 22.00% 9.23% FICA 7.65% 7.65% State 0.00% 0.00% Local 0.00% 0.00%4 more rows • Jan 1, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SD EForm - 0884 V2?

SD EForm - 0884 V2 is a specific form used for reporting purposes related to certain financial or regulatory requirements.

Who is required to file SD EForm - 0884 V2?

Entities or individuals that meet specific criteria set by the regulatory body must file SD EForm - 0884 V2.

How to fill out SD EForm - 0884 V2?

To fill out SD EForm - 0884 V2, you must follow the instructions provided in the form, ensuring all required fields are completed accurately.

What is the purpose of SD EForm - 0884 V2?

The purpose of SD EForm - 0884 V2 is to collect and report necessary information that complies with regulatory standards.

What information must be reported on SD EForm - 0884 V2?

The information reported on SD EForm - 0884 V2 typically includes financial data, identification details of the filer, and any relevant transaction information.

Fill out your sd eform - 0884 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sd Eform - 0884 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.