Get the free rev proc 2003 60 form

Show details

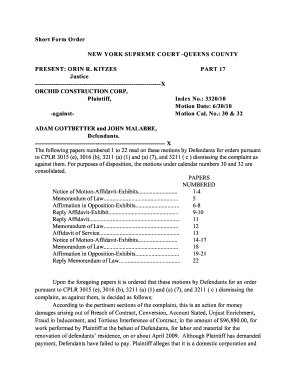

26 CFR 601. 201 Rulings and determination letters. Also Part I 170 664 2055 1. 664 2 20. 2055 2. Rev. Proc. 2003 60 SECTION 1. See Rev. Proc. 2003-60 page 274. Section 664. Charitable Remainder Trusts Section 2055. Transfers for Public Charitable and Religious Uses 26 CFR 20. SECTION 4. SAMPLE TESTAMENTARY CHARITABLE REMAINDER ANNUITY TRUST TWO LIVES CONCURRENT AND CONSECUTIVE INTERESTS I give devise and bequeath property bequeathed to my Trustee in trust to be administered under this...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 2003 60

Edit your rev proc 2003 60 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 2003 60 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 2003 60 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rev proc 2003 60. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 2003 60

How to fill out rev proc 2003 60?

01

Gather all necessary documentation and information needed to complete the form.

02

Review the instructions and guidelines provided with rev proc 2003 60 to understand the requirements and procedures for filling out the form correctly.

03

Start by entering your personal information, such as name, address, and contact details, in the designated fields.

04

Provide any relevant identification numbers, such as social security or taxpayer identification numbers, as required.

05

Follow the instructions for each section of the form, filling in the requested information accurately and completely.

06

Pay careful attention to any special instructions or additional documentation required for specific entries on the form.

07

Double-check all entries and calculations to ensure accuracy before submitting the completed form.

08

Sign and date the form as indicated, certifying that the information provided is true and accurate to the best of your knowledge.

Who needs rev proc 2003 60?

01

Individuals or entities who are required to report certain financial transactions or activities to the relevant authorities.

02

Organizations or businesses that are subject to specific reporting or disclosure requirements.

03

Taxpayers who have been notified by the tax authorities to file rev proc 2003 60 or who are advised to do so based on their specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rev proc 60 form?

The rev proc 60 form refers to Revenue Procedure 60-40, which provides guidance on how abandoned or unclaimed retirement plan assets should be handled by plan administrators.

Who is required to file rev proc 60 form?

Plan administrators of retirement plans that have abandoned or unclaimed assets may be required to file rev proc 60 form to comply with the guidelines set forth in Revenue Procedure 60-40.

How to fill out rev proc 60 form?

To fill out rev proc 60 form, the plan administrator needs to provide information about the abandoned or unclaimed retirement plan assets, such as the nature of the assets, the efforts made to locate the owners, and the proposed disposition of the assets.

What is the purpose of rev proc 60 form?

The purpose of rev proc 60 form is to provide a structured process for plan administrators to handle abandoned or unclaimed retirement plan assets in accordance with the guidelines provided in Revenue Procedure 60-40.

What information must be reported on rev proc 60 form?

The rev proc 60 form typically requires the reporting of information related to the abandoned or unclaimed retirement plan assets, including details about the assets, efforts to locate the owners, and proposed disposition plans.

How do I modify my rev proc 2003 60 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your rev proc 2003 60 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send rev proc 2003 60 for eSignature?

When you're ready to share your rev proc 2003 60, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out rev proc 2003 60 on an Android device?

Complete rev proc 2003 60 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your rev proc 2003 60 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 2003 60 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.