Get the free Notice 2003–7

Show details

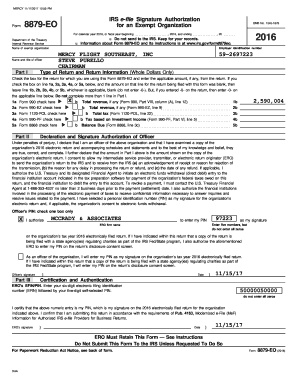

This notice provides updates on the interest rates used to calculate current liability for pension funding under the Internal Revenue Code, detailing the permissible ranges based on 30-year Treasury

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice 20037

Edit your notice 20037 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice 20037 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice 20037 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit notice 20037. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice 20037

How to fill out Notice 2003–7

01

Obtain a copy of Notice 2003–7 from the official website or IRS forms library.

02

Read the instructions provided on the form carefully.

03

Fill out your identification details at the top of the form, including your name, address, and identification number.

04

Complete the relevant sections that pertain to your circumstances, following the guidelines for each part.

05

Double-check the filled information for any inaccuracies or missing details.

06

Sign and date the form as required.

07

Submit the completed form to the appropriate IRS address or online portal as indicated.

Who needs Notice 2003–7?

01

Individuals who have received certain tax credits or need to report specific income.

02

Tax professionals who assist clients with filing requirements related to Notice 2003–7.

03

Business entities applying for tax deductions related to prior claims.

Fill

form

: Try Risk Free

People Also Ask about

What is the Minnesota 2014-7?

In January 2014, the IRS issued Notice 2014-7 stating that certain wages earned by employees providing services to individuals on a Medicaid Waiver can be excluded from federal income tax. This applies to employees living fulltime in the home with the Medicaid waiver person they provide services to.

What is exempt from sales tax in Minnesota?

Items Exempt by Law Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

What is Notice 2014-7 in Minnesota?

Under Notice 2014-7, payments for eligible Workers from a Medicaid program are now considered difficulty of care (DOC) payments, which are not federally taxable. Minnesota has elected to treat these payments similarly.

What is difficulty of care tax exemption IRS notice 2014-7?

Notice 2014-7 provides that the Internal Revenue Service (Service) will treat qualified Medicaid waiver payments as difficulty of care payments under section 131(c) of the Code that are excludable from the gross income of the individual care provider.

What is the Notice 2014-7 on my tax return?

Notice 2014-7 provides that the Internal Revenue Service (Service) will treat qualified Medicaid waiver payments as difficulty of care payments under section 131(c) of the Code that are excludable from the gross income of the individual care provider.

What is a tax forfeited property in Minnesota?

Tax forfeited parcels are properties on which delinquent property taxes were not paid, title to the land and buildings was forfeited and title is now vested in the State of Minnesota. Following a review period per Minnesota Statutes, these properties are open to the public to purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice 2003–7?

Notice 2003–7 is a guidance document issued by the IRS that outlines certain reporting requirements for taxpayers regarding foreign bank and financial accounts.

Who is required to file Notice 2003–7?

Taxpayers who have a financial interest in or signature authority over foreign financial accounts that exceed certain thresholds are required to file Notice 2003–7.

How to fill out Notice 2003–7?

To fill out Notice 2003–7, taxpayers must provide their personal information, details of the foreign accounts, and any other required information as specified in the notice instructions.

What is the purpose of Notice 2003–7?

The purpose of Notice 2003–7 is to ensure compliance with reporting requirements for foreign financial accounts and to help prevent tax evasion.

What information must be reported on Notice 2003–7?

The information that must be reported includes the account numbers, names of financial institutions, maximum value of the accounts during the year, and the taxpayer's identification information.

Fill out your notice 20037 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice 20037 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.