Get the free Rev. Proc. 98-64

Show details

This revenue procedure updates rules regarding per diem allowances for lodging, meal, and incidental expenses incurred by employees while traveling away from home. It provides guidelines on how these

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 98-64

Edit your rev proc 98-64 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 98-64 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 98-64 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rev proc 98-64. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 98-64

How to fill out Rev. Proc. 98-64

01

Obtain a copy of Rev. Proc. 98-64 from the IRS website.

02

Read the document thoroughly to understand its purpose and requirements.

03

Determine if your situation meets the criteria set forth in Rev. Proc. 98-64.

04

Gather all necessary documentation and information related to the tax issue addressed in the procedure.

05

Complete any required forms according to the guidelines provided in the Rev. Proc.

06

Review your completed forms for accuracy and completeness.

07

Submit the forms to the appropriate IRS office as indicated in the procedure.

Who needs Rev. Proc. 98-64?

01

Taxpayers who wish to claim penalties under certain specific circumstances.

02

Tax professionals who are advising clients on how to address certain tax issues.

03

Individuals facing issues of late filing, late payment, or other compliance-related challenges.

Fill

form

: Try Risk Free

People Also Ask about

Is Rev ProC 84-35 still valid?

In its recent memo, the IRS states that Revenue Procedure 84-35 is not obsolete and continues to apply. The memo goes on to say: The repeal of the small partnership exception in IRC § 6231(a)(1)(B) does not affect the scope of the penalty under IRC § 6698 for failure to file a partnership return.

How to find IRS revenue procedure?

Revenue procedures are published in the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin. This link is to a list of sources (print and online) offering the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin.

How do I get my late filing penalties waived?

In some cases, you can ask for penalty relief by calling the IRS. Use the toll-free number shown on your IRS notice. You can also seek a penalty or interest waiver by filing Form 843 with the IRS.

What do revenue procedures deal with?

Revenue Procedures deal with the internal practice and procedures of the IRS in the administration of the tax laws. They are official statements of procedures relating to sections of the Internal Revenue Code, related statutes, tax treaties, and regulations.

What does rev proc mean?

Definition: REV. PROC. is an abbreviation for REVENUE PROCEDURE. REVENUE PROCEDURE is a set of guidelines issued by the Internal Revenue Service (IRS) that provides instructions and procedures for taxpayers to follow when complying with tax laws.

What are good reasons to request an abatement of IRS penalties?

The IRS has criteria for removing penalties due to reasonable cause. Death, Serious Illness, or Unavoidable Absence, Fire, Casualty, Natural Disaster are some reasons. Best to outline your reasons in a letter to the IRS outlining your reasons and ask for abatement.

What happens if you miss the partnership tax deadline?

- Late filing penalty: The IRS charges a late filing penalty for partnerships that miss the filing deadline. This penalty is based on the number of months late, multiplied by the number of partners. In 2024, that penalty is $235 for each partner for each month that the return was late, for up to 12 months.

Does rev proc 84 35 still apply?

Revenue Procedure 84-35 is not obsolete and continues to apply. The reference to section 6231(a)(1)(B) contained in the revenue procedure is a means by which to define small partnerships for the purpose of the relief provided by the revenue procedure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

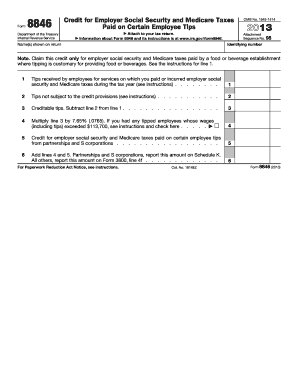

What is Rev. Proc. 98-64?

Rev. Proc. 98-64 is a revenue procedure issued by the IRS that provides guidance regarding the procedures for obtaining automatic consent to change certain methods of accounting.

Who is required to file Rev. Proc. 98-64?

Taxpayers who wish to change their accounting methods in accordance with the provisions set forth in Rev. Proc. 98-64 are required to file it.

How to fill out Rev. Proc. 98-64?

To fill out Rev. Proc. 98-64, taxpayers must complete the designated forms, provide the necessary financial information, and include the explanation of the change in accounting method.

What is the purpose of Rev. Proc. 98-64?

The purpose of Rev. Proc. 98-64 is to simplify the process for taxpayers to obtain approval for changing their accounting methods and to ensure compliance with IRS regulations.

What information must be reported on Rev. Proc. 98-64?

Information that must be reported includes the type of accounting method change, a detailed description of the current and proposed method, and any other relevant financial data as required by the IRS.

Fill out your rev proc 98-64 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 98-64 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.