Get the free Revenue Procedure 98-65

Show details

This revenue procedure outlines the guidelines and requirements for the development, design, printing, and approval of substitute tax forms acceptable for filing in lieu of official IRS forms. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue procedure 98-65

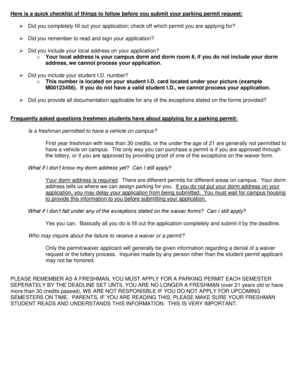

Edit your revenue procedure 98-65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue procedure 98-65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue procedure 98-65 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revenue procedure 98-65. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

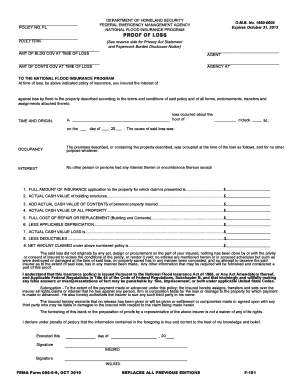

How to fill out revenue procedure 98-65

How to fill out Revenue Procedure 98-65

01

Obtain a copy of Revenue Procedure 98-65 from the IRS website.

02

Carefully read the instructions and requirements outlined in the Revenue Procedure.

03

Gather all necessary documentation related to the tax period in question.

04

Determine the specific eligibility criteria for your situation and ensure compliance.

05

Complete the required forms listed in the Revenue Procedure.

06

Double-check all information for accuracy and completeness.

07

Submit the forms to the appropriate address as indicated in the Revenue Procedure.

Who needs Revenue Procedure 98-65?

01

Taxpayers seeking relief from certain penalties imposed under the Internal Revenue Code.

02

Individuals or entities that need clarification or guidance on specific tax compliance issues.

03

Tax professionals assisting clients in filing or correcting tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Where are revenue procedures published?

Revenue ruling Revenue rulings are published in the Internal Revenue Bulletin for the information of and guidance to taxpayers, IRS personnel and tax professionals.

Where can I find IRS revenue procedures?

Revenue procedures are published in the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin.

What is revenue ruling 68 55?

Rev. Rul. 68-55 addressed the allocation of boot received in a Sec. 351 transfer, and generally required that gain or loss be computed on an asset-by-asset basis and allocated in proportion to relative asset values.

Where can I find treasury regulations?

Treasury (tax) regulations Treasury regulation sections can be found in Title 26 of the Code of Federal Regulations (26 CFR).

Where can I get IRS forms and instructions?

Need to find a product or place a telephone order? Visit the Forms, instructions & publications page to download products or call 800-829-3676 to place your order.

What is revenue ruling 96 65?

Back pay received in satisfaction of a claim for denial of a promotion due to disparate treatment employment discrimination under Title VII is not excludable from gross income under § 104(a)(2) because it is completely independent of, and thus is not damages received on account of, personal physical injuries or

What is the 84 35 revenue procedure?

Revenue Procedure 84-35 Reasonable cause for failure to file a timely and complete partnership return will be presumed if the partnership (or any of its partners) is able to show that all of the following conditions have been met: The partnership had no more than 10 partners for the taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Revenue Procedure 98-65?

Revenue Procedure 98-65 provides guidance for the proper reporting of certain damages received in lawsuits and settlements, specifically relating to the tax treatment of amounts received for personal physical injuries or physical sickness.

Who is required to file Revenue Procedure 98-65?

Taxpayers who receive damages or settlement amounts related to physical injuries or sickness are required to file Revenue Procedure 98-65 to ensure proper tax treatment of these amounts.

How to fill out Revenue Procedure 98-65?

To fill out Revenue Procedure 98-65, taxpayers must complete the required sections detailing the nature of the damages, the amounts received, and any related tax implications, following the specific instructions provided within the procedure.

What is the purpose of Revenue Procedure 98-65?

The purpose of Revenue Procedure 98-65 is to clarify how the IRS views the tax implications of damages received in lawsuits and settlements, ensuring that taxpayers report these amounts correctly and comply with tax laws.

What information must be reported on Revenue Procedure 98-65?

Taxpayers must report information including the total amount of damages received, the nature of the injuries or sickness, any attorney fees, and any applicable exclusions or deductions related to the recovered amounts.

Fill out your revenue procedure 98-65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Procedure 98-65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.