Get the free Rev. Proc. 97–3 Modification

Show details

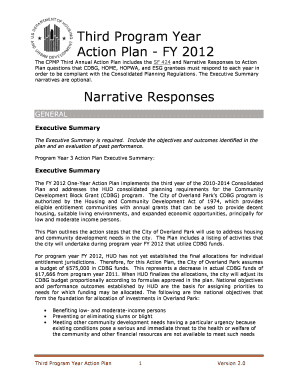

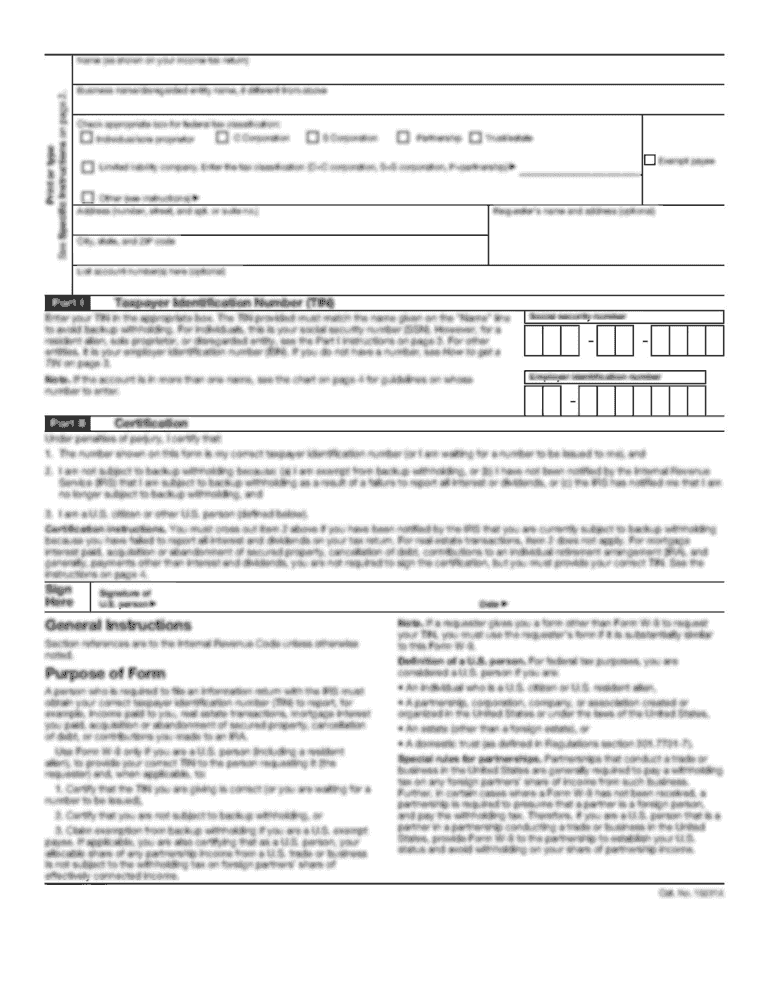

This revenue procedure modifies Rev. Proc. 97–3 and outlines provisions of the Internal Revenue Code related to rulings and determination letters for RIC and REIT shareholders. It discusses the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 973 modification

Edit your rev proc 973 modification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 973 modification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 973 modification online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rev proc 973 modification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 973 modification

How to fill out Rev. Proc. 97–3 Modification

01

Obtain a copy of Rev. Proc. 97–3 from the IRS website or relevant tax authority.

02

Review the instructions provided in the document carefully.

03

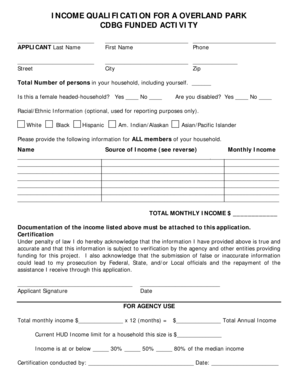

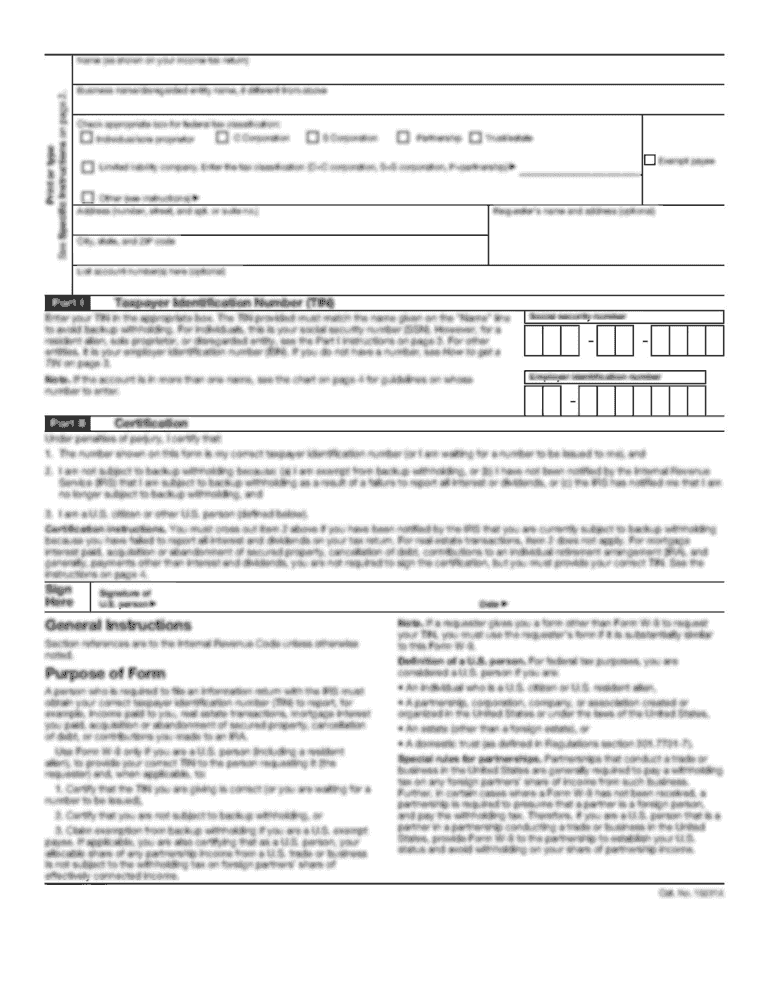

Fill out the required identification information, including taxpayer name and identification number.

04

Complete the modification request by detailing the specific changes or reasons for modification.

05

Attach any necessary supporting documents that validate your request.

06

Sign and date the form to authenticate your submission.

07

Submit the completed Rev. Proc. 97–3 Modification to the IRS office specified in the instructions.

Who needs Rev. Proc. 97–3 Modification?

01

Taxpayers who wish to modify a previous election or determination regarding certain tax treatment.

02

Businesses seeking to change their accounting method or establish a new one under specific circumstances.

03

Any individual or entity that has previously made an election under Rev. Proc. 97–3 and requires updates or corrections.

Fill

form

: Try Risk Free

People Also Ask about

What is the service warranty income method?

Service-Warranty Income Method 12 This accounting method allows taxpayers to recognize as gross income, generally over the period of the service-warranty contract, a series of equal payments, the present value of which equals the portion of the advance payment qualifying for deferral.

What is the PLR user fee 2025?

2025-1, increase for requests submitted after February 1, 2025: Fees for private letter ruling requests increase from $38,000 to $43,700. Reduced fees for certain “small” organizations increase from $3,000 to $3,450 and from $8,500 to $9,775.

What is the user fee for advance pricing agreement?

IRS User Fees for APAs Increase but Remain Attractive Fees per Rev. Proc. 2015-41Fees as of 2/1/2024 New APA 60,000 121,600 Renewal APA 35,000 65,900 Small Case APA 30,000 57,500 Amendment 12,500 24,600 Feb 23, 2024

Which constitutes a change in accounting policy that requires IRS consent?

If a taxpayer changes a method of accounting for an item that is not listed as an automatic method change, it must follow the current non-automatic method change procedures to request consent from the IRS National Office. The taxpayer files the original Form 3115 with the IRS National Office during the year of change.

What is a PLR tax?

"A private letter ruling, or PLR, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts . . . A PLR is issued in response to a written request submitted by a taxpayer . . ." ( IRS Website)

What is an IRS rev proc?

A revenue procedure is an official statement of a procedure that affects the rights or duties of taxpayers or other members of the public under the Internal Revenue Code, related statutes, tax treaties and regulations and that should be a matter of public knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 97–3 Modification?

Rev. Proc. 97–3 Modification is a procedural guideline issued by the IRS that allows taxpayers to obtain a closing agreement for certain tax matters, providing clarity and resolution on their tax liabilities.

Who is required to file Rev. Proc. 97–3 Modification?

Taxpayers who are seeking a closing agreement on tax disputes or issues related to specific transactions may be required to file Rev. Proc. 97–3 Modification.

How to fill out Rev. Proc. 97–3 Modification?

To fill out Rev. Proc. 97–3 Modification, taxpayers must complete the required forms, provide accurate information regarding the tax issue at hand, and submit the forms along with any necessary documentation to the IRS.

What is the purpose of Rev. Proc. 97–3 Modification?

The purpose of Rev. Proc. 97–3 Modification is to allow taxpayers to resolve specific tax disputes with the IRS efficiently and to provide guidance on the appropriate procedures for closing agreements.

What information must be reported on Rev. Proc. 97–3 Modification?

The information that must be reported on Rev. Proc. 97–3 Modification includes the taxpayer's identification details, a description of the tax issue, the proposed resolution, and any relevant documentation that supports the case.

Fill out your rev proc 973 modification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 973 Modification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.