Get the free Revenue Ruling 1997-43 - LIFO

Show details

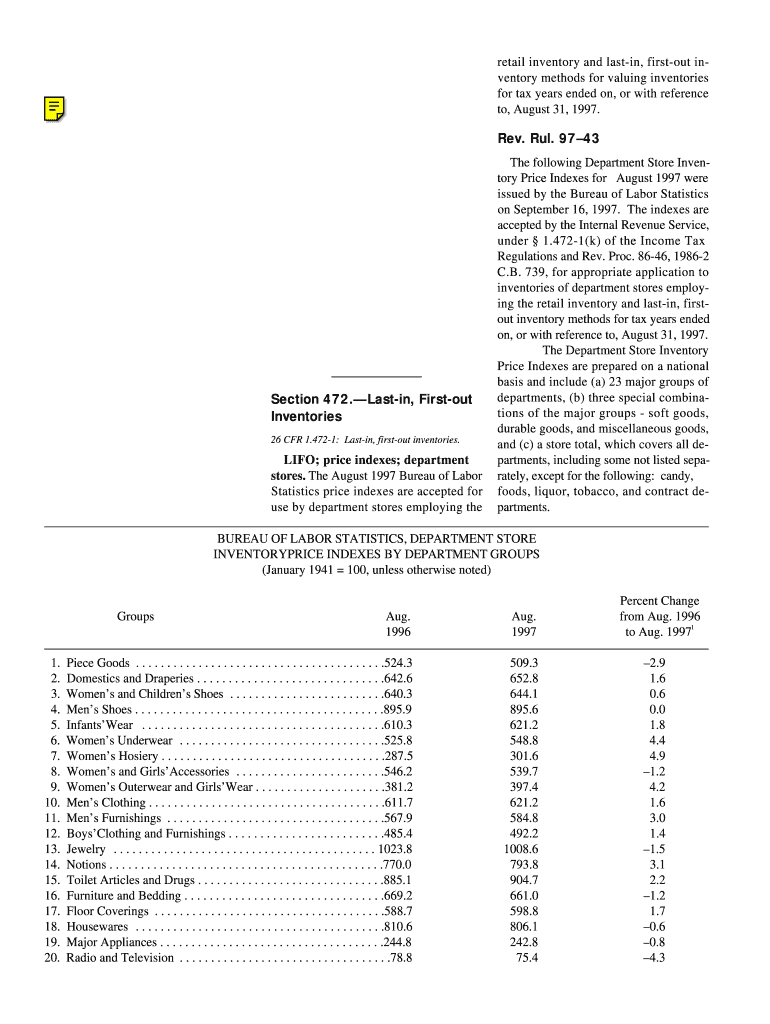

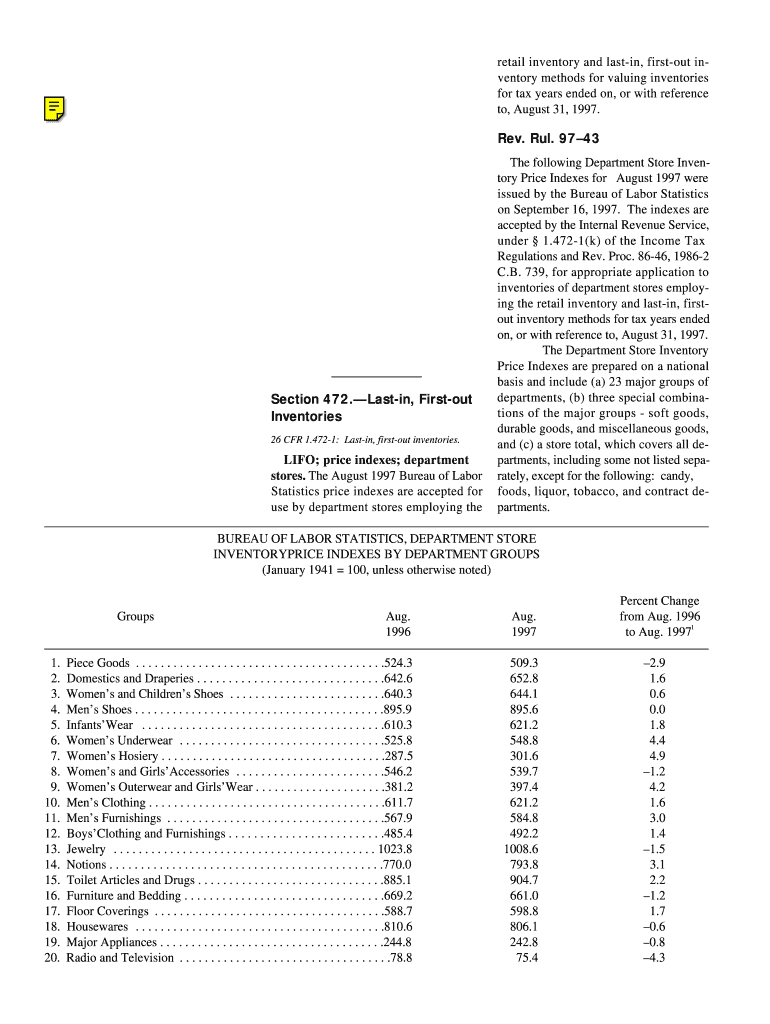

Este documento analiza métodos de inventario al por menor y de último en entrar, primero en salir para la valoración de inventarios para años fiscales que terminan el 31 de agosto de 1997. Acepta

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue ruling 1997-43

Edit your revenue ruling 1997-43 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue ruling 1997-43 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue ruling 1997-43 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revenue ruling 1997-43. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue ruling 1997-43

How to fill out revenue ruling 1997-43:

01

Gather all necessary information and documents related to the specific tax issue or situation.

02

Review revenue ruling 1997-43 thoroughly to understand its requirements and implications.

03

Use the provided form or template, if any, to fill out the ruling. Ensure that all required fields and sections are completed accurately and completely.

04

Include any supporting documentation or evidence that may be necessary to support your case or claim as per the ruling.

05

Double-check all the information provided before submitting the filled-out revenue ruling 1997-43 to avoid any errors or inconsistencies.

Who needs revenue ruling 1997-43:

01

Individuals who have a specific tax issue or situation that falls under the guidance outlined in revenue ruling 1997-43.

02

Businesses or organizations that are affected by the criteria set forth in the ruling and need to determine their tax liabilities or obligations accordingly.

03

Tax professionals, such as accountants or tax advisors, who assist clients in navigating the complexities of tax laws and regulations and require guidance on the specific matter addressed in revenue ruling 1997-43.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit revenue ruling 1997-43 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including revenue ruling 1997-43. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the revenue ruling 1997-43 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your revenue ruling 1997-43.

How do I edit revenue ruling 1997-43 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing revenue ruling 1997-43.

What is revenue ruling 43?

Revenue Ruling 43 is a document issued by the Internal Revenue Service (IRS) that provides guidance and clarification on the interpretation and application of the U.S. federal tax laws.

Who is required to file revenue ruling 43?

Revenue Ruling 43 does not require any specific individuals or entities to file. However, it is commonly referenced and relied upon by taxpayers, tax professionals, and the IRS in resolving tax-related matters and disputes.

How to fill out revenue ruling 43?

Revenue Ruling 43 is not something that needs to be filled out. It is a document prepared and issued by the IRS. If you need to reference or use information from Revenue Ruling 43, you can simply read and apply the relevant guidance provided in the document.

What is the purpose of revenue ruling 43?

The purpose of Revenue Ruling 43 is to provide clarity, guidance, and consistent interpretations of the U.S. federal tax laws. It helps taxpayers, tax professionals, and the IRS in understanding the tax implications and application of specific provisions of the tax laws.

What information must be reported on revenue ruling 43?

Revenue Ruling 43 itself does not require any specific information to be reported. It is a document that provides guidance and clarifications on tax laws and does not involve reporting or filing requirements.

Fill out your revenue ruling 1997-43 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Ruling 1997-43 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.