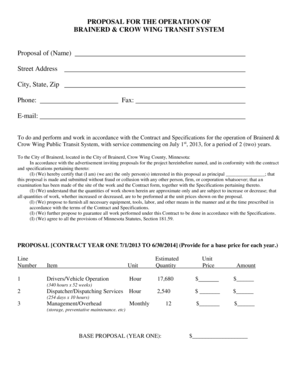

Get the free Rev. Proc. 96–47 and Rev. Proc. 96–48

Show details

Diese Einnahmeverfahren beschreiben die Bedingungen, unter denen Verteilungen an Aktionäre eines regulierten Investmentunternehmens (RIC) variieren können und dennoch als Dividenden gemäß § 562

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 9647 and

Edit your rev proc 9647 and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 9647 and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 9647 and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rev proc 9647 and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 9647 and

How to fill out Rev. Proc. 96–47 and Rev. Proc. 96–48

01

Obtain the latest versions of Rev. Proc. 96–47 and Rev. Proc. 96–48 from the IRS website or official publications.

02

Review the general instructions provided within the documents to understand their purpose and applicability.

03

Gather all necessary documentation and information required for completing the forms, such as details of the tax issues or elections involved.

04

Carefully follow the step-by-step instructions in Rev. Proc. 96–47 to fill out the respective form, ensuring all required fields are completed accurately.

05

Repeat the same process for Rev. Proc. 96–48, paying attention to any specific requirements that differentiate it from Rev. Proc. 96–47.

06

Review all completed forms for accuracy and completeness before submission.

07

Submit the forms to the appropriate IRS address or online portal, if applicable.

Who needs Rev. Proc. 96–47 and Rev. Proc. 96–48?

01

Taxpayers who have made certain tax elections or are seeking to modify existing elections.

02

Individuals or businesses dealing with tax issues related to partnership and corporate structures.

03

Professional tax preparers and accountants assisting clients with tax returns involving specific IRS procedures.

Fill

form

: Try Risk Free

People Also Ask about

What are the IRS guidelines for date of death appraisal?

Under this election, the value of all property included in the gross estate generally is determined as of 6 months after the decedent's death. However, property distributed, sold, exchanged, or otherwise disposed of within 6 months after death must be valued as of the date of sale, exchange, or other disposition.

What does rev proc mean?

Definition: REV. PROC. is an abbreviation for REVENUE PROCEDURE. REVENUE PROCEDURE is a set of guidelines issued by the Internal Revenue Service (IRS) that provides instructions and procedures for taxpayers to follow when complying with tax laws.

What is the IRC section for failure to file penalty?

58 Unsurprisingly, taxpayers often use medical illness or reliance on an agent as the basis for establishing reasonable cause to avoid the failure to pay penalty under IRC § 6651(a)(2), as they do for the failure to file penalty under IRC § 6651(a)(1).

What is a revenue procedure in the IRS?

A revenue procedure is an official statement of a procedure that affects the rights or duties of taxpayers or other members of the public under the Internal Revenue Code, related statutes, tax treaties and regulations and that should be a matter of public knowledge.

What is the IRS revenue procedure 96 15?

Revenue Procedure 96-15 PDF provides procedures for taxpayers to request a review of art valuations for income, estate, and gift returns. Taxpayers may obtain a statement of value (SOV) from the Service for an advance review of art valuation claims prior to filing the return.

How do I prove fair market value to the IRS?

Determining FMV You should consider all the facts and circumstances connected with the property, including any recent transactions, in determining value. Value may also be based on desirability, use, condition, scarcity, and mar- ket demand for that property.

What is the difference between a revenue ruling and a revenue procedure?

It is also published in the Internal Revenue Bulletin. While a revenue ruling generally states an IRS position, a revenue procedure provides return filing or other instructions concerning an IRS position.

What are the qualified appraisal requirements for a gift tax return?

A qualified appraisal must be signed no earlier than 60 days prior to the date of the gift or no later than the due date of the donor's tax return. Second: work with a qualified appraiser.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 96–47 and Rev. Proc. 96–48?

Rev. Proc. 96–47 and Rev. Proc. 96–48 are revenue procedures issued by the Internal Revenue Service that provide guidelines for taxpayers on the tax treatment of certain transactions or issues. Specifically, they outline safe harbors and certain financial disclosures to streamline tax compliance.

Who is required to file Rev. Proc. 96–47 and Rev. Proc. 96–48?

Taxpayers engaged in specific types of transactions or tax matters as described in the revenue procedures are required to file them. This typically includes corporations, partnerships, and individuals who meet the criteria specified within the procedures.

How to fill out Rev. Proc. 96–47 and Rev. Proc. 96–48?

To fill out Rev. Proc. 96–47 and Rev. Proc. 96–48, taxpayers must complete the forms as instructed, providing applicable information regarding their transactions and financial details. It is advisable to refer to the latest IRS instructions and guidance to ensure accurate completion.

What is the purpose of Rev. Proc. 96–47 and Rev. Proc. 96–48?

The purpose of Rev. Proc. 96–47 and Rev. Proc. 96–48 is to provide taxpayers with clear guidelines on reporting certain transactions, promoting compliance with tax laws, and specifying safe harbors to minimize tax liabilities related to specific financial activities.

What information must be reported on Rev. Proc. 96–47 and Rev. Proc. 96–48?

Taxpayers must report information including transaction details, amounts involved, and any relevant financial statements or disclosures as outlined in the procedures. Specific reporting requirements may vary based on the nature of the transaction.

Fill out your rev proc 9647 and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 9647 And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.