Get the free Weighted Average Interest Rate Update Notice 96–2

Show details

This document provides guidelines for determining the weighted average interest rate and the permissible range of interest rates used to calculate current liability related to the funding limitation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign weighted average interest rate

Edit your weighted average interest rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your weighted average interest rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing weighted average interest rate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit weighted average interest rate. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out weighted average interest rate

How to fill out Weighted Average Interest Rate Update Notice 96–2

01

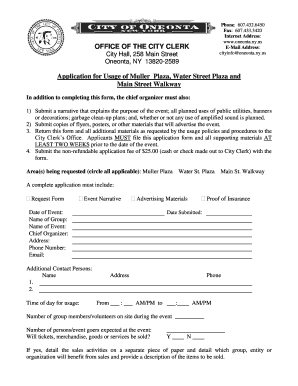

Obtain the Weighted Average Interest Rate Update Notice 96–2 form.

02

Fill in your organization's name and address at the top of the form.

03

Enter the reporting period for which you are updating the interest rate.

04

Calculate the weighted average interest rate based on your principal and interest payments.

05

Provide any supporting documentation or calculations that justify your reported rate.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate regulatory agency or body.

Who needs Weighted Average Interest Rate Update Notice 96–2?

01

Organizations that manage pension plans, retirement funds, and similar financial instruments.

02

Financial institutions that need to report average interest rates for regulatory compliance.

03

Actuaries and financial analysts involved in retirement funding assessments.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate weighted average interest rate?

To calculate the weighted average interest rate of all your loans, multiply each loan amount by its interest rate. Add the results together, then divide that number by the sum of all your loan balances. Whatever that figure is, round up to the nearest 1/8 of a percent.

How do you calculate weighted average average?

Simply, in order to find the weighted average, one must first multiply all values in the data set by their corresponding weights. Then, add up the resulting products and divide by the sum of the weights.

How to calculate weighted average interest rate in Excel?

Current Gatt Rate- 4.6% (March)

How to do a weighted average of interest rates in Excel?

To calculate the weighted average in Excel, use the SUMPRODUCT and SUM functions in the following formula: =SUMPRODUCT(X:X,X:X)/SUM(X:X) This formula works by multiplying each value by its weight and combining the values. Then, you divide the SUMPRODUCT by the sum of the weights for your weighted average.

What does weighted average interest rate mean?

A weighted average interest rate is an average that is adjusted to reflect the contribution of each loan to the total debt. The weighted average multiplies each loan's interest rate by the loan balance and divides the sum by the total loan balance.

How to calculate weighted average rate of interest?

Step 1: Multiply each loan balance by the corresponding interest rate for the loan. Step 2: Add the products of these calculations together. Step 3: Divide the sum of this calculation by the total debt load. Step 4: Round this percentage up to the nearest one-eighth of a percentage point and multiply by 100.

How can I calculate weighted average in Excel?

Apply the SUMPRODUCT function For example, if you have entered your item names in cells A2 to A25, values in cells B2 to B25, and the corresponding weights in cells C2 to C25, label cell A27 "weighted average". Then, in cell B27, enter "=SUMPRODUCT(B2:B25,C2,C25). Press Enter to return the result.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Weighted Average Interest Rate Update Notice 96–2?

The Weighted Average Interest Rate Update Notice 96–2 is a notice issued by the Internal Revenue Service (IRS) that provides updated information regarding the weighted average interest rates used for pension plans to determine minimum funding requirements and other related actuarial calculations.

Who is required to file Weighted Average Interest Rate Update Notice 96–2?

Pension plan sponsors and administrators are required to file Weighted Average Interest Rate Update Notice 96–2 as part of their obligation to report the funding status and interest rates applicable to their defined benefit plans.

How to fill out Weighted Average Interest Rate Update Notice 96–2?

To fill out the Weighted Average Interest Rate Update Notice 96–2, plan sponsors need to provide specific information including the plan name, plan number, applicable interest rates, and other required details as specified in the notice instructions.

What is the purpose of Weighted Average Interest Rate Update Notice 96–2?

The purpose of the Weighted Average Interest Rate Update Notice 96–2 is to ensure that pension plan sponsors are using the correct interest rate assumptions for funding calculations, thereby promoting compliance with federal pension funding regulations.

What information must be reported on Weighted Average Interest Rate Update Notice 96–2?

The information that must be reported on the Weighted Average Interest Rate Update Notice 96–2 includes the plan's name, identification number, the reporting period, and the relevant weighted average interest rates as specified by the IRS for that period.

Fill out your weighted average interest rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Weighted Average Interest Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.