Get the free Notice of Change of Officers or Directors - Non Profit Corporations

Show details

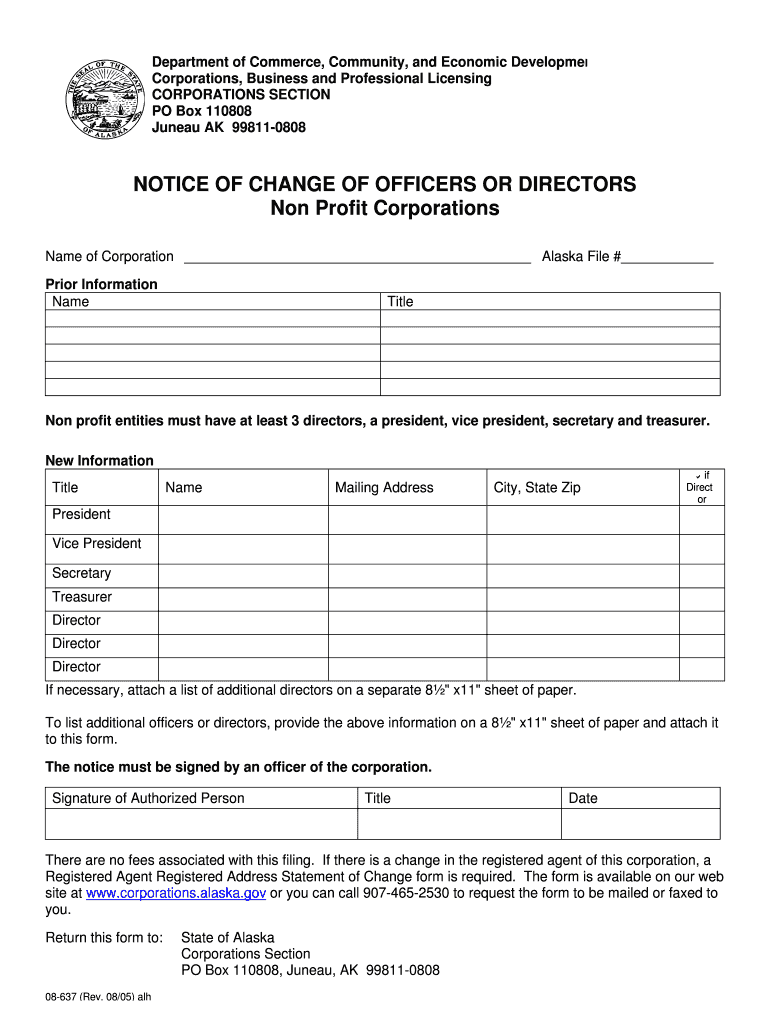

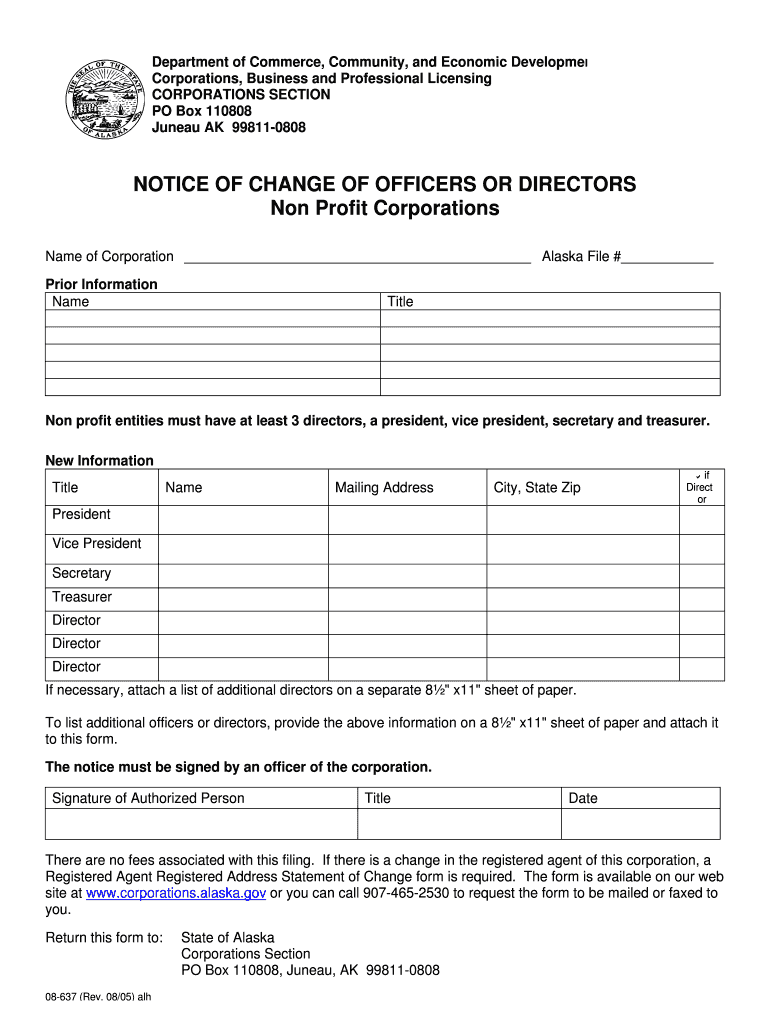

This form is used to notify the Department of Commerce, Community, and Economic Development of changes in the officers or directors of a non-profit corporation in Alaska. It requires specific information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of change of

Edit your notice of change of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of change of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of change of online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice of change of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of change of

How to fill out Notice of Change of Officers or Directors - Non Profit Corporations

01

Obtain the Notice of Change of Officers or Directors form from your state's Secretary of State website or office.

02

Complete the form with the necessary information, including the name of the nonprofit corporation and details about the current officers or directors.

03

Provide the names and addresses of the new officers or directors being appointed.

04

Include the effective date of the changes.

05

Sign the form to validate the submission, ensuring the signature is from an authorized individual within the organization.

06

Submit the completed form to the appropriate state authority, either online, by mail, or in person, along with any required fees.

Who needs Notice of Change of Officers or Directors - Non Profit Corporations?

01

Any nonprofit corporation that is changing its officers or directors is required to file a Notice of Change of Officers or Directors.

02

Organizations aiming to keep their records current with the state require this notice.

03

Boards of directors that have newly elected members need to inform the state through this notice.

Fill

form

: Try Risk Free

People Also Ask about

How to notify IRS of non-profit name change?

An exempt organization that has changed its name generally must report the change on its next annual return (such as Form 990 or 990-EZ).

How do you transfer control of a nonprofit?

Nonprofits must consult their operating agreement and follow the bylaws of ownership transfer. They can also gift the agency to someone else or transfer ownership through nonprofit mergers or acquisitions so long as it is not prohibited by the operating agreement.

How do I remove an officer from a nonprofit organization?

The most common policy for member organizations is to call a meeting of members and notify the board member in writing that they will be voted upon during said meeting. From there, bylaws can require the majority of (or sometimes more) members to vote to remove the board member.

How do you change the name of your non-profit?

The California Secretary of State requires charitable organizations that want to alter their name to file a Certificate of Amendment of Articles of Incorporation. In this document, you will need to provide information such as: The old name of your nonprofit. The new name of your nonprofit, and.

How do I change the ownership of a nonprofit?

Nonprofits must consult their operating agreement and follow the bylaws of ownership transfer. They can also gift the agency to someone else or transfer ownership through nonprofit mergers or acquisitions so long as it is not prohibited by the operating agreement.

What is the 49 rule on nonprofits?

The 49% Rule That means that the percentage of board members that are considered interested directors is limited to less than half of the total number of members. An interested director is someone who received compensation within the last year and/or any member of their family.

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

How do I notify the IRS of a change of name for a non-profit?

Change Nonprofit Name by Mail/FAX Full name (both the prior name and the new name) Employer Identification Number and. Authorized signature (an officer or trustee) with the stated role in the organization with permission to make the change.

How to transfer ownership of a non-profit?

It is not possible to sell a nonprofit business. A nonprofit business is not owned by any one individual or group of individuals. The IRS prohibits any board member or employee from receiving "profits" from a nonprofit organization. There are stiff penalties for doing so.

How do I alert the IRS about a name change?

The IRS will automatically note your name change. If you're not due to file a tax return soon, submit Form 8822, Change of Address or Form 8822-B, Change of Address or Responsible Party — Business, to notify the IRS of your name change.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice of Change of Officers or Directors - Non Profit Corporations?

The Notice of Change of Officers or Directors for Non Profit Corporations is an official document that notifies the state or relevant authorities about changes in the leadership or management of the non-profit organization.

Who is required to file Notice of Change of Officers or Directors - Non Profit Corporations?

Non-profit corporations are required to file the Notice when there are changes in their officers or directors, as stipulated by state laws governing corporate governance.

How to fill out Notice of Change of Officers or Directors - Non Profit Corporations?

To fill out the Notice, provide details such as the name of the organization, the names of the outgoing and incoming officers or directors, their positions, the date of the change, and any required signatures, following the specific instructions provided by the state.

What is the purpose of Notice of Change of Officers or Directors - Non Profit Corporations?

The purpose of the Notice is to maintain accurate and current records of leadership within the organization for legal compliance and transparency with stakeholders and regulatory bodies.

What information must be reported on Notice of Change of Officers or Directors - Non Profit Corporations?

The Notice must report the organization's name, the names and titles of both departing and incoming officers or directors, the effective date of the changes, and any other information required by the relevant state authority.

Fill out your notice of change of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Change Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.