Get the free The Purchase and Sale of a Business – Asset Transactions - minncle

Show details

Este seminario enfatiza consejos prácticos para estructurar la compra o venta de un negocio, incluyendo procesos de pre-acuerdo, redacción de documentos, y consideraciones especiales al adquirir

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form purchase and sale

Edit your form purchase and sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form purchase and sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

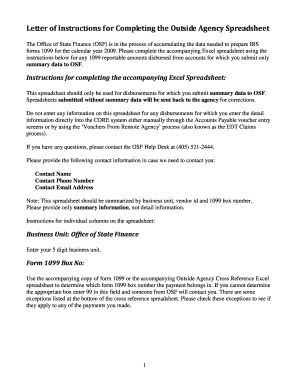

Editing form purchase and sale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form purchase and sale. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form purchase and sale

How to fill out The Purchase and Sale of a Business – Asset Transactions

01

Title the document clearly as 'Purchase and Sale of a Business – Asset Transactions'.

02

Identify the seller and buyer, including their full legal names and contact information.

03

Describe the business being sold, including its name, address, and a brief overview.

04

List all assets being sold in the transaction, including equipment, inventory, and any intangible assets.

05

Specify the purchase price and how it will be paid (e.g., lump sum, installments, etc.).

06

Include any conditions for the sale, such as financing contingencies, inspections, or approvals.

07

Outline the timeline for the transaction, including key dates for closing and transfer of ownership.

08

Specify any warranties or representations made by the seller about the business and its assets.

09

Include provisions for dispute resolution and governing law.

10

Have both parties review the document and sign it to finalize the agreement.

Who needs The Purchase and Sale of a Business – Asset Transactions?

01

Entrepreneurs looking to buy an existing business.

02

Business owners planning to sell their assets.

03

Investors seeking to understand the terms of asset transactions.

04

Legal professionals assisting clients with business transactions.

05

Financial advisors guiding clients on business purchases and sales.

Fill

form

: Try Risk Free

People Also Ask about

How do you account for an asset acquisition?

Asset acquisitions are accounted for by using a cost accumulation model (i.e., the cost of the acquisition, including certain transaction costs, is allocated to the assets acquired on the basis of relative fair values, with some exceptions).

How do you record an asset sale of a business?

Record the sale amount of the asset Record deprecation and cash received as asset debit . The original cost, along with any gains made from the sale, counts as asset credit. You can also record losses as debit. If done correctly, credit and debit cancel out.

How do you account for sale of business assets?

Follow these steps to calculate the net results of any asset sales and record them ingly in your accounting: Determine the initial value of the assets. Calculate depreciation. Negotiate the sale price. Calculate loss or gain. Record your loss or gain.

What is the accounting for the purchase of business assets?

The purchase acquisition accounting approach requires that all assets and liabilities, tangible and intangible, be measured at fair market value. That is, it is valued at the amount that a third party would have paid on the open market on the date that the company acquired it.

What is purchase or sale of assets?

In an asset sale, a business can choose what it's selling. While the buyer purchases any or all of these individual assets, the seller retains possession of the legal business entity. The buyer may create a new company or use an existing subsidiary to acquire the selected assets, along with management and contracts.

How to account for the purchase of a business?

Purchase acquisition accounting is now the standard way to record the purchase of a company on the balance sheet of the acquiring company. The assets of the acquired company are recorded as assets of the acquirer at fair market value. This method of accounting increases the fair market value of the acquiring company.

How do you record an asset purchase of a business?

Entities record their purchase of a fixed asset on the balance sheet, Asset purchases used to be noted on a sources and uses of funds statement, which is now called a cash flow statement. Fixed assets differ from inventory in that inventory exists for the purpose of consumption.

What is the accounting treatment for the purchase of an asset?

Assets are recorded on the balance sheet at cost, meaning that all costs to purchase the asset and to prepare the asset for operation should be included. Costs outside of the purchase price may include shipping, taxes, installation, and modifications to the asset.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The Purchase and Sale of a Business – Asset Transactions?

The Purchase and Sale of a Business – Asset Transactions refers to the process of buying or selling the assets of a business, rather than its stock or shares. This transaction involves the transfer of ownership of specific assets such as inventory, equipment, real estate, and intellectual property.

Who is required to file The Purchase and Sale of a Business – Asset Transactions?

Typically, both the buyer and the seller are required to file The Purchase and Sale of a Business – Asset Transactions. This includes businesses that are involved in the transaction and may need to report the sale or purchase to the relevant tax authorities.

How to fill out The Purchase and Sale of a Business – Asset Transactions?

To fill out The Purchase and Sale of a Business – Asset Transactions, you need to provide detailed information about the assets being transferred, the parties involved in the transaction, the sale price, and any applicable terms and conditions. Ensure that all required documentation is attached, including purchase agreements and asset valuations.

What is the purpose of The Purchase and Sale of a Business – Asset Transactions?

The purpose of The Purchase and Sale of a Business – Asset Transactions is to formalize and record the transfer of ownership of business assets. This documentation is crucial for accounting, tax purposes, and to ensure legal clarity regarding the ownership and rights associated with those assets.

What information must be reported on The Purchase and Sale of a Business – Asset Transactions?

The information that must be reported includes the names and contact details of the buyer and seller, a detailed list of the assets being sold, sale prices for each asset, any liabilities being assumed, and terms of the transaction. Additionally, tax identification numbers and signatures may also be required.

Fill out your form purchase and sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Purchase And Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.