Get the free Limited Liability Partnership | Annual Renewal

Show details

This document is intended for limited liability partnerships in Minnesota to file their annual renewal as required by state law, ensuring their compliance with Minnesota Statutes, Chapter 323A.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited liability partnership annual

Edit your limited liability partnership annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited liability partnership annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing limited liability partnership annual online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit limited liability partnership annual. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited liability partnership annual

How to fill out Limited Liability Partnership | Annual Renewal

01

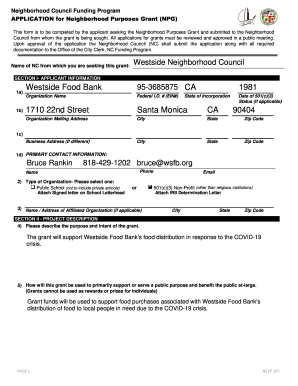

Gather required documents: Ensure you have all necessary documents, including your LLP agreement and prior renewal information.

02

Visit the appropriate government website: Navigate to the official website for LLP registrations in your jurisdiction.

03

Complete the application form: Fill out the annual renewal application form with accurate information about your LLP.

04

Pay the renewal fee: Determine the fee for annual renewal and make the payment as instructed on the website.

05

Submit the application: Submit the completed application form and payment receipt through the online portal or by mail.

06

Await confirmation: After submission, monitor your email or postal mail for confirmation of your renewal.

Who needs Limited Liability Partnership | Annual Renewal?

01

Businesses registered as Limited Liability Partnerships (LLPs) and must comply with local regulations.

02

Partners of the LLP who want to maintain the legal status and benefits of the partnership.

03

Any LLP seeking to avoid penalties or legal issues related to expired registrations.

Fill

form

: Try Risk Free

People Also Ask about

What is an UK LLP?

Although found in many business fields, the LLP is an especially popular form of organization among professionals, particularly lawyers, accountants, and architects. In some U.S. states, namely California, New York, Oregon, and Nevada, LLPs can only be formed for such professional uses.

What is the downside of an LLP?

An LLP is a form of legal business entity with limited liability for the members. The main difference between an LLP and a limited company, is that an LLP has the organisational flexibility of a partnership and is taxed as a partnership. In other respects it is very similar to a private company.

What are three disadvantages of limited liability partnerships?

Disadvantages Not recognized in every state. While general partnerships are recognized nationwide, LLPs are not recognized as a legal business structure in every state. One partner can bind the other. Special tax considerations.

Does LLP have beneficial owners?

(c) any person who exercises control over the management of the company or LLP.

What is the major disadvantage of the LLP?

Disadvantages of an LLP Public disclosure is the main disadvantage of an LLP. Financial accounts have to be submitted to Companies House for the public record. The accounts may declare income of the members which they may not wish to be made public. Income is personal income and is taxed ingly.

Why choose an LLP over an LLC?

LLPs are designed for professionals like lawyers or accountants and provide liability protection from other partners. LLCs offer a broader range of businesses general protection from debts and liabilities plus flexible management and tax options.

Is a limited liability partnership the same as an LLC?

Disadvantages of an LLP Public disclosure is the main disadvantage of an LLP. Financial accounts have to be submitted to Companies House for the public record. The accounts may declare income of the members which they may not wish to be made public. Income is personal income and is taxed ingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

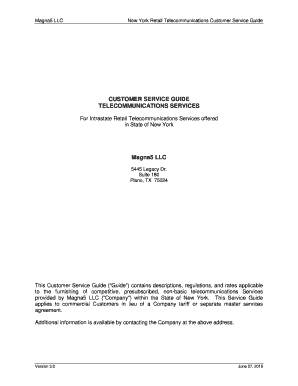

What is Limited Liability Partnership | Annual Renewal?

A Limited Liability Partnership (LLP) Annual Renewal is a legal process that requires LLPs to submit specific information and fees to maintain their status as a registered entity. This renewal ensures that the partnership complies with state regulations and continues to enjoy the benefits of limited liability.

Who is required to file Limited Liability Partnership | Annual Renewal?

All registered Limited Liability Partnerships (LLPs) are required to file an annual renewal. This includes both domestic and foreign LLPs operating within the jurisdiction.

How to fill out Limited Liability Partnership | Annual Renewal?

To fill out the LLP Annual Renewal, partners should gather necessary information such as the partnership's name, registration number, principal address, and any changes in management or ownership. They then complete the renewal form, ensuring accuracy, and submit it along with the required fee to the appropriate state authority.

What is the purpose of Limited Liability Partnership | Annual Renewal?

The purpose of the LLP Annual Renewal is to keep the partnership's registration active, confirm compliance with legal requirements, update any changes in information, and ensure that the partnership remains in good standing with the state.

What information must be reported on Limited Liability Partnership | Annual Renewal?

The information that must be reported typically includes the LLP's legal name, registration number, principle address, names and addresses of partners, any updates or changes in the partnership's structure, and the payment of the applicable renewal fee.

Fill out your limited liability partnership annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Liability Partnership Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.