Get the free Premium Tax Statement - dfs ny

Show details

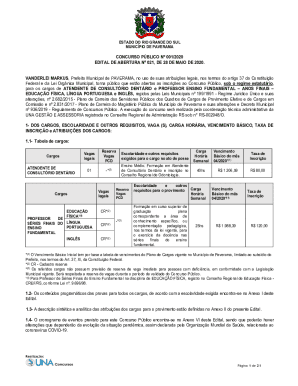

This document provides instructions and information for Excess Line Brokers in New York regarding the filing of the Premium Tax Statement for the tax year 2010, which is due on March 15, 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign premium tax statement

Edit your premium tax statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your premium tax statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing premium tax statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit premium tax statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out premium tax statement

How to fill out Premium Tax Statement

01

Gather your tax documents and income information.

02

Obtain Form 1095-A, Health Insurance Marketplace Statement, from your health insurance provider.

03

Using Form 1095-A, identify the monthly premiums, any advance premium tax credits received, and enrollment periods.

04

Complete IRS Form 8962, Premium Tax Credit, ensuring all income and family size details are accurate.

05

Transfer the information from Form 8962 to your main tax return (Form 1040).

06

Review the completed forms for accuracy before submission.

07

File your tax return by the deadline, including Form 8962 and any necessary supporting documents.

Who needs Premium Tax Statement?

01

Individuals and families who obtained health insurance through the Health Insurance Marketplace.

02

Taxpayers who received premium tax credits to lower their health insurance premiums.

03

Those who want to reconcile advanced premium tax credits received during the year.

Fill

form

: Try Risk Free

People Also Ask about

Can you fill out tax forms digitally?

Decide how you want to file your taxes. The IRS recommends using tax preparation software to e-file for the easiest and most accurate returns and fastest refunds. You may be able to file free online through IRS Direct File if you are in one of 25 participating states and have a simple tax return.

Why is the IRS asking me for form 8962?

Premium tax credit (PTC). The credit provides financial assistance to pay the premiums for the qualified health plan offered through a Marketplace by reducing the amount of tax you owe, giving you a refund, or increasing your refund amount. You must file Form 8962 to compute and take the PTC on your tax return.

What is a 1095 tax statement?

Form 1095-A Health Insurance Marketplace Statement The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used them to pay for health insurance, and the amount they paid in total for coverage.

Can I fill out form 8962 online?

Your accountant or financial adviser may provide you with a paper copy of the form or ask you to fill out the form online. If you're using tax preparation software, that software should have a link to an online Form 8962 that you can complete.

Why is the IRS asking me for form 8962?

Premium tax credit (PTC). The credit provides financial assistance to pay the premiums for the qualified health plan offered through a Marketplace by reducing the amount of tax you owe, giving you a refund, or increasing your refund amount. You must file Form 8962 to compute and take the PTC on your tax return.

Can I file form 8962 for free?

Form 8962 helps determine if you owe any additional tax credits or if you'll get a refundable credit. The Internal Revenue Service (IRS) website offers a free download of Form 8962, which you can file electronically or with a paper tax return. Failing to file this form may affect eligibility for future PTCs.

Does TurboTax automatically fill out form 8962?

TurboTax will automatically fill out Form 8962 once you enter your Form 1095-A. You have to include Form 8962 with your tax return if: You qualified for the Premium Tax Credit in 2024. You or someone on your tax return received advance payments of the Premium Tax Credit.

Why am I getting a premium tax credit?

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Premium Tax Statement?

The Premium Tax Statement is a form used to report and reconcile premium tax credits that individuals or families may be eligible for under the Affordable Care Act.

Who is required to file Premium Tax Statement?

Individuals or families who received premium tax credits to help pay for their health insurance coverage through the Health Insurance Marketplace are required to file the Premium Tax Statement.

How to fill out Premium Tax Statement?

To fill out the Premium Tax Statement, individuals must provide information about their health coverage, the premium tax credits they received, their household income, and other relevant personal information.

What is the purpose of Premium Tax Statement?

The purpose of the Premium Tax Statement is to ensure that taxpayers accurately report any premium tax credits they received and to determine if they owe any additional tax or are eligible for a refund.

What information must be reported on Premium Tax Statement?

The information that must be reported on the Premium Tax Statement includes the amount of premium tax credits received, the months during which coverage was held, household income, and family size.

Fill out your premium tax statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Premium Tax Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.