Get the free labor rate worksheet

Show details

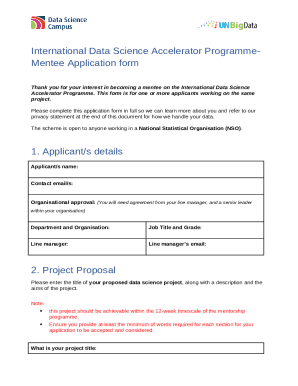

State University Construction Fund 353 Broadway Albany, New York 12246LABOR RATE WORKSHEETS UCF Project No. Contractor Name:Date:Address:County:Trade: Telephone No.:Effective Date:IRREGULAR BASE RATETOPREMIUM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign labor rate worksheet form

Edit your labor rate worksheet form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your labor rate worksheet form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing labor rate worksheet form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit labor rate worksheet form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out labor rate worksheet form

How to fill out labor rate worksheet?

01

Gather all relevant information: Start by collecting all necessary information such as employee names, job titles, and labor rates.

02

Determine the labor rate: Calculate the hourly labor rate for each employee based on their job title and experience level. This can be done by considering factors such as base salary, benefits, and any additional allowances.

03

Input the labor rates: In the labor rate worksheet, input the calculated labor rates for each employee. Make sure to accurately record the rates for easy reference.

04

Update regularly: It is important to periodically review and update the labor rate worksheet to account for any changes in employee compensation, such as salary increments or bonuses.

05

Calculate total labor costs: To determine the total labor costs, multiply each employee's labor rate by the number of hours worked for a specific period. Sum up these calculations to obtain the overall labor costs.

06

Review and analyze: Once the labor rate worksheet is complete, review and analyze the data to gain insights into labor costs, identify any discrepancies, and make informed decisions for budgeting and labor management.

Who needs labor rate worksheet?

01

Small business owners: Small business owners can utilize a labor rate worksheet to assess the labor costs associated with their employees and plan their budget accordingly.

02

HR professionals: Human resource professionals can use labor rate worksheets to maintain and update labor rates, ensuring accurate compensation for employees.

03

Project managers: Project managers often require labor rate worksheets to estimate labor costs for different projects and allocate resources effectively.

04

Finance departments: Finance departments utilize labor rate worksheets to analyze labor costs, track expenses, and prepare financial reports accurately.

05

Accountants: Accountants can use labor rate worksheets to allocate labor costs to specific departments or projects for accurate cost accounting and financial analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify labor rate worksheet form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your labor rate worksheet form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the labor rate worksheet form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your labor rate worksheet form and you'll be done in minutes.

Can I create an eSignature for the labor rate worksheet form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your labor rate worksheet form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is labor rate worksheet?

The labor rate worksheet is a document used to calculate and report the labor costs associated with projects or tasks, including wages, benefits, and overhead.

Who is required to file labor rate worksheet?

Entities that employ labor, particularly contractors and subcontractors working on government projects, are typically required to file a labor rate worksheet.

How to fill out labor rate worksheet?

To fill out a labor rate worksheet, you need to input hourly wage rates, employee classifications, benefit costs, and any additional overhead expenses, ensuring accuracy in the details provided.

What is the purpose of labor rate worksheet?

The purpose of the labor rate worksheet is to ensure accurate calculation and reporting of labor costs for compliance with contractual and regulatory requirements.

What information must be reported on labor rate worksheet?

The information reported on a labor rate worksheet typically includes employee classifications, hourly wage rates, operating costs, benefits, and applicable overhead rates.

Fill out your labor rate worksheet form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Labor Rate Worksheet Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.