Get the free Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with...

Show details

This document is used to claim a credit for taxicabs and livery service vehicles that are accessible to persons with disabilities for tax years before January 1, 2011, and to compute the carryover

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for credit for

Edit your claim for credit for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for credit for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for credit for online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for credit for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

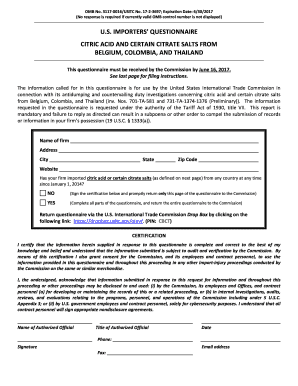

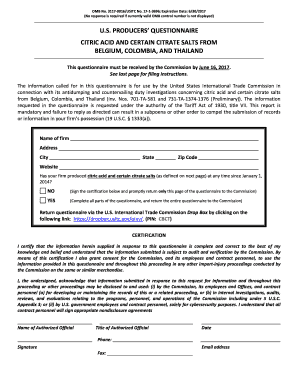

How to fill out claim for credit for

How to fill out Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities

01

Obtain the Claim for Credit form from the appropriate tax authority or official website.

02

Fill in your personal information at the top of the form, including your name and address.

03

Provide the necessary details about the taxicabs or livery service vehicles, including vehicle identification numbers and descriptions.

04

Indicate the number of accessible vehicles you are claiming for the credit.

05

Attach required documentation proving that the vehicles are accessible to persons with disabilities.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form along with any supporting documents to the specified tax authority by the deadline.

Who needs Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

01

Individuals or businesses that own or operate taxicabs and livery service vehicles that are accessible to persons with disabilities.

02

Entities looking to receive tax credits for maintaining accessible vehicles for individuals with disabilities.

03

Owners who comply with accessibility regulations and wish to get financial benefits for their efforts.

Fill

form

: Try Risk Free

People Also Ask about

Are taxi services required to purchase accessible vehicles?

Taxi drivers do not have to help with transfers, lifting, or other types of personal assistance. Does the ADA require taxi companies to purchase wheelchair accessible vehicles? It depends. The answer is no if the taxi company purchases only new or used sedans, or used vans.

What is an accessible taxi?

Accessible taxis are specially adapted vehicles that make it possible for wheelchair users to have more comfortable transportation. They are typically larger vehicles, like vans, that have enough space to safely secure wheelchairs, luggage and passengers.

What is a disabled taxi?

Accessible taxis are specially adapted vehicles that make it possible for wheelchair users to have more comfortable transportation. They are typically larger vehicles, like vans, that have enough space to safely secure wheelchairs, luggage and passengers.

What is the tax credit for handicap accessible equipment?

What is the ADA Tax Credit? The tax credit, listed under Section 44 of the IRS Code, covers 50% of the eligible access expenditures made during the previous tax year, with a maximum expenditure limit of $10,250.

Are taxi services not required to purchase accessible vehicles?

Taxi drivers do not have to help with transfers, lifting, or other types of personal assistance. Does the ADA require taxi companies to purchase wheelchair accessible vehicles? It depends. The answer is no if the taxi company purchases only new or used sedans, or used vans.

What makes a vehicle ADA compliant?

Lifts and Ramps: Vehicles need a boarding device (e.g. lift or ramp) so that a passenger who uses a wheelchair or mobility device can reach a securement location onboard. Lifts must have a minimum design load of 600 pounds and lift platforms must accommodate a wheelchair measuring 30 inches by 48 inches.

Can a taxi driver refuse service?

A taxi driver has full rights to refuse a fare if he/she feels threatened by a passenger's unruly behavior and/or actions. Violent behavior, obscene gestures, loud cursing, racially offensive language, abusive language, threatening or inebriated behavior are enough cause for a driver to refuse a fare.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

The Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities is a tax credit program designed to support taxi and livery service operators who provide accessible transportation services to individuals with disabilities.

Who is required to file Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

Taxi and livery service operators who own or lease vehicles that are specifically designed to be accessible to persons with disabilities are required to file this claim.

How to fill out Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

To fill out the claim, operators must provide their business information, details about the vehicles being used for accessible services, and attach any required documentation proving the vehicle's accessibility features.

What is the purpose of Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

The purpose of the claim is to encourage the provision of accessible transportation services and to provide financial relief to operators who invest in making their vehicles accessible to individuals with disabilities.

What information must be reported on Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

The claim must report information including the operator's business name, the vehicle identification numbers (VINs) of the accessible vehicles, and documentation that verifies the vehicle's compliance with accessibility standards.

Fill out your claim for credit for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Credit For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.