Get the free nys dtf 505 2012 form - tax ny

Show details

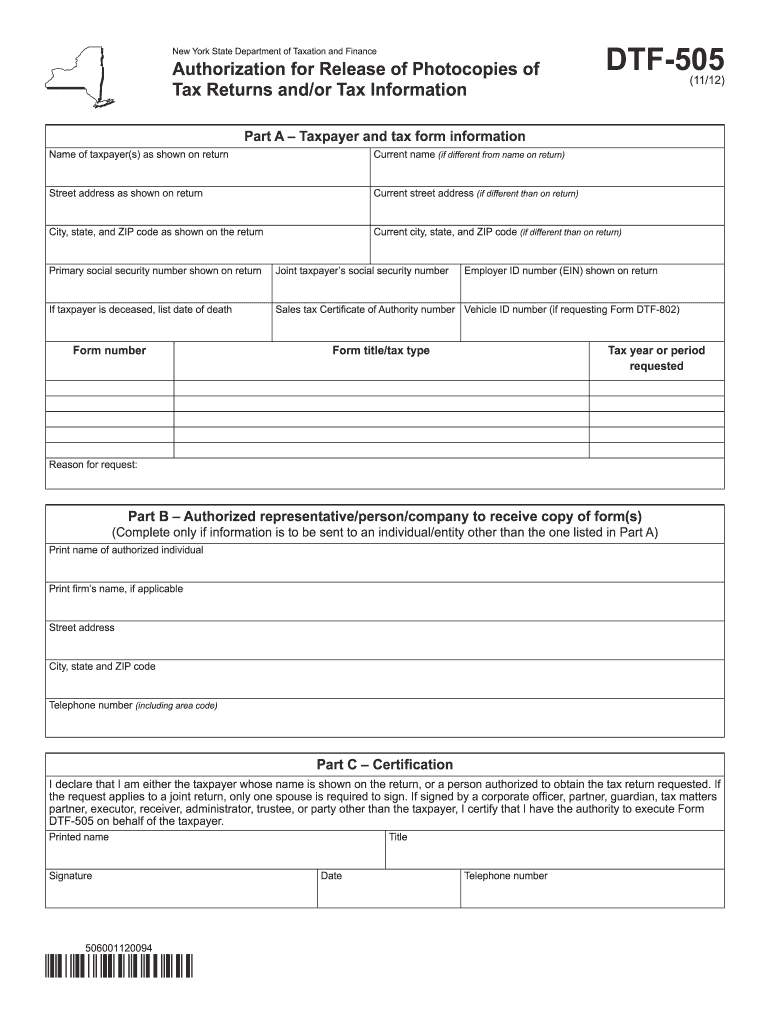

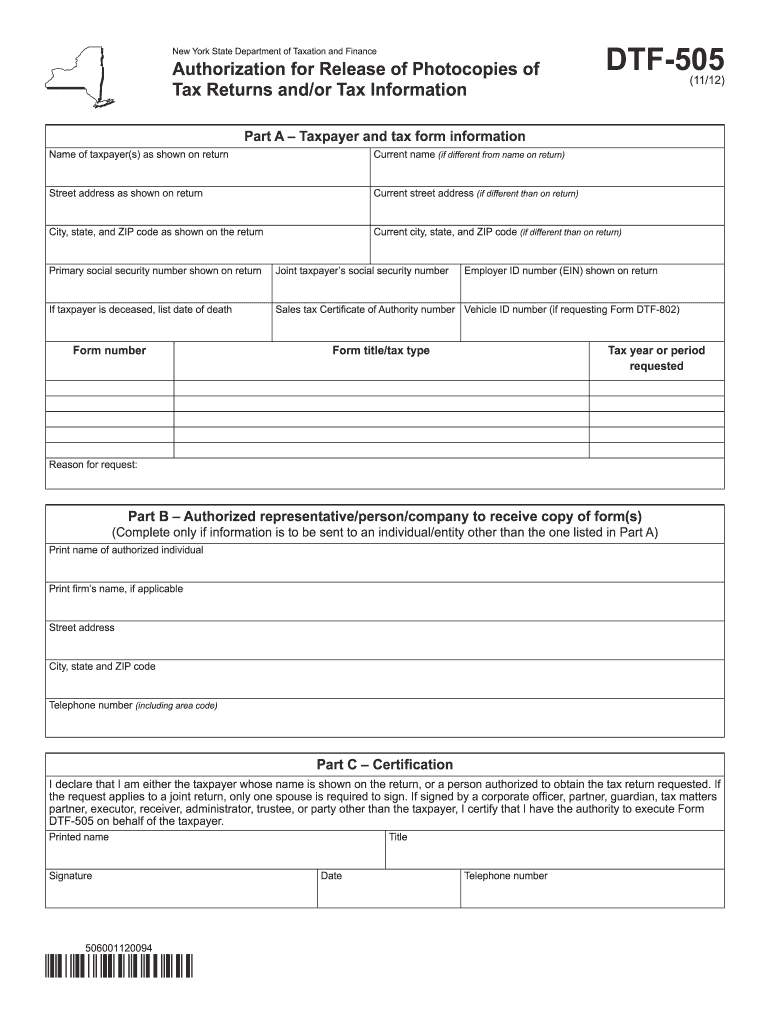

25 per page the minimum fee is 2. 00. Mail your completed request to NYS TAX DEPARTMENT DISCLOSURE UNIT W A HARRIMAN CAMPUS ALBANY NY 12227 If you are requesting that tax information be sent to someone besides yourself complete Parts A B and C. If the taxpayer is unable to sign you must submit a power of attorney power of appointment or other evidence to establish that you are authorized to act on behalf of the taxpayer or are authorized to receive the taxpayer s tax information. A...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nys dtf 505 2012

Edit your nys dtf 505 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nys dtf 505 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nys dtf 505 2012 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nys dtf 505 2012. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nys dtf 505 2012

How to fill out NY DTF DTF-505

01

Obtain the NY DTF DTF-505 form from the New York State Department of Taxation and Finance website or a local tax office.

02

Fill out your name, address, and Social Security number at the top of the form.

03

Indicate your filing status, such as single, married filing jointly, or head of household.

04

Enter your total income from all sources for the tax year.

05

Provide any deductions you are eligible for, such as standard deductions or itemized deductions.

06

Calculate your taxable income by subtracting deductions from total income.

07

Determine your tax liability using the tax tables provided with the form.

08

Enter any credits you are eligible for that reduce your tax owed.

09

Calculate the total amount of tax owed or the refund you expect.

10

Review all entries for accuracy and completeness before signing and dating the form.

11

Submit the completed form by the designated deadline, either electronically or by mail.

Who needs NY DTF DTF-505?

01

Individuals who are required to file a New York State income tax return.

02

People who received a refund for overpaid taxes in previous years.

03

Taxpayers who are reporting income from self-employment, rental properties, or other sources.

04

Residents of New York State who meet the income threshold for filing taxes.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

Do I have to file NY state tax return for nonresident?

If I'm not domiciled in New York and I'm not a resident, do I owe New York income tax? If you do not meet the requirements to be a resident, you may still owe New York tax as a nonresident if you have income from New York sources.

How do I get a certified copy of my NYS tax return?

To request copies of e-filed or paper returns for tax years 1990 and forward, complete and mail Form DTF-505, Authorization for Release of Photocopies of Tax Returns and/or Tax Information.

Where can tax forms be obtained?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What is a DTF-505 form?

Tax Returns and/or Tax Information. DTF-505.

Do I have to file New York non resident tax return?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the nys dtf 505 2012 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nys dtf 505 2012 in seconds.

How do I edit nys dtf 505 2012 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing nys dtf 505 2012.

How do I complete nys dtf 505 2012 on an Android device?

Use the pdfFiller mobile app to complete your nys dtf 505 2012 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY DTF DTF-505?

NY DTF DTF-505 is a form used by the New York State Department of Taxation and Finance for reporting and remitting sales and use tax.

Who is required to file NY DTF DTF-505?

Any business or individual that collects sales tax in New York State is required to file NY DTF DTF-505 if they meet the threshold for sales or use tax liability.

How to fill out NY DTF DTF-505?

To fill out NY DTF DTF-505, you need to provide information regarding your sales and use tax collected, calculate the tax amount due, and include any credits or payments previously made.

What is the purpose of NY DTF DTF-505?

The purpose of NY DTF DTF-505 is to report sales and use tax liability and to submit payment of the tax owed to the state.

What information must be reported on NY DTF DTF-505?

Information that must be reported on NY DTF DTF-505 includes total sales, taxable sales, total tax collected, any credits, and the total amount due.

Fill out your nys dtf 505 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys Dtf 505 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.