Get the free Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of ...

Show details

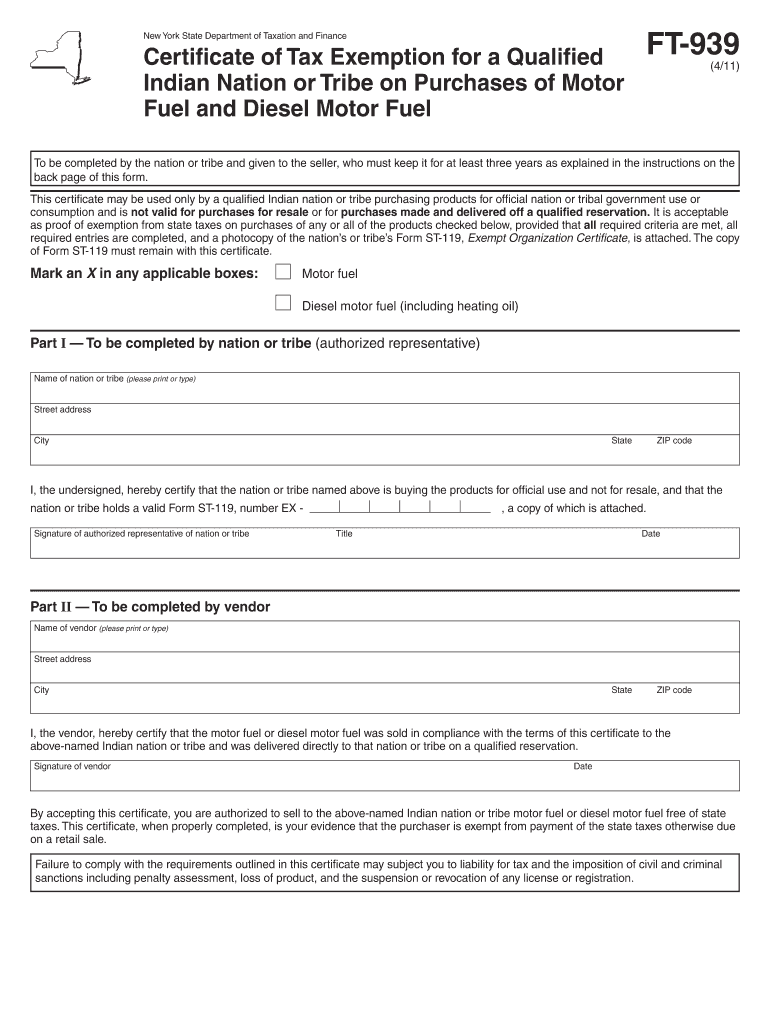

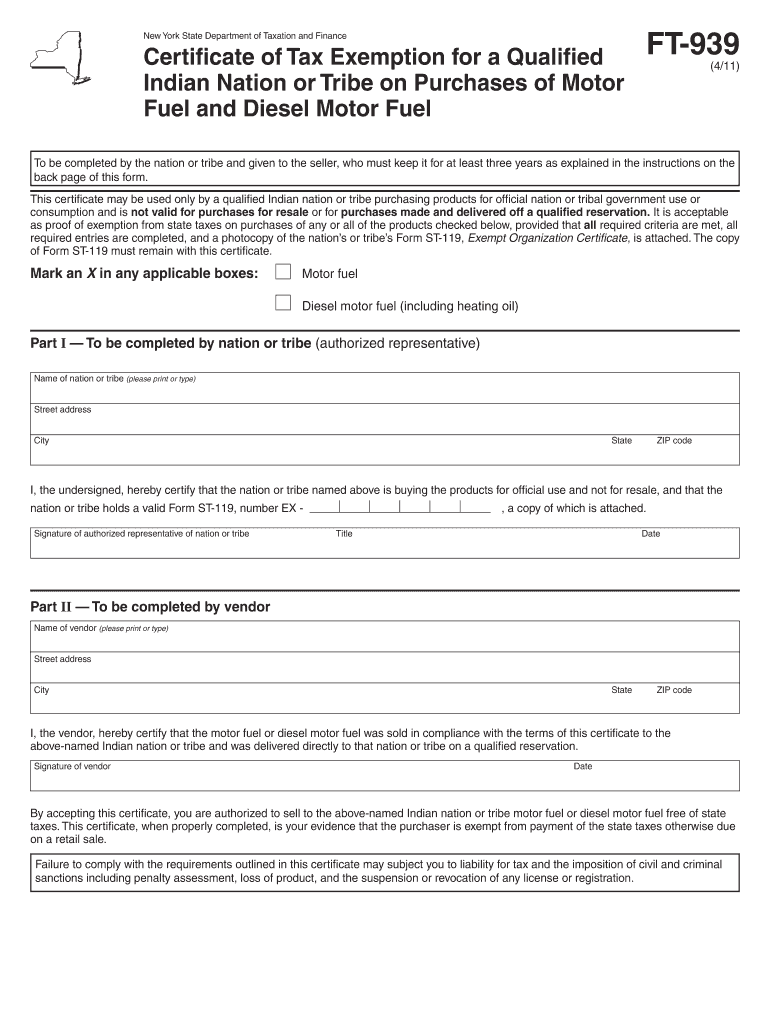

This form is used by qualified Indian nations or tribes in New York to claim tax exemptions on motor fuel and diesel fuel purchases made for official government use.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of tax exemption

Edit your certificate of tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of tax exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of tax exemption. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of tax exemption

How to fill out Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel

01

Obtain a copy of the Certificate of Tax Exemption form intended for Qualified Indian Nations or Tribes.

02

Fill in the name of the Qualified Indian Nation or Tribe in the designated field.

03

Provide the address of the tribal organization completing the form.

04

Include the tax identification number assigned to the tribe by the IRS.

05

Indicate the type of fuel (Motor Fuel or Diesel Motor Fuel) being purchased.

06

Sign and date the form at the bottom to affirm the authenticity of the information provided.

07

Submit the completed form to the fuel supplier to be exempted from state fuel taxes.

Who needs Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

01

Members of Qualified Indian Nations or Tribes who make purchases of motor fuel and diesel motor fuel.

02

Businesses operating on tribal land that require tax exemption on fuel purchases.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from sales tax in California?

Thus, items purchased for resale, or to various out-of-state entities (usually transport companies) or which are in transit to an overseas destination, are exempt. Other examples of exempt sales include sales of certain food plants and seeds, sales to the U.S. Government and sales of prescription medicine.

What taxes are Indians exempt from?

Native Americans are expected to pay taxes to the federal government. But there's an exception. Notably, tribal members do not pay taxes on income from lands held in trust, where the title is held by the U.S. Department of the Interior on behalf of tribes or individuals.

Are tribal organizations tax exempt?

However, tribal corporations chartered by states are subject to litigation in most cases. Must pay federal taxes: Tribes are not liable for federal taxes, but state-chartered tribal corporations must pay taxes regardless of where they do business.

Are Indian tribes exempt from sales tax in California?

Sales to Native Americans and Transfer of Ownership on a Reservation. If you are a California retailer who is located outside a reservation, your sales to Native Americans are generally subject to tax unless specific requirements for the exemption are met.

Are Native Americans exempt from sales tax in California?

Sales to Native Americans and Transfer of Ownership on a Reservation. If you are a California retailer who is located outside a reservation, your sales to Native Americans are generally subject to tax unless specific requirements for the exemption are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

The Certificate of Tax Exemption is a document that allows Qualified Indian Nations or Tribes to be exempt from paying motor fuel and diesel motor fuel taxes when making purchases. It confirms the eligibility of the tribe or nation for tax exemption under applicable laws.

Who is required to file Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

Qualified Indian Nations or Tribes are required to file the Certificate of Tax Exemption to demonstrate their eligibility for tax exemption on motor fuel and diesel motor fuel purchases.

How to fill out Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

To fill out the Certificate of Tax Exemption, the authorized representative of the Qualified Indian Nation or Tribe must provide information such as the name of the tribe, address, tax identification number, and details about the purchase including the type of fuel and quantity.

What is the purpose of Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

The purpose of the Certificate of Tax Exemption is to formalize the tax-exempt status of Qualified Indian Nations or Tribes for motor fuel and diesel purchases, ensuring they can operate without the burden of certain state taxes related to fuel.

What information must be reported on Certificate of Tax Exemption for a Qualified Indian Nation or Tribe on Purchases of Motor Fuel and Diesel Motor Fuel?

The information that must be reported includes the name and address of the Qualified Indian Nation or Tribe, their tax identification number, the date of the purchase, the type of fuel being purchased, the quantity of fuel, and the signature of the authorized representative.

Fill out your certificate of tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.