Get the free FT-959 - tax ny

Show details

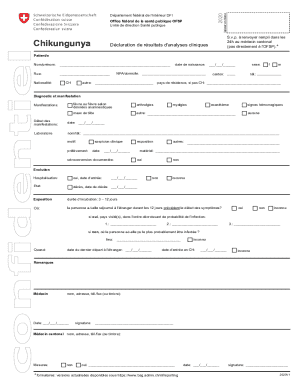

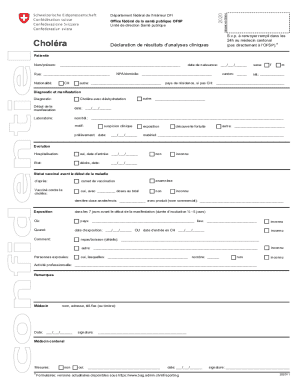

This document is a tax return form for unregistered distributors of special fuel in New York State, specifically for the recovery period following Hurricane Sandy for November 2012.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ft-959 - tax ny

Edit your ft-959 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ft-959 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ft-959 - tax ny online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ft-959 - tax ny. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ft-959 - tax ny

How to fill out FT-959

01

Gather all necessary information required for FT-959.

02

Start with section one and enter your personal details such as name and address.

03

Move on to section two and fill in any applicable identification numbers.

04

Proceed to section three and provide details regarding the purpose of the form.

05

In section four, include any relevant supporting documentation if required.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form following the specified submission guidelines.

Who needs FT-959?

01

Individuals filling out tax forms.

02

Businesses submitting financial disclosures.

03

Organizations needing to report certain financial information.

Fill

form

: Try Risk Free

People Also Ask about

How do you reset the omada controller?

Step 1 On the phone, press Applications . Step 2 Select Accessories > Setup > Reset settings. Step 3 At the warning window, select Reset. After you personalize your headset settings, your phone saves your tuning selections and applies to them to any future Cisco headset model you use.

What is the if frequency for yaesu ft 950?

The triple-conversion design features a 1st IF of 69.45 MHz, a 2nd IF of 450 kHz, and a 3rd IF of 30 kHz (FM: 24 kHz).

How do I reset my Yaesu radio?

2:02 4:26 Off. And we're going to press and hold the Monty key which is the side key just beneath the PTT.MoreOff. And we're going to press and hold the Monty key which is the side key just beneath the PTT. Button so we're going to press and hold that and we're going to turn the radio. On.

How do you reset the FT 950?

Turn OFF the front Power Switch and disconnect the DC power cable (or turn OFF the power supply for FT-950 and wait a minute, until the capacitors discharge). This resets the radio and locks in the new software.

When was the Yaesu FT 950 made?

SPECIFICATIONS GENERAL Manufactured: Japan, 2007-201x (Discontinued) Additional info: Related documents: User manual (6.5 MB) Service manual (10.7 MB) Modifications and fixes: 36 more rows • Jul 3, 2024

How do you reset a Cisco headset?

Method 2: Resetting via UniFi Applications Navigate to the device's settings. Find the “Manage” section. Look for “Forget” (UniFi Network) or “Unmanage” (UniFi Protect) Select this option to unmanage the device and restore factory settings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FT-959?

FT-959 is a form used by the IRS for reporting certain types of payments, typically related to foreign transactions or international tax matters.

Who is required to file FT-959?

Individuals or entities engaged in specific foreign financial transactions, as defined by IRS regulations, are required to file FT-959.

How to fill out FT-959?

To fill out FT-959, taxpayers must provide their identifying information, details of the foreign financial transactions, and any amounts required under IRS guidelines.

What is the purpose of FT-959?

The purpose of FT-959 is to provide the IRS with information necessary to enforce compliance with U.S. tax laws regarding foreign financial transactions.

What information must be reported on FT-959?

Information that must be reported on FT-959 includes the taxpayer's identification details, transaction specifics, amounts involved, and any relevant foreign account information.

Fill out your ft-959 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ft-959 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.