Get the free RP-466-i [Albany] - tax ny

Show details

This application is for volunteer firefighters and ambulance workers in Albany County to apply for a property tax exemption.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rp-466-i albany - tax

Edit your rp-466-i albany - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rp-466-i albany - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rp-466-i albany - tax online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rp-466-i albany - tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rp-466-i albany - tax

How to fill out RP-466-i [Albany]

01

Obtain the RP-466-i form from the New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions accompanying the form carefully to understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and property details.

04

Provide your income information as required, including any necessary documentation to support your claims.

05

Complete any additional sections that apply to your specific situation, such as exemptions or credits.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting it.

08

Submit the form by the deadline, either by mail or electronically, as instructed.

Who needs RP-466-i [Albany]?

01

Homeowners in Albany who wish to apply for property tax exemptions or reductions.

02

Individuals who meet specific income requirements for the RP-466-i form.

03

Residents seeking financial relief from property taxes due to certain circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is an exempt volunteer firefighter in NY?

An exempt volunteer firefighter is hereby declared to be a person who as a member of a volunteer fire company duly organized under the laws of the state of New York shall have at any time after attaining the age of eighteen years faithfully actually performed service in the protection of life and property from fire

Do NY volunteer firefighters get paid?

Estimated salaries The estimated salary for a volunteer firefighter is $22.89 per hour in New York State.

What do you need to be a volunteer firefighter in NY?

To become a volunteer firefighter, a candidate must successfully complete a 84-hour course that covers skills such as entering burning buildings, hose operations, and fire scene safety.

Who is an exempt volunteer firefighter in NY?

An exempt volunteer firefighter is hereby declared to be a person who as a member of a volunteer fire company duly organized under the laws of the state of New York shall have at any time after attaining the age of eighteen years faithfully actually performed service in the protection of life and property from fire

What is the volunteer firefighter law in NY?

Under New York Labor Law Section 201-d, employers are prohibited from discriminating against employees who serve as volunteer firefighters. This means an employer cannot fire, demote, or otherwise retaliate against an employee for missing work due to an emergency response.

What is the tax break for volunteer firefighters in NY?

The volunteer firefighters' and ambulance workers' credit is available to full-year New York State residents who are active volunteer firefighters or volunteer ambulance workers for the entire tax year for which the credit is claimed. The credit is $200 for each active volunteer firefighter or ambulance worker.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

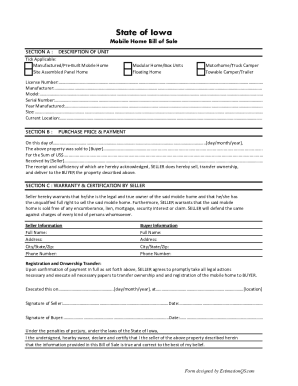

What is RP-466-i [Albany]?

RP-466-i [Albany] is a form used in Albany, New York for reporting property tax exemptions.

Who is required to file RP-466-i [Albany]?

Property owners who qualify for certain tax exemptions within Albany are required to file RP-466-i.

How to fill out RP-466-i [Albany]?

To fill out RP-466-i, provide necessary property information, exemption details, and owner identification as per the instructions provided with the form.

What is the purpose of RP-466-i [Albany]?

The purpose of RP-466-i is to assess and verify eligibility for property tax exemptions in Albany.

What information must be reported on RP-466-i [Albany]?

Information required includes property address, owner details, types of exemptions being claimed, and any supporting documentation.

Fill out your rp-466-i albany - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rp-466-I Albany - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.