Get the free ST-810.11 - tax ny

Show details

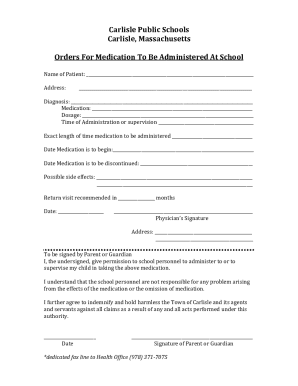

Schedule for New York Vendors to Report Connecticut Sales Tax for the period of May 1, 1997, through May 31, 1997. It includes instructions for reporting sales tax due, as well as penalties for late

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-81011 - tax ny

Edit your st-81011 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-81011 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-81011 - tax ny online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit st-81011 - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-81011 - tax ny

How to fill out ST-810.11

01

Obtain the ST-810.11 form from the appropriate tax authority website or office.

02

Fill in your personal information including name, address, and taxpayer identification number.

03

Specify the type of goods or services involved in the transaction.

04

Indicate the reason for exemption, if applicable.

05

Provide details of the purchase including dates and amounts.

06

Sign and date the form at the bottom.

07

Submit the completed form to the designated tax authority or retain it for your records.

Who needs ST-810.11?

01

Businesses and individuals engaging in certain exempt transactions that fall under the jurisdiction of the ST-810.11 form.

02

Taxpayers who are seeking exemption from sales tax on specific goods or services.

Fill

form

: Try Risk Free

People Also Ask about

What is the 810 trespassing statute in Florida?

One acre or less in area and is identified as such with a sign that appears prominently, in letters of not less than 2 inches in height, and reads in substantially the following manner: “THIS AREA IS A DESIGNATED CONSTRUCTION SITE, AND ANYONE WHO TRESPASSES ON THIS PROPERTY COMMITS A FELONY.” The sign shall be placed

What is the new trespassing law in Florida?

Penalties for Trespass A Trespass in Structure or Conveyance is typically charged as a second degree misdemeanor, punishable by up to 60 days in jail. However, if a person is present in the structure where the trespass occurs, then trespass is considered a first degree misdemeanor, punishable by up to 1 year in jail.

Is it a felony to trespass on a construction site in Florida?

For example, section 810.09(1)(a), Florida Statutes, states that "[a] person who, without being authorized, licensed, or invited, willfully enters upon or remains in any property other than a structure or conveyance . . . [a]s to which notice against entering or remaining is given, . . .

What is the statute 810.09 1 in Florida?

(2) “Dwelling” means a building or conveyance of any kind, including any attached porch, whether such building or conveyance is temporary or permanent, mobile or immobile, which has a roof over it and is designed to be occupied by people lodging therein at night, together with the curtilage thereof.

Is trespassing a construction site illegal?

(1) Whoever, without being authorized, licensed, or invited, willfully enters or remains in any structure or conveyance, or, having been authorized, licensed, or invited, is warned by the owner or lessee of the premises, or by a person authorized by the owner or lessee, to depart and refuses to do so, commits the

Is trespassing on a construction site a felony in Florida?

Legal Consequences Aside from physical dangers, trespassing on a construction site is illegal. Getting caught could mean fines or even a criminal record — so it's not worth the thrill of sneaking in.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-810.11?

ST-810.11 is a form used for reporting sales and use tax in the state of New York.

Who is required to file ST-810.11?

Businesses and individuals who make taxable sales or purchases in New York are required to file ST-810.11.

How to fill out ST-810.11?

To fill out ST-810.11, gather your sales and use tax information, enter the required data in the specified fields on the form, and ensure accuracy before submitting.

What is the purpose of ST-810.11?

The purpose of ST-810.11 is to report and remit sales tax due to the state of New York.

What information must be reported on ST-810.11?

Information that must be reported includes total sales, exempt sales, taxable purchases, and the amount of tax due.

Fill out your st-81011 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-81011 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.