Get the free Quarterly Schedule U - tax ny

Show details

Este formulario se utiliza para reportar las transacciones de impuestos sobre los servicios relacionados con la propiedad personal tangible utilizada o consumida en la producción durante el período

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly schedule u

Edit your quarterly schedule u form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly schedule u form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quarterly schedule u online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit quarterly schedule u. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

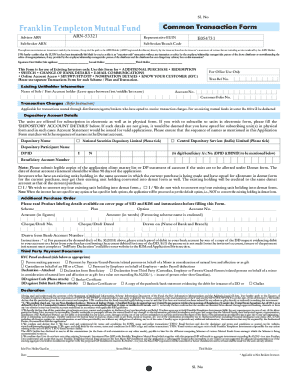

How to fill out quarterly schedule u

How to fill out Quarterly Schedule U

01

Obtain the Quarterly Schedule U form from the appropriate tax authority website or from your tax preparer.

02

Fill in your business name, address, and tax identification number at the top of the form.

03

Enter the reporting period for the quarterly schedule in the specified section.

04

Provide details of your income and expenses for the quarter, including any applicable deductions.

05

If applicable, report any changes in the ownership structure or management of the business.

06

Review all the entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed Schedule U by the due date, either electronically or by mail, as specified by the tax authority.

Who needs Quarterly Schedule U?

01

Businesses that are required to report their income and expenses on a quarterly basis.

02

Corporations or partnerships that are subject to specific tax regulations necessitating the use of Schedule U.

03

Taxpayers engaging in certain activities or earning income that mandates the filing of this schedule.

Fill

form

: Try Risk Free

People Also Ask about

Are there 4 quarters in a school year?

The quarter system breaks the year up into four time periods. Each quarter is a 10 week session with classes that occur in the fall, winter, spring, and an optional summer. The academic year starts in September and ends in June. Students usually take 3-4 classes per quarter, which amounts to 9-12 credit hours.

Which US universities have a quarter system?

Some notable schools that follow the quarter system: the University of California system (except UC Berkeley and UC Merced), CalTech, Dartmouth, Drexel, Northwestern, University of Chicago, Oregon State, and Stanford.

What is the quarterly school schedule?

A quarter system consists of four 10-week sessions in the fall, winter, spring, and summer. The average full-time student takes 3-4 courses per term, or 9-12 credits. An academic year on the quarter system normally runs from mid-September through early June.

What is one quarter of the school year?

A quarter system consists of four 10-week sessions in the fall, winter, spring, and summer. The average full-time student takes 3-4 courses per term, or 9-12 credits.

What are the school quarters?

An academic quarter refers to the division of an academic year into four parts, which commonly are not all exactly three months or thirteen weeks long due to breaks between terms.

What is a quarter of a school year called?

The school year is divided into trimesters (or quarters) that last about three months. Summer is usually counted as a term break, although the beginning of June is still part of the third trimester.

What is the trimester schedule?

A trimester system divides the academic year into three sessions: fall, winter, and spring. Each trimester is approximately 12-13 weeks long. Each trimester you can take three to four classes depending on how many credits each class is.

What is a quarter of a year called?

The calendar year can be divided into four quarters, often abbreviated as Q1, Q2, Q3, and Q4. Since they are three months each, they are also called trimesters. In the Gregorian calendar: First quarter, Q1: January 1 – March 31 (90 days or 91 days in leap years) Second quarter, Q2: April 1 – June 30 (91 days)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Schedule U?

Quarterly Schedule U is a financial reporting form used by businesses to report information about their financial position and operations on a quarterly basis.

Who is required to file Quarterly Schedule U?

Entities that are required to file Quarterly Schedule U typically include certain corporations, partnerships, and other business organizations that meet specific financial reporting thresholds set by regulatory authorities.

How to fill out Quarterly Schedule U?

To fill out Quarterly Schedule U, businesses must provide detailed financial data, including revenue, expenses, and assets, following the prescribed format and instructions provided by the regulatory body overseeing the filing.

What is the purpose of Quarterly Schedule U?

The purpose of Quarterly Schedule U is to maintain transparency and accountability in financial reporting, allowing regulators and stakeholders to assess a business's performance and compliance with financial regulations.

What information must be reported on Quarterly Schedule U?

The information that must be reported on Quarterly Schedule U includes financial metrics such as total revenue, operating expenses, net income, and any other specific line items as required by the regulatory guidelines.

Fill out your quarterly schedule u online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Schedule U is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.