Get the free ST-101.11 - tax ny

Show details

Schedule for New York Vendors to Report Connecticut Sales Tax. This form is used specifically for vendors in New York to report their sales tax transactions in Connecticut for the period stated.

We are not affiliated with any brand or entity on this form

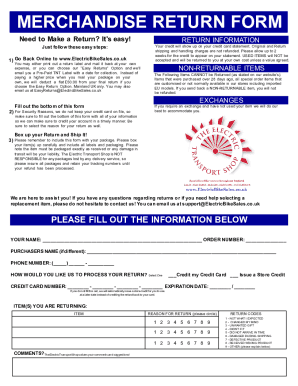

Get, Create, Make and Sign st-10111 - tax ny

Edit your st-10111 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-10111 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-10111 - tax ny online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit st-10111 - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-10111 - tax ny

How to fill out ST-101.11

01

Obtain the ST-101.11 form from the appropriate tax authority website or office.

02

Fill in your personal information, including your name, address, and identification number.

03

Indicate the type of tax exemption or deduction you are applying for.

04

Complete the sections that require details about the property or transaction in question.

05

Provide any necessary supporting documentation as required by the form.

06

Review all information for accuracy before submission.

07

Submit the completed form to the designated tax authority by the deadline.

Who needs ST-101.11?

01

Individuals or businesses seeking tax exemptions.

02

Property owners applying for property tax reductions.

03

Non-profit organizations claiming tax-exempt status.

Fill

form

: Try Risk Free

People Also Ask about

What is the FDA calorie requirement?

2,000 calories a day is used as a general guide for nutrition advice, but your calorie needs may be higher or lower depending on your age, sex, height, weight, and physical activity level. Eating too many calories per day is linked to overweight and obesity.

Why do restaurants not put calories on the menu?

It's meant to show the ones who just eat and eat and don't think about the calories (myself included) who might make a healthier choice if they had an informed decision. There's no law against making separate menus with no calories on it though, so restaurants should be making those available upon request.

Are calorie counts required on menus?

United States. The first U.S. menu item calorie labeling law was enacted in 2008 in New York City. California was the first state to enact a calorie count law, which occurred in 2009. Restaurants that do not comply can be fined up to $2,000. Other localities and states have passed similar laws.

Is it a law to put calories on menus?

After several court challenges, the law was implemented in 2008. Later that year, California passed the first state-wide menu labeling law. In all, more than 20 states, counties, and cities have enacted menu labeling policies.

What is the 28-301.1 of the NYC administrative code?

§28-301.1 Owner's responsibilities. Whenever persons engaged in building operations have reason to believe in the course of such operations that any building or other structure is dangerous or unsafe, such person shall forthwith report such belief in writing to the department.

Is it required to show calories on menus?

Food businesses are required to place nutrition labels and calorie information on all packaged food and drink products, and have been required to do so for a number of years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-101.11?

ST-101.11 is a form used for the reporting and payment of sales and use tax in certain jurisdictions.

Who is required to file ST-101.11?

Businesses and individuals who collect sales tax or incur use tax obligations in jurisdictions requiring this form must file ST-101.11.

How to fill out ST-101.11?

To fill out ST-101.11, gather all necessary sales and use tax information, complete each section accurately, and ensure to calculate the total tax due before submitting.

What is the purpose of ST-101.11?

The purpose of ST-101.11 is to provide a standardized method for reporting sales and use tax collected by businesses and ensuring compliance with tax obligations.

What information must be reported on ST-101.11?

ST-101.11 requires the reporting of total sales, exempt sales, taxable purchases, and the total amount of sales and use tax collected.

Fill out your st-10111 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-10111 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.