Get the free PT-100-A - tax ny

Show details

This form is used to report tax payments for the Petroleum Business Tax for the month of November 2000 as required by the New York State Department of Taxation and Finance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt-100-a - tax ny

Edit your pt-100-a - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt-100-a - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pt-100-a - tax ny online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pt-100-a - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

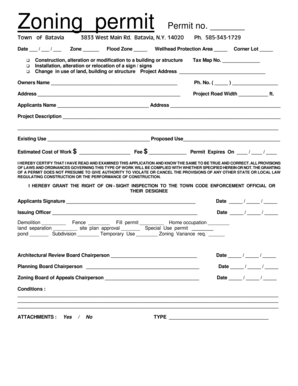

How to fill out pt-100-a - tax ny

How to fill out PT-100-A

01

Gather the necessary documents and information required for filling out the PT-100-A.

02

Begin with your personal information, including your full name, address, and Social Security number.

03

Complete the section related to the type of request you are making on the form.

04

Provide details about the specific actions or changes you are requesting.

05

If applicable, include any supporting documentation that may be required.

06

Review the entire form for accuracy and completeness.

07

Sign and date the application at the designated section.

08

Submit the form to the appropriate agency or department as indicated in the instructions.

Who needs PT-100-A?

01

Individuals or entities applying for certain permits or licenses.

02

Those needing to report income or changes in tax status.

03

Anyone required to document specific actions for regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a thermocouple and a PT100?

PT100 sensors provide high accuracy and stability, making them the first choice for precise applications. Thermocouples, on the other hand, are less accurate but offer a fast response time and are suitable for temperatures that a PT100 sensor cannot cover.

What is the difference between PT100 and PT 1000?

The Difference Between Pt100 and Pt1000 Sensors Pt100 sensors have a nominal resistance of 100Ω at ice point (0°C). Pt1000 sensors' nominal resistance at 0°C is 1,000Ω. Linearity of the characteristic curve, operating temperature range, and response time are the same for both.

What does PT100 mean in RTD?

PT100 is a specific type of RTD that uses platinum as the sensing element with a nominal resistance of 100 ohms at 0°C. Therefore, the primary difference lies in the material used for the sensing element, with PT100 specifically referring to platinum-based RTDs.

What does PT100 mean?

PT100 refers to a type of temperature sensor with a platinum resistance element. The “PT” stands for platinum, and “100” denotes its nominal resistance at 0 degrees Celsius. PT100 sensors are widely used for precise temperature measurements in various industrial and scientific applications.

How to test a PT100 with a multimeter?

1:43 3:48 Friends if you want to check RTD. Then you have to use multimeter. This multimeter here take probesMoreFriends if you want to check RTD. Then you have to use multimeter. This multimeter here take probes of multimeter. And connect with wires of RTD. In this way we will do the connection.

Why does PT100 have 3 wires?

As for the 3 wire of RTD PT100, it's basic function is to eliminate the influence of lead resistance on the sensor.

What is PT100 class A?

Class A Pt100 sensors typically have an accuracy of ±0.15°C or better over the temperature range of -50°C to 150°C. Class B Pt100 sensors typically have an accuracy of ±0.3°C or better over the temperature range of -50°C to 200°C.

Which is better, PT100 or PT1000?

The higher resistance of PT1000 sensors reduces the impact of lead wire resistance, thereby enhancing measurement accuracy. PT1000 sensors offer increased sensitivity, making them more suitable for monitoring rapid temperature changes. PT100 sensors generally have lower initial costs compared to PT1000 sensors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PT-100-A?

PT-100-A is a tax form used in certain jurisdictions for reporting specific financial information related to businesses.

Who is required to file PT-100-A?

Businesses or entities that meet certain criteria, such as having a certain level of income or operating within specific sectors, are required to file PT-100-A.

How to fill out PT-100-A?

To fill out PT-100-A, obtain the form from the relevant tax authority, provide accurate financial data in the specified sections, and ensure all required signatures are included before submitting.

What is the purpose of PT-100-A?

The purpose of PT-100-A is to provide tax authorities with information needed to assess a business's tax liability and ensure compliance with tax regulations.

What information must be reported on PT-100-A?

The information that must be reported on PT-100-A typically includes business income, expenses, and other financial data relevant to determining tax obligations.

Fill out your pt-100-a - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt-100-A - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.