Get the free PT-101 - tax ny

Show details

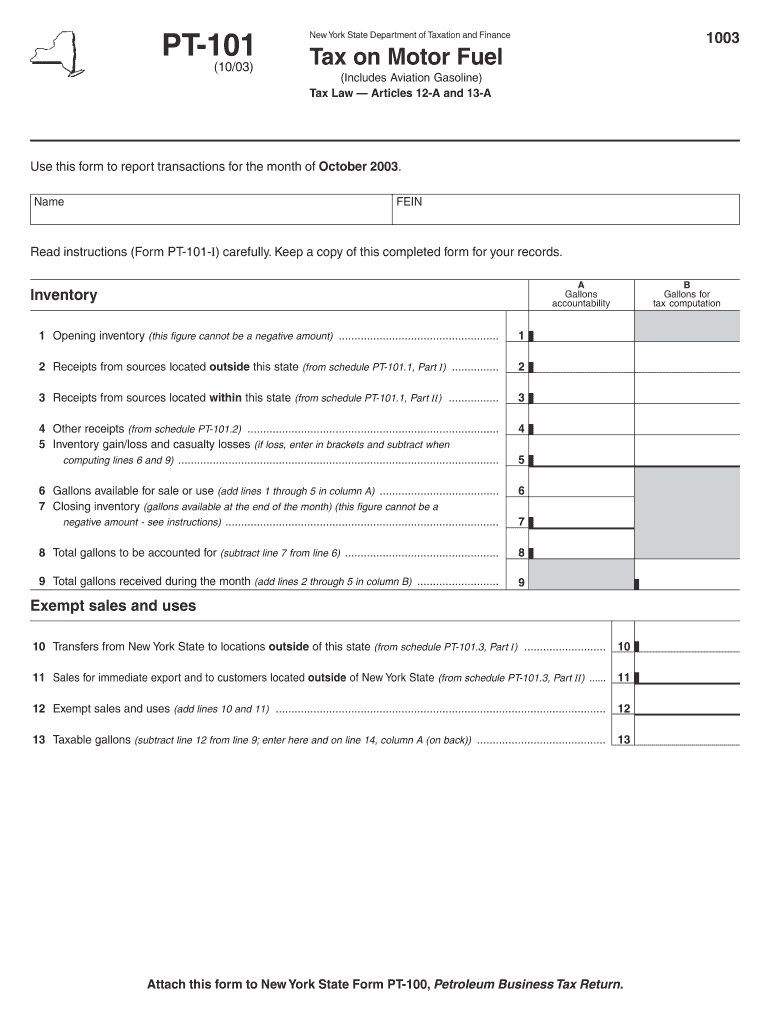

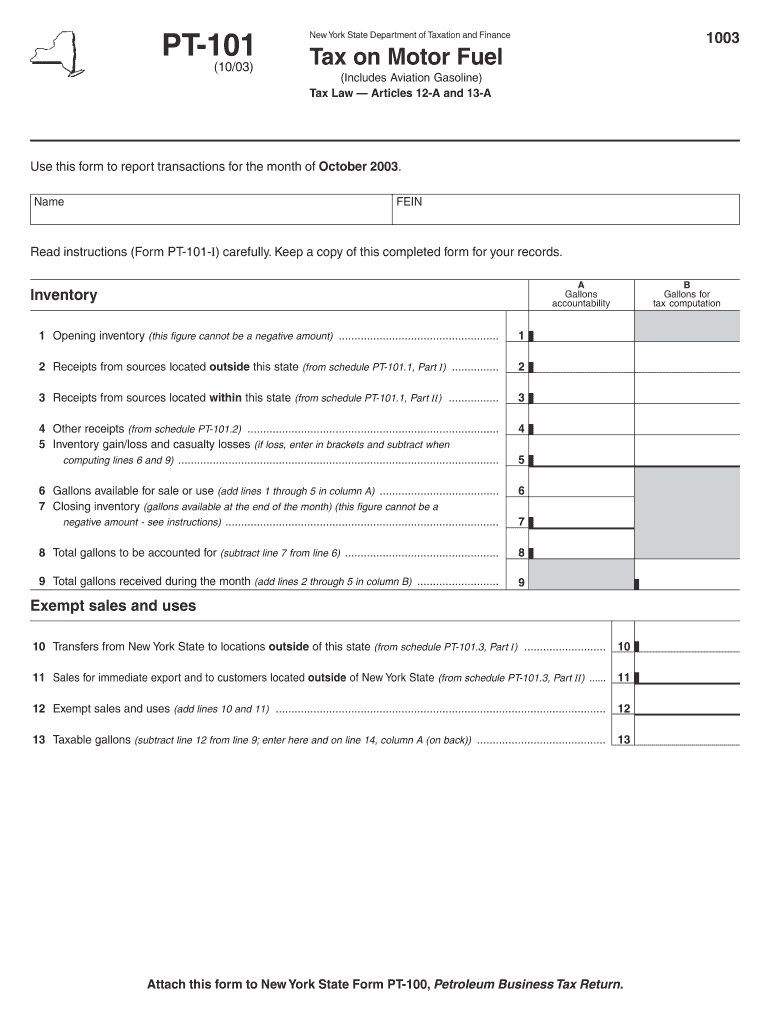

Use this form to report transactions for the month of October 2003 related to the tax on motor fuel and aviation gasoline in New York State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt-101 - tax ny

Edit your pt-101 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt-101 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pt-101 - tax ny online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pt-101 - tax ny. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pt-101 - tax ny

How to fill out PT-101

01

Gather the necessary personal and financial information before starting.

02

Begin by entering your personal details at the top of the form, including your name, address, and Social Security number.

03

Fill out the income section by reporting all sources of income for the tax year.

04

Deduct any eligible expenses or credits in the designated sections.

05

Review each section for accuracy before moving to the next.

06

Sign and date the form at the end to certify that all information provided is true and accurate.

07

Submit the completed PT-101 form according to the guidelines provided by the relevant authorities.

Who needs PT-101?

01

Individuals who are filing their taxes and reporting their income.

02

Self-employed individuals who need to report business income.

03

Taxpayers seeking to claim specific deductions or credits.

Fill

form

: Try Risk Free

People Also Ask about

What books do you read in English 101?

Understand Basic Grammar for English Verb Tenses: Understand simple tenses like the present (e.g., “I eat”), past (e.g., “I ate”), and future (e.g., “I will eat”). Articles and Prepositions: Practice using articles (a, an, the) and prepositions (in, on, at) in sentences.

What does English 101 consist of?

In this course, you will practice critical thinking, reading, and writing by applying a variety of strategies that enhance your work as a communicator, citizen, and scholar. analyze texts for purpose, audience, context, and overall composition.

What year is the LSAT prep test 101?

The new practice tests for August 2024 and beyond, which will not include a logic games section, will have three-digit numbers starting at 101.

What is taught in English 101?

Course Description Welcome to ENG 101: Writing and Critical Reading. This is a composition course focusing on academic writing, the writing process, and critical reading. Emphasis will be on essays that incorporate readings.

What skills do you learn in English 101?

Reading List Jane Austen: Pride and Prejudice (Romantic) Charlotte Bronte: Jane Eyre (Romantic) Charles Dickens: A Tale of Two Cities (Victorian) George Eliot: Middlemarch (Victorian)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PT-101?

PT-101 is a tax form used to report certain taxable income and claim any applicable tax credits.

Who is required to file PT-101?

Individuals or entities that have taxable income relevant to the form's requirements must file PT-101.

How to fill out PT-101?

To fill out PT-101, gather the necessary financial documentation, complete each section of the form accurately, and submit it by the designated deadline.

What is the purpose of PT-101?

The purpose of PT-101 is to provide the government with information regarding an individual's taxable income to ensure proper tax assessment and compliance.

What information must be reported on PT-101?

PT-101 must report personal identification information, total income, deductions, and any tax credits applicable for the reporting period.

Fill out your pt-101 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt-101 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.