Get the free ST-100.4 - tax ny

Show details

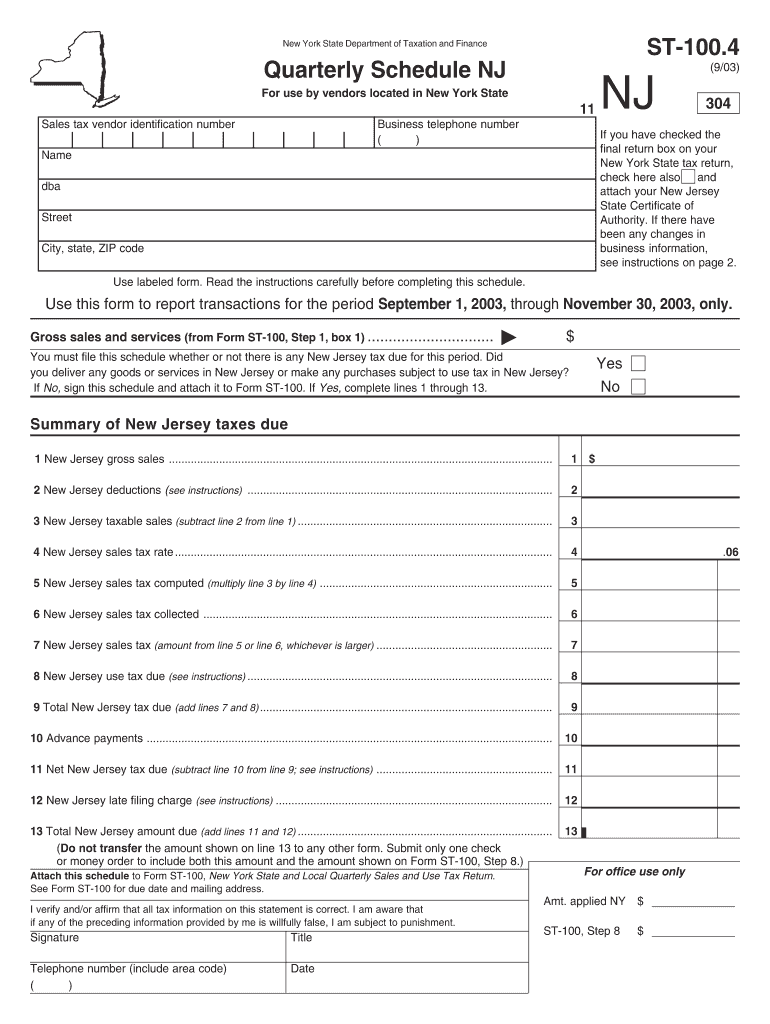

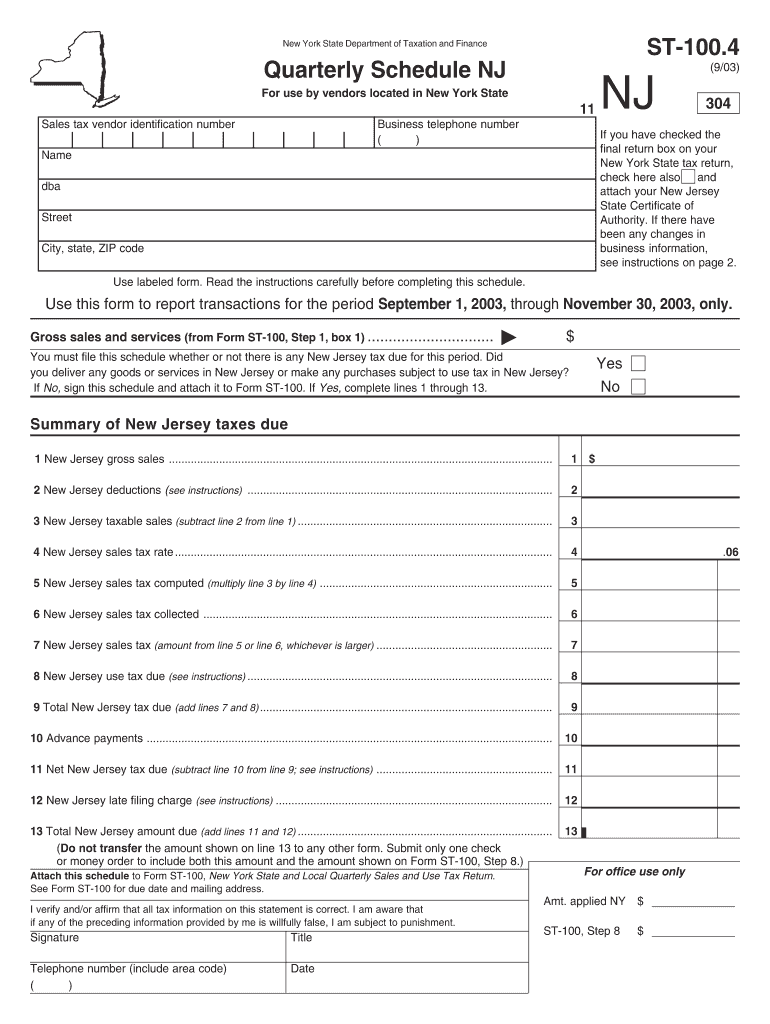

This form is used by vendors located in New York State to report New Jersey sales and use tax for a specified quarterly period and includes instructions for proper filing and tax computation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-1004 - tax ny

Edit your st-1004 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-1004 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-1004 - tax ny online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit st-1004 - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-1004 - tax ny

How to fill out ST-100.4

01

Obtain the ST-100.4 form from the relevant state tax authority's website or office.

02

Fill in your business name, address, and tax identification number at the top of the form.

03

Indicate the reporting period for which you are filing the return.

04

Calculate your total sales for the reporting period and enter the amount in the designated section.

05

Deduct any exempt sales and provide the calculations in the appropriate fields.

06

Total your taxable sales based on the calculations provided.

07

Apply the appropriate tax rate to your taxable sales to determine the total sales tax due.

08

Fill in any adjustments, if applicable, such as previous overpayments or credits.

09

Review all entries for accuracy before submission.

10

Submit the completed form by the due date as instructed.

Who needs ST-100.4?

01

Businesses that collect sales tax in the jurisdiction, including retailers, wholesalers, and service providers.

Fill

form

: Try Risk Free

People Also Ask about

What is the prayer for Psalm 100:4?

Prayer: Heavenly Father, thank you for your abundant goodness and love that endures forever! You deserve my praise every day, no matter the circumstances. Help me to have a grateful heart day and night and never forget your promises to me.

What is the meaning of Psalm 100 4?

Worship the LORD with gladness; come before him with joyful songs. Know that the LORD is God. It is he who made us, and we are his; we are his people, the sheep of his pasture. Enter his gates with thanksgiving and his courts with praise; give thanks to him and praise his name.

What is Psalm 100 1 5 in English?

4 Enter his gates with thanksgiving; go into his courts with praise. Give thanks to him and praise his name. 5 For the LORD is good. His unfailing love continues forever, and his faithfulness continues to each generation.

What does Psalm 100:4 mean in Hebrew?

The Hebrew word in Psalm 100:4 is “towdah” and it means to give praise or sing hymns of worship to God. Many times we want to come to God with our own agenda. We want to speak to Him with the words of pleading or asking. Sometimes even demanding, we enter His gates.

What is the study of Psalm 100 4?

Psalm 100:4 joins thanksgiving and praise together. Instead of complaining, harboring gratitude, and indulging in self-pity, we should count our blessings and praise the Lord for who He is and for His numerous gifts.

What is Psalms 100:4 in the Living Bible?

4 Enter his gates with thanksgiving; go into his courts with praise. Give thanks to him and praise his name. 5 For the LORD is good. His unfailing love continues forever, and his faithfulness continues to each generation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-100.4?

ST-100.4 is a sales tax form used in New York State for certain businesses to report their sales tax liability.

Who is required to file ST-100.4?

Businesses that make sales subject to sales tax in New York State and meet certain criteria are required to file ST-100.4.

How to fill out ST-100.4?

To fill out ST-100.4, businesses must provide their sales figures, calculate the sales tax owed, and disclose any exempt sales made during the filing period.

What is the purpose of ST-100.4?

The purpose of ST-100.4 is to enable the New York State Department of Taxation and Finance to collect sales tax from businesses accurately and efficiently.

What information must be reported on ST-100.4?

Information required on ST-100.4 includes total taxable sales, exempt sales amounts, and the total sales tax due for the reporting period.

Fill out your st-1004 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-1004 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.