Get the free IT-86 - tax ny

Show details

This document provides information on how to order various tax forms and publications from the New York State Department of Taxation and Finance, including methods for ordering via telephone, fax,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-86 - tax ny

Edit your it-86 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-86 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-86 - tax ny online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it-86 - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-86 - tax ny

How to fill out IT-86

01

Gather necessary personal and financial information.

02

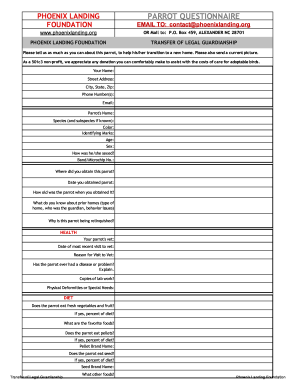

Obtain a copy of the IT-86 form from the official tax website or tax office.

03

Start by filling out your personal details, including your name, address, and Social Security number.

04

Provide information about your income sources, such as wages, self-employment earnings, and other income.

05

Complete sections related to tax credits and deductions applicable to you.

06

Review all information for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form either electronically or via mail, following the instructions provided.

Who needs IT-86?

01

Individuals and businesses who need to report their income for state tax purposes.

02

Taxpayers seeking to apply for tax credits or deductions available in their jurisdiction.

03

Residents who fulfill specific criteria set by state tax regulations requiring the use of the IT-86 form.

Fill

form

: Try Risk Free

People Also Ask about

Is the 86 light novel in English?

The light novels are licensed in North America by Yen Press, which has published 13 volumes as of December 10, 2024. The English version was translated by Roman Lempert.

What is the slang 86 mean?

86 is a commonly used term in restaurants that indicates an item is out of stock or no longer available to be served to guests. This happens often, especially with seasonal, special, or limited-availability items, and it could also indicate that an inventory item has gone bad.

Is 86 dubbed in English?

86 EIGHTY-SIX (English Dubbed): Season 1. Eighty-sixers - those considered to be less than human and treated as mere tools. Shin, the captain of Spearhead Squadron, which is comprised of Eighty-sixers, continues to fight a hopeless war on a battlefield where only death awaits him.

Which Yakuza games are dubbed in English?

The first game in the series was dubbed into English when released outside of Japan. However, due to criticism of the English voice acting, each subsequent Western release through Yakuza 6 retained the original Japanese voice acting.

Is dub the English version of anime?

Basically, a subbed anime has everything the Japanese version has, with the exception of subtitles in English. By contrast, a dub is the Japanese version translated to English, with English voice acting and, in some cases, edits to the animation and music.

Does 86 have an English dub?

86 EIGHTY-SIX (Dubbed): 86 EIGHTY-SIX (English) - TV on Google Play.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-86?

IT-86 is a tax form used by certain individuals and businesses to report income and calculate tax liabilities for state income tax purposes.

Who is required to file IT-86?

Individuals and entities who earn income that is subject to state taxation are required to file IT-86, including residents and non-residents depending on the state's tax laws.

How to fill out IT-86?

To fill out IT-86, taxpayers must provide personal and financial information, including income details, deductions, and credits as specified in the form instructions.

What is the purpose of IT-86?

The purpose of IT-86 is to enable taxpayers to report their taxable income and calculate their tax obligations accurately to the state.

What information must be reported on IT-86?

Individuals must report their total income, specific deductions, applicable credits, and any additional information required by the state tax authority.

Fill out your it-86 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-86 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.