Get the free Annual Schedule B-ATT - tax ny

Show details

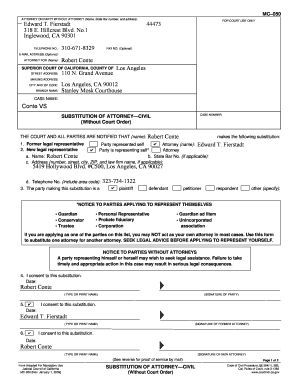

This document is used to report consumer utility and fuel taxes for nonresidential services provided to Qualified Empire Zone Enterprises (QEZE) in New York State for the tax period specified.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual schedule b-att

Edit your annual schedule b-att form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual schedule b-att form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual schedule b-att online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual schedule b-att. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual schedule b-att

How to fill out Annual Schedule B-ATT

01

Begin by gathering all necessary financial documents related to your income and expenses.

02

Start filling out your personal information at the top of the form, including your name, address, and tax identification number.

03

Review the instructions section for specific guidelines related to your situation, especially regarding reporting foreign income.

04

Proceed to Section 1 and list all sources of income that should be reported on Schedule B.

05

In Section 2, indicate where you have foreign bank accounts or financial accounts, if applicable.

06

Fill out the details required for each bank account, including the name of the bank, account number, and maximum value during the year.

07

Double-check all entries for accuracy and completeness before submitting the form.

08

Add your signature and date before sending the form to the appropriate tax authority.

Who needs Annual Schedule B-ATT?

01

Individuals who have received income from sources requiring tax reporting.

02

Taxpayers who have foreign financial accounts that meet the reporting threshold.

03

Those who need to declare interest and dividends from their investments.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to complete Schedule B?

Most taxpayers only need to file a Schedule B if they receive more than $1,500 of taxable interest or dividends. Taxable interest includes most types of interest earned, but some interest such as from certain municipal bonds can be excluded.

What is the Schedule B payment?

Schedule B is specifically required for employers who are classified as semiweekly schedule depositors. You must file Schedule B if you: Reported more than $50,000 of employment taxes in the lookback period, OR. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Do I need to file form B?

Form 1095-B is not required to file your state or federal taxes and you may self‑attest to your health coverage without it. You should get a Form 1095-B in the mail by January 31 following the reported tax year.

What happens if you forgot to file a 1099-B?

If you forget to report 1099 income, you may need to amend your tax return. By filing Form 1040-X, you can make changes to your previously filed 1040 form. However, if the deadline for the 1040 has not passed yet, you may be able to file a superceded return with the correct information.

What is the meaning of Schedule B?

A Schedule-B is a U.S.-specific classification code for exporting goods from the United States. It is administered by the Census Bureau's Foreign Trade Division, which keeps records of exports by country as well as the quantity and value in U.S. dollars.

What is Schedule B on your tax return?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What happens if you don't file Schedule B?

Failing to file Schedule B or report foreign accounts can lead to IRS scrutiny and penalties. To avoid costly mistakes, taxpayers should review filing requirements, ensure they file an FBAR if required, and consult a tax professional if unsure. Complete Schedule B correctly to remain in compliance with U.S. tax laws.

Is Schedule B mandatory?

You have to file Schedule B if you earned more than $1,500 of ordinary dividends or taxable interest during a given tax year. You might also have to file Schedule B if you need to report: Accrued interest from a bond. Interest from a seller-financed mortgage for the buyer's personal residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Schedule B-ATT?

Annual Schedule B-ATT is a form used by tax-exempt organizations to report additional information regarding their unrelated business income and other relevant financial activities.

Who is required to file Annual Schedule B-ATT?

Organizations that have unrelated business income, whether they are exempt from taxes or not, are required to file Annual Schedule B-ATT to disclose this income and related expenses.

How to fill out Annual Schedule B-ATT?

To fill out Annual Schedule B-ATT, organizations need to clearly list their unrelated business income sources, report expenses associated with generating that income, and provide any required supplementary information as instructed on the form.

What is the purpose of Annual Schedule B-ATT?

The purpose of Annual Schedule B-ATT is to provide the IRS with a detailed overview of unrelated business activities conducted by tax-exempt organizations, ensuring transparency and compliance with tax regulations.

What information must be reported on Annual Schedule B-ATT?

Organizations must report details such as types of unrelated business income, the amounts generated, related expenses, and any contributions or other financial activities affecting the reported income.

Fill out your annual schedule b-att online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Schedule B-Att is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.