Get the free PT-100-B - tax ny

Show details

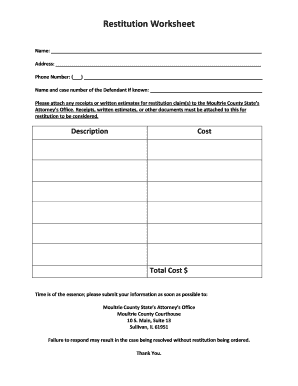

This form is used to report requested weekly refund/reimbursement for the Articles 12-A and 13-A taxes for the month of July 2012, based on the reports from Form(s) AU-629.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt-100-b - tax ny

Edit your pt-100-b - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt-100-b - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pt-100-b - tax ny online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pt-100-b - tax ny. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pt-100-b - tax ny

How to fill out PT-100-B

01

Start by gathering all necessary information related to your tax situation.

02

Download the PT-100-B form from the official tax agency website.

03

Fill out your personal details, including name, address, and Social Security number.

04

Indicate your filing status: single, married, or head of household.

05

Report your income sources in the appropriate sections (e.g., wages, self-employment income).

06

Deduct eligible expenses and report them accordingly.

07

Review your calculations to ensure accuracy of the reported income and deductions.

08

Sign and date the form once you complete all sections.

09

Submit the PT-100-B form by the specified deadline, either electronically or by mail.

Who needs PT-100-B?

01

Individuals or businesses with taxable income.

02

Those who have specific deductions or credits to claim.

03

Taxpayers who need to report specific financial information to the tax authority.

Fill

form

: Try Risk Free

People Also Ask about

How accurate is the RTD Pt100 Class B?

Even the least accurate Pt100 (Class B) will generally be more accurate than a thermoocouple. Pt100s are available with very high accuracies, 1/10 DIN elements, for example, have an accuracy of ±0.03ºC at 0ºC.

What does Class B tolerance mean?

The tolerance of Class B glassware is twice that of Class A. Using the example above, the tolerance of a Class B volumetric flask is ±0.04mL, meaning that the liquid it contains could range from 9.96mL to 10.04mL when filled precisely to the inscribed 10mL mark.

What is the difference between Pt100 and Pt 1000?

The main difference between Pt100s and Pt1000s in general is the electrical resistance at 0⁰C, which is the number in the name: a Pt100 is 100Ω at 0⁰C and a Pt1000 is 1000Ω at ⁰C. This makes Pt1000s more accurate for small temperature changes as they would result in larger changes in resistance when compared to Pt100s.

What does Pt100 mean?

PT100 refers to a type of temperature sensor with a platinum resistance element. The “PT” stands for platinum, and “100” denotes its nominal resistance at 0 degrees Celsius. PT100 sensors are widely used for precise temperature measurements in various industrial and scientific applications.

What is a class B RTD?

IEC 751 defines two classes of RTD; class A and class B. Class A RTDs operate over the temperature range of -200°C to 650°C. Class B RTDs operate over the temperature range of -200°C to 850°C. Class B RTDs have about twice the uncertainty of class A RTDs.

What is the Pt100 form?

The PT-100 form serves to report the personal property owned by businesses for tax assessments. It provides necessary information to local tax authorities for accurate billing. Proper filing ensures compliance and avoids penalties associated with late submissions.

What is Pt100 class B?

Product information "Pt100 Class B" Pt100 measuring elements are the most widely used measuring elements in industrial temperature measurement technology. The reasons for this include their long-term stability, the large measuring range and their high measuring accuracy.

What are the different types of Pt100?

Common accuracy specifications for Pt100 sensors include classes such as Class A, Class B, 1/3 DIN, or 1/10 DIN, which correspond to different levels of accuracy. For example: Class A Pt100 sensors typically have an accuracy of ±0.15°C or better over the temperature range of -50°C to 150°C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PT-100-B?

PT-100-B is a form used for reporting tax information, often related to business income or operations.

Who is required to file PT-100-B?

Businesses and individuals who meet specific income thresholds or engage in certain types of business activities are required to file PT-100-B.

How to fill out PT-100-B?

To fill out PT-100-B, gather necessary financial information, accurately complete each section of the form, and ensure all figures are correct before submission.

What is the purpose of PT-100-B?

The purpose of PT-100-B is to provide the tax authorities with a detailed account of income and expenses for accurate tax assessment.

What information must be reported on PT-100-B?

PT-100-B requires reporting of income, deductions, business expenses, and any other relevant financial data applicable to the reporting period.

Fill out your pt-100-b - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt-100-B - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.