Get the free Budget Performance Payment Comparison Workbook - dads state tx

Show details

This document provides instructions for Area Agencies on Aging (AAAs) to review the Budget Performance Payment Comparison Workbook (BPPCW) which helps reconcile expenditures and evaluate services

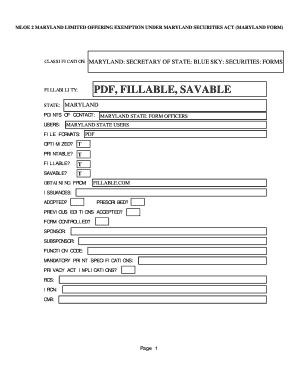

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budget performance payment comparison

Edit your budget performance payment comparison form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budget performance payment comparison form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit budget performance payment comparison online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit budget performance payment comparison. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budget performance payment comparison

How to fill out Budget Performance Payment Comparison Workbook

01

Open the Budget Performance Payment Comparison Workbook.

02

Identify the relevant project for which you need to fill out the workbook.

03

Start with the budget section: input the total allocated budget for the project.

04

Enter the projected expenses in the designated fields of the workbook.

05

Record the actual expenses incurred to date.

06

Calculate and input the variance between the budgeted and actual expenses.

07

Move to the performance section: fill in key performance indicators relevant to the project.

08

Compare budgeted versus actual performance metrics.

09

Review all entries for accuracy and completeness before finalizing the document.

10

Save and share the completed workbook as required.

Who needs Budget Performance Payment Comparison Workbook?

01

Project managers who need to analyze project budget performance.

02

Financial analysts responsible for budget tracking and reporting.

03

Stakeholders interested in reviewing budget adherence and performance.

04

Teams engaged in project management and cost control.

05

Accountants who need a structured document for financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is the 50/30/20 rule on a budget spreadsheet?

Keep your monthly budget and savings on track and on target with the 50/30/20 approach. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts.

What is the 50 20 30 rule in Excel?

Using a 50/30/20 budget template for Excel offers a structured way to manage money every month. The template starts with a field where users input their monthly income, which is automatically divided into 50 percent for needs, 30 percent for wants and 20 percent for savings.

What is an example of the 50/30/20 budget rule?

This budgeting method divides your monthly income among three main categories: 50% for needs, 30% for wants and 20% for savings and debt repayment. Before using this calculator, figure out your net income, which is the money that goes into your bank account after taxes and deductions.

Where can I get a budget template?

Google Sheets has pre-made templates, such as an annual budget and monthly budget. There are also business budgets for entrepreneurs who want to track their expenses.

What is the 50 30 20 rule in Excel?

Using a 50/30/20 budget template for Excel offers a structured way to manage money every month. The template starts with a field where users input their monthly income, which is automatically divided into 50 percent for needs, 30 percent for wants and 20 percent for savings.

How do you create a 50/30/20 budget spreadsheet?

Sections of the 50 30 20 budget template. Needs: 50% Half of your earnings should go toward the things you need. Wants: 30% Life isn't all about needs and savings. Savings: 20% The last category in a 50 30 20 budget is for savings. Additional resources.

What is a performance budget in English?

What Is a Performance Budget? A performance budget is a results-oriented method of budgeting that revolves around desired outcomes.

What is the 70-10-10-10 budget rule?

This principle says for each dollar you earn or are given, you should save 10%, share 10%, invest 10% and spend 70%. A key part of this formula is “paying yourself first” which means the first 30% of your earnings are paid to you, for your benefit … for your retirement, for emergencies, and for sharing with others.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Budget Performance Payment Comparison Workbook?

The Budget Performance Payment Comparison Workbook is a financial tool used to compare budgeted funds against actual performance and expenditures to evaluate the efficiency and effectiveness of budget management.

Who is required to file Budget Performance Payment Comparison Workbook?

Entities or organizations that receive funding and need to report on their budget performance, including government agencies and non-profit organizations, are typically required to file the Budget Performance Payment Comparison Workbook.

How to fill out Budget Performance Payment Comparison Workbook?

To fill out the Budget Performance Payment Comparison Workbook, organizations need to input their budgeted amounts, actual expenditures, and any variances, ensuring all figures are accurate and align with accounting records.

What is the purpose of Budget Performance Payment Comparison Workbook?

The purpose of the Budget Performance Payment Comparison Workbook is to provide a clear understanding of budget compliance and financial performance, allowing for better decision-making and resource allocation.

What information must be reported on Budget Performance Payment Comparison Workbook?

The information that must be reported includes budgeted amounts, actual expenditures, variances, program descriptions, and any relevant notes explaining the discrepancies between budgeted and actual figures.

Fill out your budget performance payment comparison online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budget Performance Payment Comparison is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.