Get the free Verification of Long Term Care Insurance Policies - dads state tx

Show details

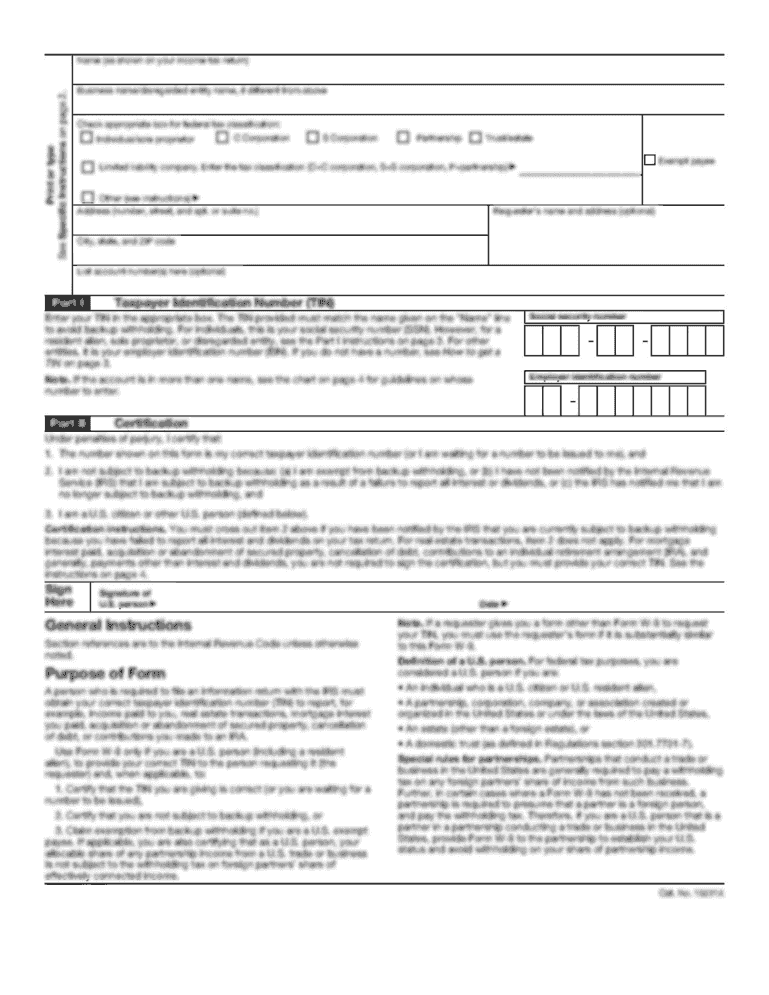

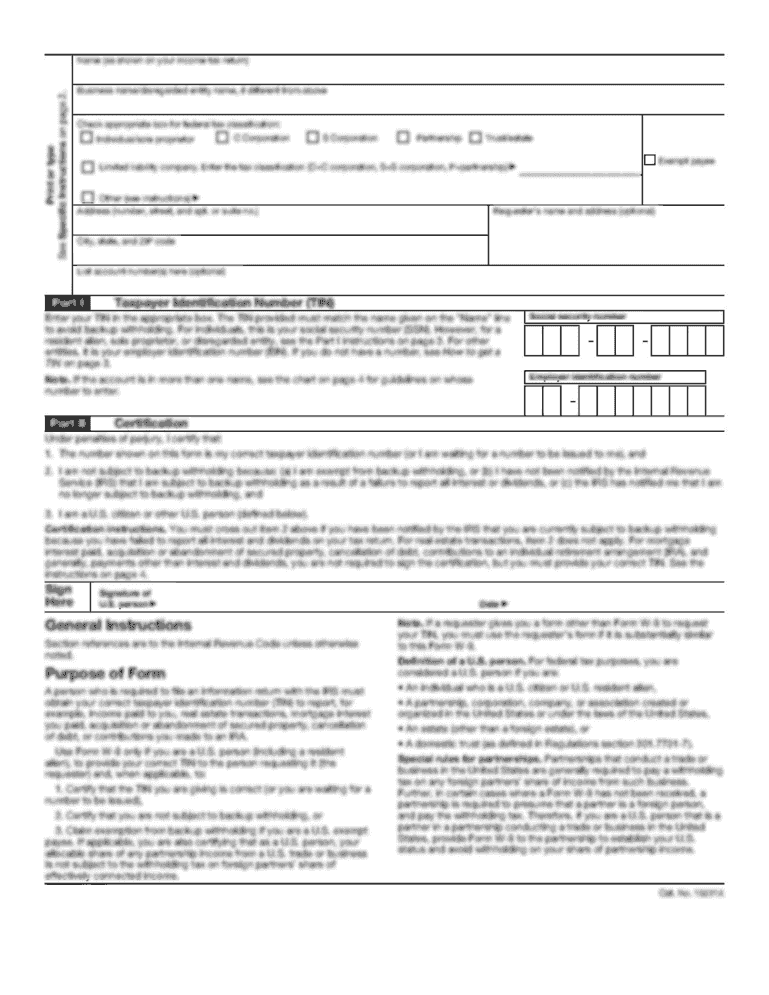

This document is used to verify information related to Long-Term Care Partnership policies for individuals seeking assistance from HHSC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of long term

Edit your verification of long term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of long term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification of long term online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit verification of long term. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification of long term

How to fill out Verification of Long Term Care Insurance Policies

01

Begin by gathering all necessary documentation related to the long term care insurance policy.

02

Locate the Verification of Long Term Care Insurance Policies form, which can usually be found on the insurance company's website or obtained from your insurance agent.

03

Fill in the policyholder's personal information, including their name, address, and contact details.

04

Provide the insurance policy number and the name of the insurance company.

05

Indicate the coverage details, including the type of long term care provided by the policy.

06

Include any relevant dates, such as the policy's effective date and expiration date.

07

Sign and date the form, ensuring that all information is accurate and complete.

08

Submit the completed form to the appropriate party, whether it's the insurance provider, healthcare provider, or facility that requires the verification.

Who needs Verification of Long Term Care Insurance Policies?

01

Individuals applying for long term care services who need to prove their insurance coverage.

02

Healthcare providers or facilities that require confirmation of insurance before providing care.

03

Family members managing the affairs of a loved one who is in need of long term care.

04

Insurance agents or brokers helping clients understand their long term care policy benefits.

Fill

form

: Try Risk Free

People Also Ask about

Are insurance policies public record?

Here are some steps for you to take: Check the vendors on the bank statement. Contact your state insurance department. Reach out to the Medical Information Bureau. Ask your car and homeowner policy agent if a life policy was brought through them. Enlist a policy locator service.

Is there a way to look up if someone has a life insurance policy?

Insurance policies are generally not public record. Some insurance policy details, like the existence of a policy and the insurer's name, can be found in public records.

Can you tell if someone had life insurance?

Contact the insurance company before the patient's initial visit. The bulk of the reason why you should start the verification process early is that it can take some time to complete this second step. You could be sitting on the phone for around 20 minutes — and that's with a relatively smooth verification process.

What is the biggest drawback of long-term care insurance?

How to find out if someone has life insurance Sort through paperwork and emails. Search with the National Association of Insurance Commissioners (NAIC) Check with your loved one's financial advisor. Conduct a free search with the National Association of Unclaimed Property Administrators (NAUPA) Contact previous employers.

How to find out if someone has long-term insurance?

Every individual long-term care policy must be guaranteed renewable. Guaranteed Renewable means that the insurer may not cancel your coverage unless you do not pay premiums on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verification of Long Term Care Insurance Policies?

Verification of Long Term Care Insurance Policies is the process of confirming the details and validity of long term care insurance plans, ensuring they meet specific regulatory requirements and provide the necessary coverage.

Who is required to file Verification of Long Term Care Insurance Policies?

Insurance companies that offer long term care insurance must file Verification of Long Term Care Insurance Policies as part of compliance with state regulations.

How to fill out Verification of Long Term Care Insurance Policies?

To fill out the Verification of Long Term Care Insurance Policies, one must provide required information such as policyholder details, policy number, coverage limits, and verification of claims history, ensuring all fields are completed accurately.

What is the purpose of Verification of Long Term Care Insurance Policies?

The purpose of Verification of Long Term Care Insurance Policies is to ensure that insurance policies provide the promised benefits, and to protect consumers by identifying any discrepancies or issues in coverage.

What information must be reported on Verification of Long Term Care Insurance Policies?

The information that must be reported includes the policy number, insured individual's details, coverage amounts, premium information, claim history, and any changes to the policy status.

Fill out your verification of long term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Long Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.