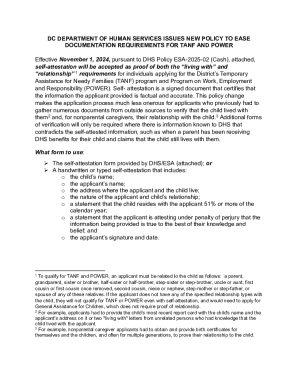

Get the free Information Letter No. 10-12 - dads state tx

Show details

This document provides guidance for Community Based Alternatives (CBA) and Integrated Care Management Waiver (ICMW) Home and Community Support Services Agencies regarding the verification of third-party

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information letter no 10-12

Edit your information letter no 10-12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information letter no 10-12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit information letter no 10-12 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit information letter no 10-12. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out information letter no 10-12

How to fill out Information Letter No. 10-12

01

Start by obtaining a copy of Information Letter No. 10-12.

02

Read the instructions and guidelines provided in the letter carefully.

03

Gather all required documentation and information needed to complete the form.

04

Fill out the personal details section with accurate information.

05

Complete the main body of the letter, providing all requested details point by point.

06

Review the filled-out letter for any errors or omissions.

07

Ensure all necessary signatures are affixed where required.

08

Submit the completed Information Letter No. 10-12 as instructed.

Who needs Information Letter No. 10-12?

01

Individuals or organizations required to report specific information to relevant authorities.

02

Professionals who need to comply with regulatory requirements.

03

Entities applying for permits, licenses, or approvals associated with governmental procedures.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a response letter to the IRS?

Reference the IRS Notice or Issue: Clearly mention why you're writing the letter. Include the notice number (found on the top of the IRS letter you received) and briefly describe the issue, like an unfilled tax return or a correction to your tax return.

What is information letter in English?

Definition of "information letter" A type of letter from an administrative body, often given in reply to a query, which offers information. This information often serves to highlight an interpretation or principle of law How to use "information letter" in a sentence.

What is a letter of explanation for the IRS?

An explanation letter, also known as a letter of explanation, clarifies discrepancies or provides explanations for unusual activity in records. It is crucial for creating a positive impression when applying for benefits or addressing mistakes.

How do I write a formal letter to the IRS?

6 Essential Tips for Writing a Letter to the IRS Follow the business letter format. Explain why you qualify for a penalty abatement. Include a copy of the IRS notice you received. Identify additional enclosures. Close the letter on a friendly note. Send your letter as soon as possible.

How do I write a reasonable cause letter to the IRS?

When requesting abatement of penalties for reasonable cause, your statement should include supporting documentation and address the following items: The reason the penalty was charged. The daily delinquency penalty may be charged for either a late filed return, an incomplete return, or both.

Is a 12C letter an audit?

This letter is not a notification of an audit but rather a tax preparation issue, as you submitted your tax return to the IRS without all of the required forms.

What is the IRS government information letter?

As a special service to government entities, IRS will issue a “governmental information letter” free of charge. This letter describes government entity exemption from Federal income tax and cites applicable Internal Revenue Code sections pertaining to deductible contributions and income exclusion.

How to write an explanation letter to the IRS?

So, your explanation letter to IRS should include the following writing items: Name, address, and contact information of the taxpayer. An explanation expressing your desire to appeal the IRS conclusions. The tax period. A list of the points you disagree with and your explanations. Facts supporting your position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Information Letter No. 10-12?

Information Letter No. 10-12 is a formal communication issued by a governmental or regulatory agency detailing specific requirements or guidelines related to compliance, reporting, or procedures within a particular sector.

Who is required to file Information Letter No. 10-12?

Entities or individuals who are affected by the guidelines set forth in Information Letter No. 10-12, typically including businesses, organizations, and sometimes individuals within the regulated sector.

How to fill out Information Letter No. 10-12?

To fill out Information Letter No. 10-12, one should carefully read the instructions provided within the letter, gather all necessary data, complete each section accurately, and submit it through the specified channels by the indicated deadline.

What is the purpose of Information Letter No. 10-12?

The purpose of Information Letter No. 10-12 is to inform relevant parties of their obligations, provide guidance on compliance, and ensure that all reporting is conducted in a systematic and transparent manner.

What information must be reported on Information Letter No. 10-12?

The information required to be reported on Information Letter No. 10-12 typically includes identification details of the filer, specific data as per the guidelines, compliance metrics, and any relevant attachments or supporting documentation as instructed.

Fill out your information letter no 10-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information Letter No 10-12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.