Get the free Form 1123 - dads state tx

Show details

This document serves as a review form for Assisted Living Facility Type C, focusing on provider qualifications, home requirements, and compliance with health and safety regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1123 - dads

Edit your form 1123 - dads form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1123 - dads form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1123 - dads online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1123 - dads. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

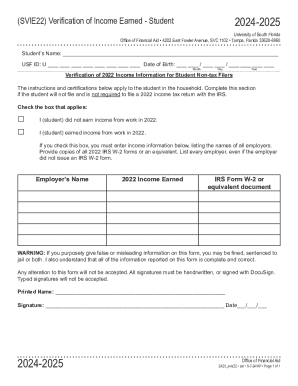

How to fill out form 1123 - dads

How to fill out Form 1123

01

Obtain the Form 1123 from the IRS website or your local IRS office.

02

Provide your organization’s name and address at the top of the form.

03

Indicate the type of organization you are applying for, such as a charitable organization.

04

Complete the sections detailing your organization's purpose and activities.

05

Attach any required documentation that supports your application.

06

Review the form for completeness and accuracy.

07

Sign and date the form.

08

Submit the completed Form 1123 to the IRS, either by mail or electronically if allowed.

Who needs Form 1123?

01

Nonprofit organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

02

Organizations that intend to operate as charitable, educational, or scientific entities.

03

Religious organizations also seeking recognition of their tax-exempt status.

Fill

form

: Try Risk Free

People Also Ask about

How to prepare for O level English?

A Step-by-Step Guide Using English O Level Past Papers Step 1: Familiarize with the Exam Format. Step 2: Analyze Question Trends. Step 3: Practice Essay Writing. Step 4: Master Comprehension Skills. Step 5: Refine Summary Writing Skills. Step 6: Review Marking Schemes. Step 7: Time Management Practice. Step 8: Seek Feedback.

What happens if I use Form 1023 EZ and bring in more than $50,000?

In the event that you exceed the $50,000 threshold, the IRS can retroactively revoke your organization's 501(c)(3) status if you are unable to make a persuasive case that you met the Form 1023-EZ eligibility criteria at the time you applied.

Is English 1123 the first language?

Cambridge O Level 1123 English Language: Best for learners who speak English at home or at school, at near first language level.

How long does it take for Form 1023 to be approved?

If you file Form 1023, the average IRS processing time is 6 months. Processing times of 9 or 12 months are not unheard of. The IRS closely scrutinizes these applications, as the applicants are typically large or complex organizations.

How fast can I start a non-profit?

Instant Nonprofit's 501(c)3 approval time, from “idea to IRS approval” ranges from less than 30 days (for lower-budget organizations whose applications go through without additional IRS interaction) to around 3-4 months (for higher budget organizations with more complex files).

Can I accept donations while waiting for 501c3 status?

ing to the IRS website, you can start to function like a nonprofit after you have filed for nonprofit status, and before you receive the official letter granting that status. This condition allows you to raise funds and engage in charitable activities before you receive your 501c3 designation.

What are the tips for English 1123?

For narrative, your first line should want to make the reader invested. For argumentative essays/directed writing, the body paragraphs should develop your main ideas with supporting evidence, analysis and arguments – all while keeping in mind the points you have to cover in the essay that is given.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1123?

Form 1123 is a document used by organizations seeking recognition as tax-exempt under Section 501(c)(3) of the Internal Revenue Code.

Who is required to file Form 1123?

Organizations that are applying for tax-exempt status under Section 501(c)(3) must file Form 1123.

How to fill out Form 1123?

To fill out Form 1123, organizations must provide detailed information about their structure, governance, activities, and financial data as required by the IRS.

What is the purpose of Form 1123?

The purpose of Form 1123 is to officially apply for tax-exempt status and to provide the IRS with comprehensive information to evaluate the organization's eligibility.

What information must be reported on Form 1123?

Form 1123 requires reporting on the organization's mission, activities, financial structure, governance, and details about its leadership and board of directors.

Fill out your form 1123 - dads online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1123 - Dads is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.