Get the free CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST

Show details

This document serves as a checklist for credit life and credit accident and health insurance presumptive premium rates adopted under the Commissioner's Order.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit life and credit

Edit your credit life and credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit life and credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit life and credit online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit life and credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit life and credit

How to fill out CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST

01

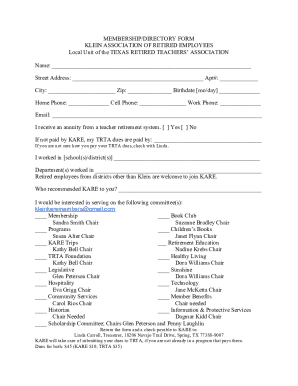

Obtain a copy of the CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST form.

02

Review the provided guidelines and ensure you have all necessary information and documents at hand.

03

Start by filling out your personal details, including your name, address, and contact information.

04

List any existing credit accounts for which you are seeking coverage.

05

Indicate the amount of credit life and accident and health insurance coverage desired for each account.

06

Check the applicable boxes regarding the type of coverage you are interested in.

07

Review the rates and fill out the presumptive rate calculations as specified in the form.

08

Sign and date the checklist to confirm the information provided is accurate and complete.

09

Submit the completed checklist to the relevant institution or lender as instructed.

Who needs CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

01

Individuals applying for credit that require insurance coverage to protect against life and accident-related risks.

02

Borrowers looking to secure their loans through credit life or health insurance.

03

Financial institutions that need to assess the risk exposure of their lending activities.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of credit life insurance?

Premiums can be more expensive than regular life insurance: Since credit life insurance doesn't require a medical exam, the coverage could be more costly than traditional life insurance. If you're in good health, you might pay less by buying your own life insurance policy.

What is the main disadvantage of life insurance?

Cons of life insurance One disadvantage of life insurance is that the older you are, the more you'll pay for a policy. This is because you're more likely to pass away during the policy period than a younger policyholder and will, in turn, cost the life insurance company more money.

Does credit life insurance still exist?

There are various life insurance plans out there, and each one is designed to help your loved ones recover in the event of a serious loss. However, credit life insurance exists to help pay off any outstanding debt if the policyholder dies.

What are the risks covered by credit insurance?

It covers: Extended payment defaults (late payments). Bad debts arising from customer insolvency. Political risk: non-payment resulting from political or climate-related events, currency restrictions, interruption of trade or expropriation.

What are the three types of credit insurance?

There are three kinds of credit insurance — disability, life, and unemployment — available to credit card customers.

What is the advantage of a credit life insurance policy?

A basic credit life insurance policy can ensure that you're not leaving behind debt for your loved ones to handle in the event of your untimely death. While there is no payout or death benefit for your beneficiaries, credit life insurance can satisfy outstanding financial obligations.

What is a disadvantage to a credit life insurance policy?

Potential Drawbacks of Credit Life Insurance Premiums can be more expensive than regular life insurance: Since credit life insurance doesn't require a medical exam, the coverage could be more costly than traditional life insurance. If you're in good health, you might pay less by buying your own life insurance policy.

What does credit life and health insurance cover?

Credit life insurance – This pays off all or some of your loan if you die. Credit disability insurance – Also called accident and health insurance, this type of insurance makes payments on the loan if you become ill or injured and can't work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

The CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST is a standardized form used to report premium rates and claims related to credit life and health insurance products. It ensures compliance with regulatory requirements and helps in assessing the financial soundness of insurance providers.

Who is required to file CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

Insurance companies that offer credit life and credit accident and health insurance products are required to file the CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST with the relevant regulatory authority.

How to fill out CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

To fill out the checklist, insurers must provide detailed information including premium rate calculations, the basis for rate determinations, and any supporting data as required by the regulatory authority. Each section should be completed accurately and thoroughly to avoid compliance issues.

What is the purpose of CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

The purpose of the checklist is to facilitate the oversight of credit life and accident/health insurance rates, ensuring that they are fair and adequate, and to protect consumers from excessive pricing while promoting transparency and accountability in the insurance market.

What information must be reported on CREDIT LIFE AND CREDIT ACCIDENT AND HEALTH PRESUMPTIVE RATES CHECKLIST?

The information that must be reported includes premium rates, claims experience, policyholder demographics, risk assessments, and any other data that supports the rate-setting process and demonstrates compliance with regulatory standards.

Fill out your credit life and credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Life And Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.