Get the free Corporate Owned Life Insurance (COLI) - Individual Checklist

Show details

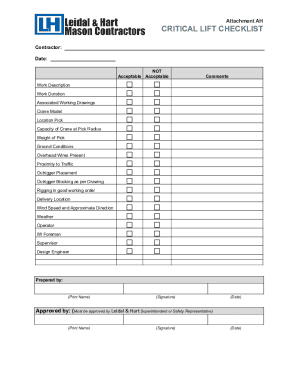

This document serves as a checklist for filing and reviewing Corporate Owned Life Insurance policies covering employees, including specific requirements and the nature of COLI.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate owned life insurance

Edit your corporate owned life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate owned life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate owned life insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corporate owned life insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate owned life insurance

How to fill out Corporate Owned Life Insurance (COLI) - Individual Checklist

01

Gather necessary personal information: Collect details such as your name, date of birth, Social Security number, and contact information.

02

Identify the insured: Determine who will be covered by the COLI policy, which is typically an employee or executive of the corporation.

03

Complete employer information: Fill out the section that asks for details about the corporation, including its name, address, and tax identification number.

04

Choose the type of policy: Decide whether you want a whole life or term life policy based on your corporation's needs.

05

Determine coverage amount: Specify the face value of the policy that corresponds to the financial obligations of the corporation.

06

Review beneficiary designations: Identify who will receive the benefits upon the insured's death, usually the corporation itself.

07

Sign and date the checklist: Ensure that all sections are completed and sign the checklist as necessary.

Who needs Corporate Owned Life Insurance (COLI) - Individual Checklist?

01

Corporations looking to provide financial protection for the company against the loss of key employees or executives.

02

Businesses aiming to fund buy-sell agreements between owners in the event of an untimely death.

03

Companies wanting to leverage cash value life insurance as a tax-advantaged savings vehicle.

04

Employers interested in enhancing employee benefits packages for critical employees.

Fill

form

: Try Risk Free

People Also Ask about

Is business owner life insurance tax deductible?

In most cases, life insurance for business owners is not tax deductible. Even if you're self-employed, you cannot subtract your premium payments from your total income each year. As a business owner, however, you can offer life insurance policy coverage as an employee benefit.

What is the IRS form for corporate owned life insurance?

Use Form 8925 to report the: Number of employees covered by employer-owned life insurance contracts issued after August 17, 2006. Total amount of employer-owned life insurance in force on those employees at the end of the tax year.

Can a corporation deduct key man life insurance premiums?

Key man insurance plays a critical role in protecting businesses from the financial impact of losing a key employee or executive. However, the IRS does not allow businesses to deduct key man insurance premiums as a business expense since the company is a direct or indirect beneficiary of the policy.

What are the disadvantages of corporate-owned life insurance?

Cons: Disadvantages of Corporate-Owned Life Insurance High Upfront Costs: COLI policies can be expensive, especially whole life or universal life insurance. Ongoing Premium Payments: The company is responsible for paying the premiums, which can be a financial burden if the company is facing cash flow issues.

Does corporate owned life insurance trigger AMT?

As a general rule, proceeds from a life insurance policy are exempt from income tax. However, when proceeds are paid to a C corporation, exposure to the AMT is increased to the extent that the death benefit exceeds the corporation's basis in the policy.

What are the disadvantages of corporate-owned life insurance?

Cons: Disadvantages of Corporate-Owned Life Insurance High Upfront Costs: COLI policies can be expensive, especially whole life or universal life insurance. Ongoing Premium Payments: The company is responsible for paying the premiums, which can be a financial burden if the company is facing cash flow issues.

What is the IRS form for corporate owned life insurance?

Use Form 8925 to report the: Number of employees covered by employer-owned life insurance contracts issued after August 17, 2006. Total amount of employer-owned life insurance in force on those employees at the end of the tax year.

What will disqualify me from life insurance?

This is often due to health challenges like diabetes and obesity, as well as non-health related life insurance disqualifiers like a dangerous job or hobby, a history of speeding tickets or using tobacco products. Here's how to understand what might make you uninsurable for life insurance and what your options are.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate Owned Life Insurance (COLI) - Individual Checklist?

Corporate Owned Life Insurance (COLI) - Individual Checklist is a document that companies use to track and manage life insurance policies taken out on the lives of employees, typically key executives. It helps ensure compliance with tax regulations and corporate policies.

Who is required to file Corporate Owned Life Insurance (COLI) - Individual Checklist?

Businesses that own life insurance policies on their employees, particularly key personnel, are required to file the Corporate Owned Life Insurance (COLI) - Individual Checklist to comply with IRS regulations.

How to fill out Corporate Owned Life Insurance (COLI) - Individual Checklist?

To fill out the checklist, a company should provide accurate information regarding each insurance policy, including details about the insured person, the policy owner, the beneficiaries, and the coverage amount, along with ensuring all relevant signatures and dates are included.

What is the purpose of Corporate Owned Life Insurance (COLI) - Individual Checklist?

The purpose of the checklist is to ensure that all necessary information regarding the COLI policies is accurately documented and compliant with regulatory requirements, thus facilitating proper management of the policies.

What information must be reported on Corporate Owned Life Insurance (COLI) - Individual Checklist?

The information that must be reported includes the name of the insured, the policy number, the amount of coverage, the policy owner’s details, the beneficiaries, and any pertinent dates related to the policy.

Fill out your corporate owned life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Owned Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.