TX TREC 32-2 2008-2025 free printable template

Show details

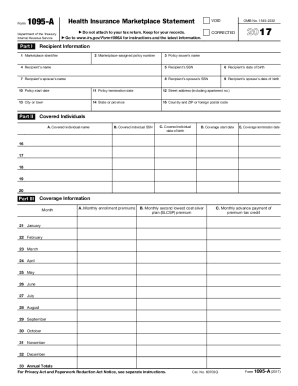

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREE) 06-30-08 CONDOMINIUM RESALE CERTIFICATE EQUAL HOUSING OPPORTUNITY (Section 82.157, Texas Property Code) Condominium Certificate concerning Condominium

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas resale certificate form

Edit your texas sales and use tax resale certificate pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt form texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas exemption certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit resale certificate texas form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas tax exempt form

How to fill out TX TREC 32-2

01

Obtain a blank TX TREC 32-2 form from the Texas Real Estate Commission website or your real estate agent.

02

Enter the names of the parties involved in the transaction in the designated fields.

03

Fill out the property address and legal description of the property.

04

Specify the purchase price and any earnest money being placed.

05

Include any special provisions or contingencies as necessary.

06

Sign and date the form where indicated, ensuring that all parties have appropriate signatures.

07

Review the completed form for accuracy before submitting it.

Who needs TX TREC 32-2?

01

Real estate agents or brokers involved in a transaction.

02

Buyers and sellers of residential properties in Texas.

03

Anyone required to formalize an agreement regarding property transactions in Texas.

Fill

texas sales and use tax exemption certification

: Try Risk Free

People Also Ask about texas sales tax exemption form

Does Texas have a tax exemption certificate?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

How do I get a tax exempt form in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Does Texas require a tax exempt number?

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID. Sales and Use Tax "Exemption Numbers" or "Tax Exempt" Numbers do not exist.

How do I get a tax exempt resale certificate in Texas?

HOW TO GET A RESALE CERTIFICATE IN TEXAS ✔ STEP 1 : Complete the Texas Sales Tax Form. ✔ STEP 2 : Fill out the Texas resale certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

What is the form for 30 day hotel tax exemption in Texas?

Permanent Residents (30-Day Rule) Guests who do not notify the hotel must pay the tax for the first 30 days and will be exempt after that. Hotel records are proof of a permanent resident's exemption, and Form 12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF), is not required.

How do you qualify for tax exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fillable texas resale certificate?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific texas tax exempt form pdf and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in sales tax exemption form texas?

The editing procedure is simple with pdfFiller. Open your texas resale certificate form pdf in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit tax resale certificate texas straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing tax exempt certificate texas right away.

What is TX TREC 32-2?

TX TREC 32-2 is a form used in Texas for the disclosure of certain information during real estate transactions, specifically for reporting the status of the property and its features to potential buyers.

Who is required to file TX TREC 32-2?

The seller of the property is required to file TX TREC 32-2 to provide the necessary disclosures to the buyer.

How to fill out TX TREC 32-2?

To fill out TX TREC 32-2, the seller must provide detailed information regarding the property, including its condition, features, any known defects, and required disclosures about potential hazards.

What is the purpose of TX TREC 32-2?

The purpose of TX TREC 32-2 is to ensure that buyers are fully informed about the property they are considering and to protect both the buyer and seller by documenting the current state of the property.

What information must be reported on TX TREC 32-2?

TX TREC 32-2 requires the reporting of various information such as property details, condition, any known issues, disclosures about lead-based paint, and other relevant legal obligations pertaining to the sale.

Fill out your TX TREC 32-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Tax Exempt Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to texas sales tax permit

Related to texas sales and use tax permit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.