Get the free Mortgage Loans - sml texas

Show details

This brochure helps you become familiar with basic mortgage loans, determine the best terms for your situation, and identify key issues to consider before taking out a mortgage loan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loans - sml

Edit your mortgage loans - sml form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loans - sml form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loans - sml online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage loans - sml. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loans - sml

How to fill out Mortgage Loans

01

Gather necessary documentation, including proof of income, credit history, and employment details.

02

Determine the amount you can afford for a mortgage by calculating your budget.

03

Research different mortgage lenders and compare interest rates and terms.

04

Pre-qualify or get pre-approved for a mortgage to understand how much you can borrow.

05

Complete the mortgage application form accurately with required information.

06

Submit all required documentation alongside the application form to the lender.

07

Wait for the lender to evaluate your application and conduct a credit check.

08

If approved, review the loan estimate and terms carefully before accepting.

09

Schedule a home appraisal to determine the property's value.

10

Close the loan by signing the mortgage agreement and paying closing costs.

Who needs Mortgage Loans?

01

First-time homebuyers seeking to purchase a property.

02

Individuals looking to refinance their existing mortgage for better rates.

03

Those wanting to buy a second home or an investment property.

04

Homeowners needing funds for home renovations or improvements.

Fill

form

: Try Risk Free

People Also Ask about

How do English mortgages work?

There are two main types of repayment mortgage: Fixed rate mortgage – your interest rate is guaranteed to stay the same for a set period. Tracker mortgage – your interest rate tracks the Bank of England Base Rate, plus a bit more. This means your monthly repayments and interest rates can go up or down during your term.

How do mortgages work in the UK?

A repayment mortgage – also known as a capital and interest mortgage – is the most common type of mortgage. You make payments each month for an agreed term. By the end of the term, you'll have paid off the full loan amount and its interest – assuming you keep up with your repayments.

What salary do I need for a 400k mortgage in the UK?

How Much Do I Need to Earn to Get a Mortgage of £400,000 UK? Lenders typically offer mortgages ranging from 4 to 5 times your yearly income. Therefore, for a £400k mortgage, an annual salary of £80,000 to £100,000 is generally required.

What is the meaning of mortgage loan in English?

A mortgage loan is a secured loan that allows you to avail funds by providing an immovable asset, such as a house or commercial property, as collateral to the lender. The lender keeps the asset until you repay the loan.

Does the UK have 30 year fixed mortgages?

For decades, most homeowners in the UK have had a 25-year term on their mortgage. However, longer-term mortgages of 30 years or more are becoming increasingly popular. Research from Uswitch found 51% of mortgage borrowers chose a term of 30 years or longer in 2023. Get fee free mortgage advice from our partners at L&C.

How much is the mortgage on a 300k house in the UK?

How much is a 300k mortgage per month in the UK? For a 300k mortgage in the UK, you can expect to pay around £1,520 per month if you choose a 30-year term with an interest rate of 4.5%.

What is the difference between simple mortgage and English mortgage?

Absolute Transfer: Unlike other forms of mortgages where only a lien or charge is created on the property, an English Mortgage involves an absolute transfer of the title to the lender.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Loans?

Mortgage loans are a type of loan used to purchase real estate, wherein the property itself serves as collateral for the loan.

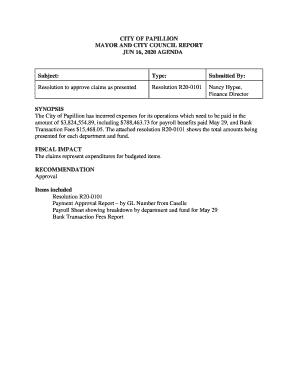

Who is required to file Mortgage Loans?

Homebuyers and real estate investors who are seeking financing to purchase a property are typically required to file for mortgage loans.

How to fill out Mortgage Loans?

To fill out a mortgage loan application, one must provide personal information, employment details, income, credit history, and information about the property being purchased.

What is the purpose of Mortgage Loans?

The purpose of mortgage loans is to enable individuals or businesses to finance the purchase of real estate, allowing them to own property without requiring the full purchase price upfront.

What information must be reported on Mortgage Loans?

Information that must be reported includes borrower details, property information, loan amount, interest rate, term of the loan, and any applicable fees.

Fill out your mortgage loans - sml online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loans - Sml is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.