TX TRS 228A 2013 free printable template

Show details

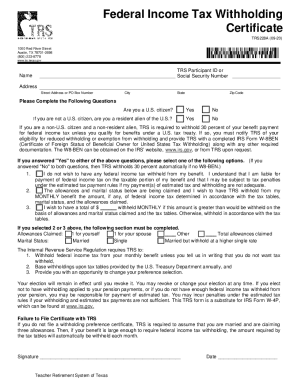

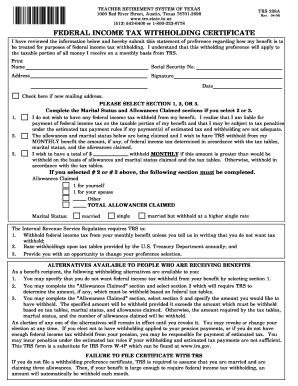

*+228A* TEACHER RETIREMENT SYSTEM OF TEXAS 1000 Red River Street, Austin, Texas 78701-2698 www.trs.state.tx.us (512) 542-6400 or 1-800-223-8778 TRS 228A Rev. 04-08 FEDERAL INCOME TAX WITHHOLDING CERTIFICATE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TRS 228A

Edit your TX TRS 228A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TRS 228A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX TRS 228A online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX TRS 228A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TRS 228A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TRS 228A

How to fill out TX TRS 228A

01

Obtain the TX TRS 228A form from the Texas Teacher Retirement System website or your school district office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your employment status by checking the appropriate box for 'Active', 'Inactive', or 'Retired'.

04

Provide information about your school district or employer, including the name and address.

05

Complete the sections related to your service credit, including years of service and any applicable positions held.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form to the appropriate office or department as instructed.

Who needs TX TRS 228A?

01

Current employees of Texas public schools who are seeking to report or verify their service credit.

02

Individuals transitioning from active to inactive status.

03

Retired educators who need to update or confirm their retirement benefits.

04

Human resource personnel in school districts managing employee retirement benefits.

Fill

form

: Try Risk Free

People Also Ask about

Are Texas retired teachers getting a 13th check?

Over the last two legislative sessions, lawmakers gave retired teachers a one-time payment, commonly referred to as the “13th check.” The Teacher Retirement System provides monthly payments to more than 475,000 retired Texas teachers.

What does Tier 2 mean in TRS Texas?

TIER 2. If you did not meet the 2005 eligibility requirements to be grandfathered but your current TRS mem- bership began prior to Sept. 1, 2007, and you had at least five years of service credit in TRS as of Aug. 31, 2014, and you maintain your membership until retirement, your membership falls under Tier 2.

Can I cash out my TRS Texas?

Once you have terminated all employment, you may then withdraw your accumulated contributions and interest in your member account. Once you have terminated your employment if you want a refund of your TRS contributions you must complete a form TRS 6 “Application for Refund.”

What happens to my Texas TRS if I quit?

If your membership is terminated, your service credit will be canceled and your accumulated contributions will no longer accrue interest. You may leave your accumulated contributions with TRS and earn interest at a rate of 2 percent per year.

Can I get a loan from my Texas TRS account?

You may borrow a minimum of $1,000 up to a maximum of $50,000 or 50% of your vested account balance reduced by your highest outstanding loan balance during the past 12 months.

What happens to your retirement when you quit teaching?

Benefits will depend heavily on what your state allows. ing to the National Council on Teacher Quality (NCTQ), if you leave before meeting your plan's “vesting” requirements (see next question below), you'll typically get back only your pension contribution and a small amount of interest in most states.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX TRS 228A without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like TX TRS 228A, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit TX TRS 228A online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your TX TRS 228A and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit TX TRS 228A on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as TX TRS 228A. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is TX TRS 228A?

TX TRS 228A is a form used by certain Texas pension funds to report contributions and other relevant information to the Texas Retirement System.

Who is required to file TX TRS 228A?

Entities and organizations that participate in the Texas Retirement System and are required to report contributions must file TX TRS 228A.

How to fill out TX TRS 228A?

To fill out TX TRS 228A, you must provide detailed information about contributions, participant data, and other relevant financial information as specified by the Texas Retirement System instructions.

What is the purpose of TX TRS 228A?

The purpose of TX TRS 228A is to ensure accurate and comprehensive reporting of retirement contributions and related financial information to the Texas Retirement System.

What information must be reported on TX TRS 228A?

TX TRS 228A must report contributions made, participant information, earnings, and any other details required by the Texas Retirement System guidelines.

Fill out your TX TRS 228A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TRS 228a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.