Get the free MORTGAGE CREDIT CERTIFICATE PROGRAM

Show details

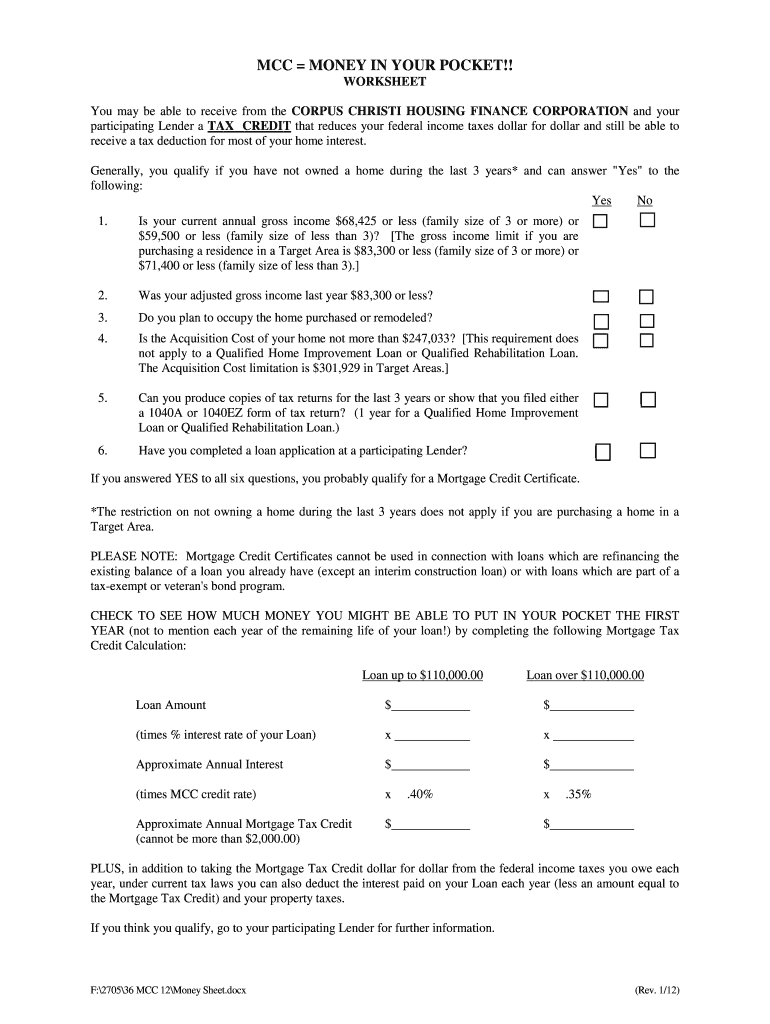

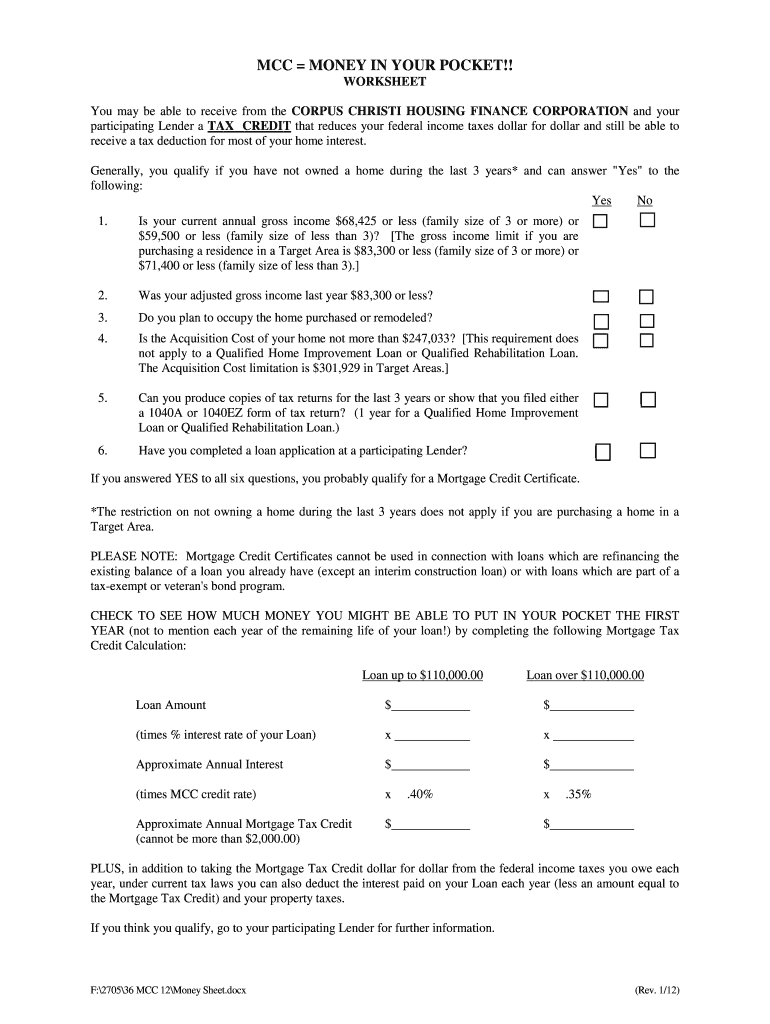

The guide provides information on the Mortgage Credit Certificate Program operated by the Corpus Christi Housing Finance Corporation, aimed at assisting low to moderate income households in home ownership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage credit certificate program

Edit your mortgage credit certificate program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage credit certificate program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage credit certificate program online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage credit certificate program. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage credit certificate program

How to fill out MORTGAGE CREDIT CERTIFICATE PROGRAM

01

Step 1: Determine eligibility based on income limits and home location.

02

Step 2: Obtain and complete the Mortgage Credit Certificate (MCC) application form.

03

Step 3: Collect required documentation, including income verification and tax returns.

04

Step 4: Submit the completed application and documentation to the issuing authority.

05

Step 5: Attend any required interviews or meetings with the program administrators.

06

Step 6: Wait for approval and receive your Mortgage Credit Certificate.

Who needs MORTGAGE CREDIT CERTIFICATE PROGRAM?

01

First-time homebuyers looking to reduce their federal tax liability.

02

Low to moderate-income individuals or families seeking affordable housing.

03

Buyers purchasing a primary residence within eligible jurisdictions.

04

Those needing financial assistance to afford mortgage payments.

Fill

form

: Try Risk Free

People Also Ask about

What is the qualification for MCC?

A pass in the Tamil Nadu Higher Secondary or equivalent Examination. Plus two marks are a must for applying. (Please note that you cannot apply with 10th or 11th Standard Marks). The upper age limit for admission to UG courses is 21 years as on 1st July 2025.

What are the requirements for MCC?

Mortgage credit certificate example Let's say you have a $300,000 mortgage with a 5% interest rate. During the year, you make $15,000 in interest payments. Assuming your program offers a 20% MCC percentage, you'll receive a $3,000 tax credit ($15,000 x 20%).

Is a mortgage credit certificate worth it?

The state or local housing finance agency is responsible for issuing the certificate.

Where can I get my mortgage credit certificate?

MCC Eligibility Requirements 200 hours of coaching education. 2,500 coaching experience hours (including at least 2,250 paid hours). 10 hours of mentor coaching.

What is the income limit for MCC?

Program Requirements Size of HouseholdIncome Limits 1-2 person(s) $125,280 $125,280 3 or more $146,160 $146,160 Purchase Price Limits Non-Target Area Target Area Existing Housing $653,883 $799,1913 more rows

What do you need to get into Metropolitan Community College?

MCC's admissions requirements Students who want to enroll at MCC have several avenues that lead to admission: a high school diploma, a High School Equivalency Test (HiSET) that certifies the equivalency of high school graduation, home-school graduation, or transfer.

What qualifies as MCC?

A Major Complication and Comorbidity (MCC) is essentially any serious secondary diagnosis that increases the complexity of a patient's condition. As a result, it also increases the resources required to treat it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE CREDIT CERTIFICATE PROGRAM?

The Mortgage Credit Certificate Program is a government initiative that allows eligible homebuyers to receive a federal income tax credit for a portion of the mortgage interest they pay, thereby making homeownership more affordable.

Who is required to file MORTGAGE CREDIT CERTIFICATE PROGRAM?

Homebuyers who wish to take advantage of the Mortgage Credit Certificate need to file the program as part of their mortgage application process and eligibility is typically based on income and purchase price limits set by the local housing authority.

How to fill out MORTGAGE CREDIT CERTIFICATE PROGRAM?

To fill out the Mortgage Credit Certificate, applicants should complete the necessary forms provided by the local housing authority or lender, providing information such as household income, the proposed mortgage amount, and property details.

What is the purpose of MORTGAGE CREDIT CERTIFICATE PROGRAM?

The purpose of the Mortgage Credit Certificate Program is to increase homeownership opportunities for low to moderate-income families by providing a tax incentive that reduces the amount of federal income tax owed.

What information must be reported on MORTGAGE CREDIT CERTIFICATE PROGRAM?

Information that must be reported includes the borrower’s income, the amount of the mortgage loan, the interest rate, property details, and any other required financial and eligibility information as stipulated by the relevant housing authority.

Fill out your mortgage credit certificate program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Credit Certificate Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.