Get the free CREDIT RATING AGENCIES REGULATIONS, 1999 - sebi gov

Show details

These regulations provide the framework for the registration, functioning, and obligations of credit rating agencies in India, aiming to ensure investor protection and market integrity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit rating agencies regulations

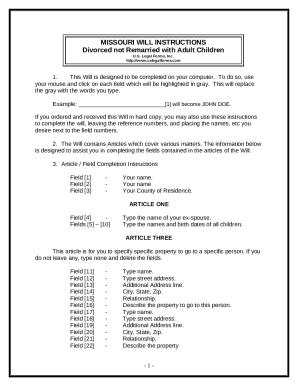

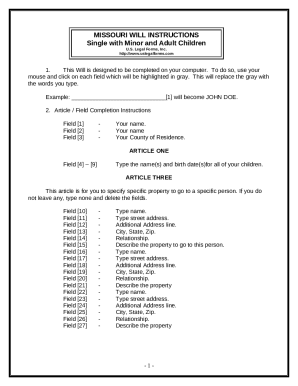

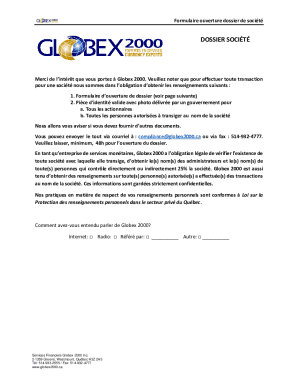

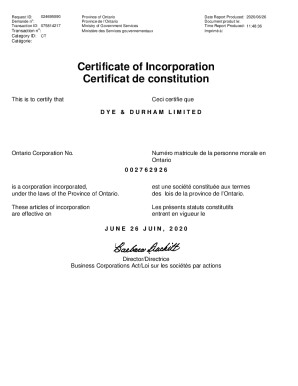

Edit your credit rating agencies regulations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit rating agencies regulations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit rating agencies regulations online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit rating agencies regulations. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit rating agencies regulations

How to fill out CREDIT RATING AGENCIES REGULATIONS, 1999

01

Obtain and read the full text of the CREDIT RATING AGENCIES REGULATIONS, 1999 document.

02

Identify the purpose and scope of the regulations as outlined in the document.

03

Determine the eligibility criteria for rating agencies as specified in the regulations.

04

Gather required documentation for registration, including financial statements and governance structure.

05

Complete the application form as per the guidelines provided in the regulations.

06

Submit the application along with necessary documents to the regulatory authority.

07

Await feedback or approval from the regulatory body after submission.

08

Ensure compliance with ongoing reporting and operational standards as mandated in the regulations.

Who needs CREDIT RATING AGENCIES REGULATIONS, 1999?

01

Credit rating agencies seeking to operate legally in the jurisdiction.

02

Financial institutions that rely on credit ratings for assessing risk.

03

Investors looking to make informed decisions based on credit ratings.

04

Companies that issue debt and require credit ratings to attract investors.

05

Regulatory bodies monitoring the activities of credit rating agencies.

Fill

form

: Try Risk Free

People Also Ask about

What is the role of a credit rating agency?

Credit rating agencies are agencies which provide ratings to represent objective analyses and independent assessments of companies, entities or countries that issue such debt securities. These ratings are an indication to the buyers of this debt how likely they are to be paid back.

What role did the rating agencies play?

Key Takeaways. Credit rating agencies give investors information about bond and debt instrument issuers. Agencies provide information about countries' sovereign debt. The global credit rating industry is highly concentrated, with three leading agencies: Moody's, Standard & Poor's, and Fitch.

What role did the credit rating agencies play leading up to the start of the financial crisis in 2007?

Inaccurate ratings provided by credit-rating agencies helped promote risk taking throughout the financial system. The credit-rating agencies were the first to see signs of trouble, and they developed more stringent standards as the housing bubble evolved.

What role did credit rating agencies play in the crisis?

Credit rating agencies came under scrutiny following the mortgage crisis for giving investment-grade, "money safe" ratings to securitized mortgages (in the form of securities known as mortgage-backed securities (MBS) and collateralized debt obligations (CDO)) based on "non-prime" — subprime or Alt-A — mortgages loans.

What are the regulation of credit rating agencies?

Detailed Solution. The correct answer is Securities and Exchange Board of India (SEBI). All the credit rating agencies in India are regulated by SEBI (Credit Rating Agencies) Regulations, 1999 of the Securities and Exchange Board of India Act, 1992.

What is the Credit Rating Agency Reform Act?

The Credit Rating Agency Reform Act ( Pub. L. 109–291 (text) (PDF)) is a United States federal law whose goal is to improve ratings quality for the protection of investors and in the public interest by fostering accountability, transparency, and competition in the credit rating agency industry.

What role did credit rating agencies play in the financial crisis?

During the financial crisis of 2008, major credit rating agencies faced sharp criticism for failing to recognize and warn of the risks of emerging instruments like mortgage-backed securities.

Who regulates credit rating agencies in the US?

For example, the Securities and Exchange Commission (SEC) is responsible for regulating credit rating agencies based in the US.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT RATING AGENCIES REGULATIONS, 1999?

The CREDIT RATING AGENCIES REGULATIONS, 1999 is a set of rules established to govern the operations and conduct of credit rating agencies in order to enhance the credibility, transparency, and integrity of credit ratings.

Who is required to file CREDIT RATING AGENCIES REGULATIONS, 1999?

Credit rating agencies that operate in the jurisdiction where the regulations apply are required to file under the CREDIT RATING AGENCIES REGULATIONS, 1999.

How to fill out CREDIT RATING AGENCIES REGULATIONS, 1999?

To fill out the CREDIT RATING AGENCIES REGULATIONS, 1999, agencies must complete the designated forms provided by the regulatory authority, ensuring that all required information is accurately reported and submitted by the specified deadlines.

What is the purpose of CREDIT RATING AGENCIES REGULATIONS, 1999?

The purpose of the CREDIT RATING AGENCIES REGULATIONS, 1999 is to establish a framework for the regulation and oversight of credit rating agencies, promote transparency and accountability, and protect the interests of investors.

What information must be reported on CREDIT RATING AGENCIES REGULATIONS, 1999?

Information that must be reported includes the agency's organizational structure, financial statements, credit rating methodologies, and any conflicts of interest that may affect the integrity of the ratings issued.

Fill out your credit rating agencies regulations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Rating Agencies Regulations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.